My Mom & Dad called recently to get my take on their Long Term Care (LTC) insurance. They’ve had a policy for fourteen years and recently got a notice from their insurer that their rates would be going up. The increase – stepped over the next few years – totaled a little more than +50% versus what they were paying now. If they didn’t want to pay the higher premium, they also had the choice of stepping down the amount of coverage they had to keep their premiums the same.

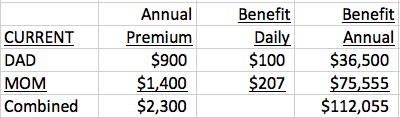

Here is the premium and coverage they have now:

They are being given to options for the future:

1) higher premium, same benefit; or, 2) same premium, but lower benefit:

The difference between the two options is about $1,200 of premium for $14,560 worth of coverage. I felt like Option 1 was the better choice for them for a number of reasons:

- COVERAGE LEVEL – The average cost of Assisted Living care is about $42K a year, the cost of Home Care (8 hours/day) is about $48K, and the cost of a private room in a Nursing Home is $88K a year. While my Mom’s benefit feels like it is at the high side of the range, my Dad’s is short of the range.

- ADJUSTED RISK – About 70% of people are said to make some type of claim on their LTC policy, including 40% that enter a nursing home for, on average, 2.4 years. Just using nursing home utilization as a possibility, a 40% risk factor multiplied by an $88K cost for 2.4 years yields a risk adjusted potential cost of $84.5K. Again, she is pretty well cover for that, but he is less than half of the payout. For him, they would need to cash flow the balance.

- BREAKEVEN – The payout on $1,200 extra a year in premium for an additional $14,560 in benefit is about 12 years. I’m no actuary, but that is a pretty long time. Given their ages (84 & 79 this year), that feels like more than enough time for the payout window to make financial sense – although I’m hopeful they both live to 115!

- PEACE OF MIND – I mentioned to them that when I got married, my oldest brother (their oldest son) suggested I buy plenty of insurance “so you needn’t worry about any kind of calamity.” I’ve followed that advice for the most part over the years and never felt bad about the extra cost. I wouldn’t tell my Mom that she might be “over-insured” for the risks, because I want her to have that peace of mind. If anything, he is the one who might have gotten a bit more coverage when they started the policy.

After we chatted, I looked up LTC insurance in the new Jane Bryant Quinn retirement book. The chapter it is in has a headline “Don’t Skimp On Insurance” and she talks about the hardship that some married couples face when one spouse is left holding the bag for expensive long term care.

What has been your experience in thinking about the cost/benefit relationship with respect to Long Term Care insurance? Any additional considerations?

Image Credit: Pixabay; LTC Cost Graphic: Ameriprise

Is money an issue for them? If they can afford the bump in premium, I don’t know why they would skimp on coverage now when they are getting closer to the point of potentially using it.

As far as myself is concerned, I’ve thought about LTC policies a bit. I know the potential need for care will be there for my wife and I as we age, but I’ve considered “self-insuring” this risk. I haven’t dug into the numbers, but if I buy coverage for 30 years, wouldn’t that cost be equal or much more than the potential benefit of a claim? As a side note, I’ve heard there are “outs” for the insurer to reduce claim payments so definitely important to read the fine print. What I would consider doing is working one more year or so to cover this risk rather than buying a policy.

LikeLike

Yes – I agree they should take the bump in the LTC premium. I think the payout is good. For us, we’ve chosen to ‘self-insure’. We have the cash flow, so it shouldn’t be a hardship.

LikeLike

My husband and I took out LTC insurance about 10 years ago, initially it was quite affordable. Last year premiums increased ALOT, however since we have paid in for so long it doesn’t make sense now to cancel. So we decided to step down coverage, but it is very likely premiums will continue to rise. I am a firm believer in insurance for peace of mind, but we are worried about the continued rise in costs.

LikeLiked by 1 person

Interesting experience with your LTC premiums – it sounds a lot like my parent’s situation. I wonder if something happened in the market that is causing it to be repriced up.

LikeLike

Mr. Groovy and I are just getting to the age where it is recommended but we’ll probably pass. I fear the rate hikes your parents are experiencing, or worse, that the insurance company will go out of business. I feel their pain.

It all depends on the policy and the reputation of the insurer. It’s certainly not like term life insurance where the rate and benefits are fixed for 20 years.

LikeLiked by 1 person

No – LTC insurance isn’t structured at all like term life insurance, is it? I wish it were too. Looking online, it looks like every 5 years or so, the market goes through a big premium increase: 2016, 2011, etc. Hard to plan around that!

LikeLike

We just received our annual premium notices for our LTC policies yesterday. Fortunately, they have remained the same. I don’t doubt that they will be raised at some point though (we’ve had them for about 5-6 years), so I appreciate seeing your analysis on it. I do hope your parents choose Option #1 even though writing that check is painful (even if they have the money).

LikeLike

I’ve carried LTC insurance for a decade. Thank God, I haven’t needed it so far. For me, it is there to protect financial assets for my family in case of an unforeseeable (but possible) debilitating and deteriorating health condition after retirement. Like all insurance, it is a calculated gamble. I’m betting I’ll need it someday. The insurance provider is betting I won’t. I have personal health records. They have actuarial data. If this were casino gambling, the insurance company is the “house.” As the expression goes, the house always wins. If their odds change, they change the game. In cases like your parents, it creates tension of “buyers remorse” (we wasted our money?) vs “buyers rationalization” (what we bought is good and will continue to be good). Personally, my strategic financial purpose for LTC purchase hasn’t changed, so I stay the course. I intend to protect my family, yet I hope the house wins, so I never need to use the LTC. Time will tell.

LikeLiked by 1 person

Great comment! Your casino analogy is a perfect explanation of how the market works. At this point, the House is asking them to up their ante or reduce their odds. Since it is not worth it for them to play without an adequate jackpot, they are upping their bets.

LikeLiked by 1 person