I early retired in April at age 49. I was just a couple weeks short of my 50th birthday and so I felt like I was ‘buying’ an extra 10 years of my life (without work). With a reasonable degree of success in my career I decided to put TIME ahead of banking more money and more material things.

So far things have been going great, but for those of you who haven’t made the leap yet, I thought I would try to put a price tag on what those extra 10 years really cost for early retirement.

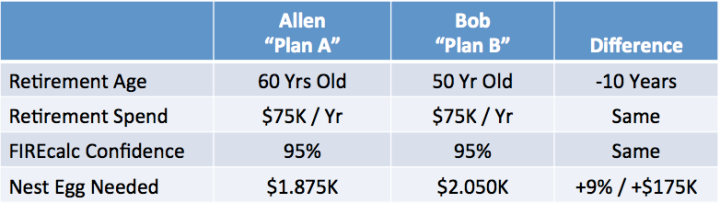

Using the trusty FIREcalc.com website, I created two scenarios. Plan A “Allen” retires at a traditional age 60, and enjoys a $75K/year spending in retirement. Plan B “Bob” wants the same spending in retirement, but also wants to retire at age 50.

In this example, Bob ‘buys’ himself 10 years of work-free early retirement. According to FIREcalc, to reach the same probability of not running out of money (95%), this means Bob’s retirement nest egg needs to be 9% more than Allen (+$175K):

Assuming that Bob has worked 25+ years in his career before he retired, he could have covered the early retirement premium he needed by just saving about $5K more a year and investing it with the rest of his retirement savings to reach $175K.

While this covers the spending needs that Bob will have in early retirement, there is one other big spending item that he will have to save for: health insurance. How much this is will depend on Bob’s family situation – how many people are being covered and what kind of policy he chooses to get.

In our situation, we are paying about $900 a month for coverage (up from the $100 we paid when I worked for MegaCorp). This works out to about $10K a year additional that Bob needs to save (although there are some minor work expenses that will go away).

I would say that for one to reach their goal of early retirement (including paying extra for health insurance), they need to save about 15% more during the course of their career. The trick, of course is that you need to get 15% more in 10 less years. The key here is to start early so that you aren’t already 10 years into your career before you lean into big savings.

If that’s too difficult, another way to think about this is could you SPEND 15% less when you buy a new house, new car, or other purchases to enable the savings? Or could you just spend less in early retirement? Bob might say instead of spending $75K/year in retirement like Allen, he would be just as happy spending $65K a year and not have to save ANY more than Allen. They would have the same level of FIREcalc confidence at 95%, adjusting already for the health insurance difference.

My opinion is that early retirement is within reach of far more people than actually do it. We save what we are “supposed to” for a traditional age 60-65 retirement and don’t realize how close we are to retiring as early as 50.

The keys to achieving this vision are SAVING EARLY and keeping focused on what your goal is. Let me tell you – after 4 months of early retirement myself – you are going to want this!

Image Credit: Pixabay

I agree, I think early retirement is in play for many more people who just fail to realize the opportunity and sacrificing a bit more luxury today for much more in the future. It’s great playing around with the FIRE calc website and the different scenarios to run. Thanks for the post!

LikeLike

Very interesting calculation. It doesn’t look like it takes much more to retire early, but the catch is of course, that Allen can afford to have a much lower portfolio at age 50 (maybe only 800K to a million, then grow it with more contributions and capital gains for another 10 years), at a time when Bob already has to have 2 million dollars. So I guess, the cost is that Allen has to save a lot more aggressively up to age 50 than Bob.

But then again: over a 25-30 year work history, 2 million is definitely doable!

LikeLike

Yes – good point. Allen can wait and save up money later in his career, which gives him flexibility for more lifestyle luxury spending earlier in his life. I’m guessing a lot of people approach retirement like Allen – perhaps unwittingly having to save more later to reach retirement @ age 60.

LikeLiked by 1 person

$2 million over a 25-year-career? (Age 25 to 50). That means saving at least $40k per year, assuming average 5% annual growth. That’s a lot to most people.

Then again, if there’s two of you both earning an income, wanting to retire when your shared assets reach $2 million, it’s easier. And also when you decide that for you, $1 million ($30k of expenses per year) is more than enough.

LikeLiked by 2 people

True! So, most people will have to find ways to stretch this a little bit:

1: Start maybe right out of college with some smaller contributions and then ages 25-50 full force

2: Invest in 100% equities (6.7% real returns on average over the 150 years) and be prepared for a wild ride

3: lower the expectations to maybe 1.5 or even 1 million

4: Realize that Social Security is only 12-20 years away, so maybe afford a slightly higher withdrawal rate.

Good luck!!!

LikeLiked by 1 person

Yes, the example assumes that someone wanted to spend $75K / year in retirement. If you can live the life you want with less, the more power to you. Others may want to spend much more (and would need to save more).

LikeLiked by 2 people

Good case study example. Similar thoughts to ERN.

And I would add that for many the concept of a 25 year saving plan ( for the 50 yr old retiree) may only really be a 15-18 year plan if you are coming out of a second degree, paying down college debt, getting an initial step onto the hosing ladder etc. In which case savings would need to be even more aggressive to hit $2M, or salary would need to be much much higher to compensate. Do-able certainly but not easy. Then again, FIRE is not easy and never will be easy for the majority of us.

With all that said, I am amazed that our portfolio weathered the dot com bubble, Great Recession, the mis-steps made by ourselves – don’t we all have those mistakes to tell our children !?

LikeLike

Good comments, I agree. In business, many people finish their MBA program at age 26. This gives them only 24 years to save before age 50. As you say, their incomes should be higher since they have graduate degrees, so they should be able to save more. Of course, many people adopt a higher cost lifestyle when they are making more and never end up getting ahead.

LikeLike

Great case study and powerful suggestions. Just imagine if more people really sought to grow the gap by investing 15% more AND spending 15% less! That’s my goal for this next stage of life as I ramp up my efforts towards achieving FIRE.

LikeLike

Saving more AND spending less is certainly the DOUBLE win! In our case, we largely HELD our spending over the last 10 years as our income went up. The amount we were able to save became amazing.

LikeLike

I think when it is explained this way, it would make a lot of sense to people. 15% more for 10 years of freedom? Definitely! And as Superhero said – if you could cut expenses by 15% too – wow, you’d make fast work of this. Nice explanation and glad you are having fun with no regrets!

LikeLiked by 1 person

Ten years work-free is a lot of time. In the end, I think time is the ultimate luxury.

LikeLiked by 1 person

This is great! One way to get around the health insurance problem is use a Christian health sharing plan. I use Christian Health Ministries and it’s only $150/month per person!

LikeLike

Time is the ultimate luxury. Mr. Groovy has an acquaintance (the brother of a friend) whose wife died from a sudden heart attack a few weeks ago at age 51. Each of us has had a good friend who died in his and her 40s. If you can get the heck out of the rate race, do it!

Thanks for the figures and the comparisons.

LikeLiked by 1 person

Sorry to hear that, Mrs Groovy. I would hate to have not had this chance at a “second childhood” – makes me enjoy life more.

LikeLike

When you present it like that it is extremely exciting to see how attainable early retirement really is. Sometimes I feel like we aren’t doing this early retirement thing “fast enough”, we can only invest in little trickles at the moment, saving for IVF.. but then I realise we are doing so much more than lots of people around us and when the compounding takes hold we will be a step ahead. The sheer fact that we are working towards retirement in our mid-20s gives me hope that we can make it.

Jasmin

LikeLike

Mid-20s will be incredible. I bet you can do it though!

LikeLike

I feel like I should clarify; we are mid-20s right now and working towards hitting FIRE probably around 40 or so.. I’d love to be about to say we’d achieve mid-20s FIRE but sadly nope!

Jasmin

LikeLike

I guess I mis-read that – you are in your mid-20s now, aiming for an early retirement as soon as you can! We were in our 20s when we started making plans. Could have gotten there by age 45-46, but worked a few years more.

LikeLike

Oops didn’t see this other reply underneath. I’m glad to hear you guys were mid-20s when you started and have done very well for yourselves on FIRE age. If we can do as well as you have we’d be happy with that. I think Tristan wants to aim for 40-45 though, I’m more on the 45-50 end.. But I wouldn’t turn it down if we achieved it earlier.

Jasmin

LikeLike

Plan for 40-45, but expect 45-50. You’ll both be happy in the end! 🙂

LikeLike

I enjoy this example – as I am technically Bob plan B lol. And it is doable or so we hope anyways. We are on that path to retire at 50-52 after already having taken one year off for grad school/ travel and two years of both stay at home parenting. We did not make much at first (liberal arts students under and grad) but with experience and moving around our incomes have come to a point finally where we are able to save a ton and focus on early retirement. Def more income makes it easier but expenses and lifestyle choices will get you there. (on my blog I post our incomes so far year by year and where we are going/how – amazing what a plan and focus can do). We are trying to focus on the expense side of things next…that scares me most given our spoiled ways – but hey, old habits can always be broken right?

I absolutely loved the chance of being ‘retired’ in my early 30s for a couple of years (that was awsome!) but I actually missed work esp after being home with the kids all the time. Now I am refreshed and convinced that in about a decade I will be ready to ‘be all done with it’.

I am very much looking forward to hearing your story while in retirement at your age – keeps me totally motivated! (and Japan is so on my list after doing Singapore, Malaysia and Hong Kong last year https://traveltravelandretire.com/2016/08/13/hong-kong-penang-malaysia-singapore/)

LikeLike

It’s amazing how small the percentage difference is for 10 more years of freedom. Definitely encouraging.

LikeLiked by 1 person

Agree – yet it is something that you need to do for a long time – people aren’t very good at even small sacrifices over the long haul. Those that do, get a huge benefit!

LikeLiked by 1 person

I’m not trying to be a buzz kill but the challenge is not so much the extra 15% to cover health care its how much more you have to save to get to the 1.8 million in ten less years.

With a 7% rate of return you need to save about $1800 a month for 28 years verses only $800 for 38 years.

I think its possible and worth it, I’m just saying that to get there its not just the 15% to cover health care.

LikeLiked by 2 people

Yes – well put. Plan “A” Allen has the opportunity to save less for longer. That, unfortunately, is the path so many take.

LikeLike

Excellent analysis!

It is nice to know the work can be done a few different ways.

As others have mentioned, the other detriment to retiring decades early is not having the benefit of compounding interest on the initial investments. If we take the approach to limit spending early in retirement – so the nest egg stays preserved – then we can even see that amount spike up tremenously over ten or twenty years.

LikeLiked by 1 person

I like that approach – spend conservatively to start and let the nest egg grow to maturity.

LikeLike