I was talking with a good friend over lunch a couple Fridays ago and he mentioned that his kids were still quite young, and that he couldn’t see retiring until his kids were at least a certain age in school. I often thought about that myself before we retired and ultimately waited until my son was almost done with his senior year in high school before calling it quits at MegaCorp.

I think the age of your kids is as much a consideration for early retiring as is your own age. There is obviously a financial component to this – most parents want to save enough money to get their kids successfully through college – but the considerations go beyond money, too. In my experience, people feel like they ‘should be’ working while their kids are school-aged, and retirement shouldn’t come until they have been at college for a year or two, at the minimum.

To get some additional perspective on the subject, I turned to friends at early-retirement.org, and asked them how old their kids were when they retired and how they felt about it. It is a good group of early retirees to bounce ideas off of and see how they did it. Thirty people responded to the question and I plotted out how old their youngest child was at the time they early retired. I was surprised by what a broad range of ages that people reported …

As you can see, a full third of people early retired when their kids were very young – grade school age or earlier. Another third retired when their kids were in middle or high school (most commonly 16 years old). And, the final group awaited until the kids were in college, or older. The sample set his obviously small here, but I wanted to show the data that people reported.

In addition, many people shared how they thought about the age of their kids and their FIRE escape plan. I noticed five themes that people highlighted when they thought about when to retire …

- SPEND TIME WITH KIDS – For some people, retiring early is done for the KEY reason that they want to spend time with their kids. Some of the parents have retired when their youngest was still in diapers because they want to be home the whole time when the kids are growing up. One early retired Dad talked about how much he enjoyed having the time to volunteer coach, support their school, and be the driver to activities. I worked until our son was done with HS, but took a lot of time off to get involved in school activities. Since my office was just 5 minutes from his school, it was easy to sneak out when I needed to, even during the day.

- SEND THE RIGHT MESSAGE ABOUT WORK – Parents who retire when their kids are in high school or younger feel like they are setting a good example for their kids. They hope that it shows their kids that they worked hard and made the right choices to enjoy the freedom they have. My son has said as much in a post that he authored before he went off to college. It is great to see him be very disciplined with his saving and spending at a young age.

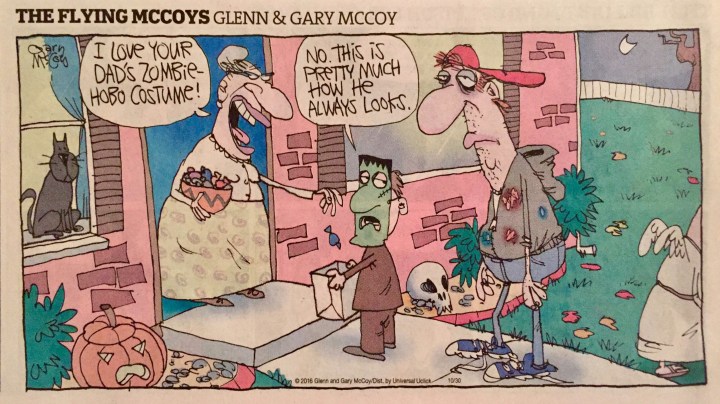

- NOT A BUM – One concern that people have is whether they will seem like a bum to others. One humorously noted that “as long as you don’t lay around the house in your Big Lebowski robe and drink White Russians” you should be all right. Another noted that they didn’t worry at all about the bum label – their kids never saw them at work anyway. I’ll admit that there are some times that I feel like a bum not working – but it is a good feeling, not a bad one. 🙂

- COLLEGE COSTS – The cost of sending your kids through university is on many parents’ minds. One forum member said that it would “feel a bit strange to bail out [of work] when they are in the hurricane of peak college costs”. Others are concerned about retiring early until they are even confident of their kids job prospects coming out of college. We had saved up all of the money our son needed for college in a 529 before he started high school and I’m confident he will do great coming out of college with a Computer Science degree.

- THE RIGHT MESSAGE ABOUT FAMILY – The last area that these early retirees with your children noted was that they felt their kids learned the right lessons about the importance of family. They may see other families with a much higher material lifestyle, but understand that it takes a ‘high income, high spend’ focus to achieve it. Kids whose parents work full-time have more stuff, but not as much time with their parents, help with school work/extracurriculars, or opportunity for extended family travel. Neither approach is right or wrong, but these early retirees value this approach more.

All in all, what I notice is that the paradox of kids and early retirement is that people want to be home with their kids while they are growing up, yet feel responsible for having enough money to get their kids through college the best the can. For us, we split the difference – working until we had enough saved and our son was ready for college. My wife stayed home all of those years and that was our work & home balance. She worked & I was home. Everyone will make their own decisions, but along with saving enough of a retirement nest egg, your kids ages are a key consideration on one’s journey to financial independence and retiring early.

Please comment on your plans for retiring early and the age your kids were/will be …?

Image Credit: Pixabay

I’m right with you. My husband is retired and I am “semi-retired”. Our youngest is a senior in high school now. While he is home, I still work a number of part-time gigs (and just finished a full-time temporary one). It just makes sense for our family right now. I don’t “have to” work – I choose to. I also think your age and the age you had kids makes a big difference too in all of this. Interesting results!

LikeLiked by 1 person

Yes – it sounds like we are tracking together!

LikeLike

We will be pulling the plug when both our boys are 11 and 9. The opportunity to spend much more time focused on school activities and the outdoors stuff is a huge part of the plan. We will be living in a mountain town of sorts and appreciate the working class nature of the local area. Thus being sensitive to what other families make of our situation is going to be interesting for sure. The data from your poll surprised me a little in that I am happy to see a good number of people retiring when kids are quite young. Albeit with a small data set.

If kids get the basics covered and get quality parent time, there is not much more a kid really needs. Our family passions of enjoying outdoor stuff like hiking, skiing are an important part of our budget planning, especially the skiing one which can get easily out of control if not managed carefully.

LikeLiked by 2 people

Sounds like a great plan. It will probably be a bit awkward to explain in a working class town.

LikeLike

It’s interesting to me the difference in how you can interpret the “example” set to your kids. I’ve looked at it like what you said. It’s a good example of how disciplined saving and hard work means you can retire early. Not a bad thing to show kids.

On the other hand, Ms. FP doesn’t think early retirement makes sense. She sees it as a potentially bad example to set to kids. No matter what you teach a kid, they won’t quite understand why you aren’t working.

I’m still too far away from kids or early retirement to consider those impacts, but just thought it’s interesting how the same thing can be viewed differently by two different people.

LikeLiked by 2 people

At times, I feel like I have to watch what I say around my son. While I’m done with work, I don’t want to denigrate its importance.

LikeLike

Our kids will be 6 and 8 when I switch to stay at home dad role. Mrs. SSC may still be teaching since she really likes it, but at least I’ll be home full time. My plans are going to be filled with that role mainly, followed by some other things like volunteer coaching, or getting involved with their school more and that sort of thing.

Having our kids was kind of a big driver for us to hit FIRE. We realized we don’t really want to retire away from something, rather retire to have more free time to spend with them.

We’ve had that discussion about what kind of example it would set for them to see us not working. I feel like it will be more of an example that you don’t have to subscribe to the societal norm of working until you’re 60 or older. Through mindful spending and avoiding mindless consumerism, you can live life on whatever terms you want.

LikeLiked by 1 person

Early retirement combined with a lesson of avoiding excessive consumerism would be a very powerful message, indeed!

LikeLike

If we become FI in 9 years, our kids will be in elementary school. One of our dreams once we reach FI is to travel extensively and live somewhere outside of Vancouver extensively. So one of the ideas we have is to home school. This will allow us to spend more time iwth our kids too.

LikeLiked by 1 person

I love this post! For us, we are targeting the year our youngest (of 2) starts college, while the oldest would be starting his third year of college. Why? because I honestly think I would be a little bored not working especially as we live in a city that is not that exciting to me… Also, that is how long it would take us to save enough.

That said – we cheated :). We took 3 years off already – one for our MAs (alone) and 2 to be with our kids when both were little. Those three years were among the best in our lives so far and would not change them for anything even if of course now it means that we have to work a little longer….That said I admit, I like my life so much better when I went back to work after staying at home once they started pre-school half day, but I get to see them a lot as I have flexibility still and have a nice balance of being ‘me’ vs just ‘mom’ which I was losing a little bit when they were very little.

We felt this was a great balance of taking a break when we had enough (twice) and now knowing that our kids are a little older, we totally spent as much time as possible those first few years of life AND having a great goal at work for our careers to reach professional goals (I have 12 years to reach X level) seems like the perfect fit.

That said, I would totally consider retiring earlier if somehow we save sooner when our kids would be old enough to travel with us all summer long (how fun would that be?!) and we could try to take solo trips with mom and dad here and there during school year….

As for kids’ example – we teach them financial management concepts and also that mom and dad work really hard now and put 100% to what we do. I think them seeing that we BOTH stayed home and now both work and actually enjoy working AND that we want to still travel with them and retire early and that this could not be possible without a solid plan (we always tell them when we cannot do something because then it limits our ability to do X also), habits and dedication, is best that we can do….

LikeLiked by 1 person

Sounds like you had a great approach and got a head start on living independently. I once saw a TED talk about a (single) guy who was taking a 2 year sabbatical every 5 years. That was his way of retiring 10 years early and enjoying it along the way.

LikeLike

I plan to be among the cohort who retires when kids are in grade school. My wife has been home to take care of their every need from birth, which has been great.

Kids are fun at every age, but boy, are they a lot of work when young. I plan to start sharing the child-rearing duties more 50 / 50 when the work is minimal. 😉 At ages 6 & 8, we’re getting close!

Cheers!

-PoF

LikeLiked by 1 person

That will be awesome for you and your wife. You never regret the time you spend with your kids. Our son is off st college, but I would love to recapture some of those grade school days!

LikeLike

If we were to do the early retirement thing “right” we would be cutting all ties when our oldest graduates from high school… but we may create a different plan entirely based on the kids. If they want to just stay put and live “normal” school lives, we’ll plan toward that… if they want to take a year off to be crazy together as a family traveling or whatever, I want to be open to that as well. We’ll see! 🙂

LikeLiked by 1 person

A ‘family gap year’? That sounds really cool. I wish I would have thought about that.

LikeLike

It may not end up happening… if I could figure out how to live in the UK legally for a year and have my kids go to school there, I would DO IT TOMORROW! But I haven’t figured out the logistics… and the older the kids get, the less likely they are to want to uproot and be crazy for a year. Again, we’ll see how it all plays out… 🙂

LikeLiked by 1 person

Our daughter will be in preschool age when we leave the workforce. We plan to spend 2 years in Spain, 2 in Germany and 2 in China and then come back to the U.S. for her to begin middle school.

LikeLiked by 1 person

What an amazing experience she will have growing up. That will really shape her world view and create incredible memories for you as a family. Maybe she’ll grow up to be an Ambassador!

LikeLike

That’s a great survey. I retired when our kid was 18 months old. That was perfect because he was still really cute and a lot of fun. It got a lot tougher when he turned 2. He just started kindergarten this year so I have more time again. Mrs. RB40 probably will retire very soon.

I don’t have a problem with the looking like a bum because I work on my blog all the time. My kid knows that I work. I’m not lying around watching TV all day.

College cost is a big problem. We saved $50k in his 529 already so that should help a lot.

LikeLiked by 1 person

I suppose your child is so young, your life is normal. That will be fun for both you and your wife to be officially FIRE when your child is still in grade school. 🙂

LikeLike

We are currently aiming to become part of the first 30% (well second 20% actually, we already missed the first 10%). The idea is have Mr CF semi-retire and only work some when Miss CF is going to school. Mrs CF still loves her job and will provide some extra income to arrange full FIRE at a later date.

This way we can meet both our goals: FIRE and be there for Miss CF when she’s done with school so we can help her with homework and spend some quality time with her as well.

LikeLike