.

If you ask many people what defines the American Dream, they would say ‘owning your own home’. For decades, home ownership defined what being independent and successful looked like. More than just shelter, a home is viewed as an ever-giving fountain of financial security and status.

That being the case, it is not surprising that Americans have poured more and more of their wealth into housing than any other spending. In a post from a few months ago – “Over 75 Years, Consumer Spending Starts at Home” – I noted how incredible it is that there seems to be no limit to what people spend on housing.

Consider that houses – both in size and value (adjusted for inflation) have doubled since the 1970s as people climb from ‘starter homes’ (~$150K) to trade-up homes (~$250K) to what Trulia calls “premium homes” (~$550K).

It’s this ladder of escalating housing costs that I am convinced leaves otherwise successful people little chance of reaching FIRE and retiring early. To test my theory, I created a financial analysis of two successful Americans – who I’ll call Tom & Bob, for this example.

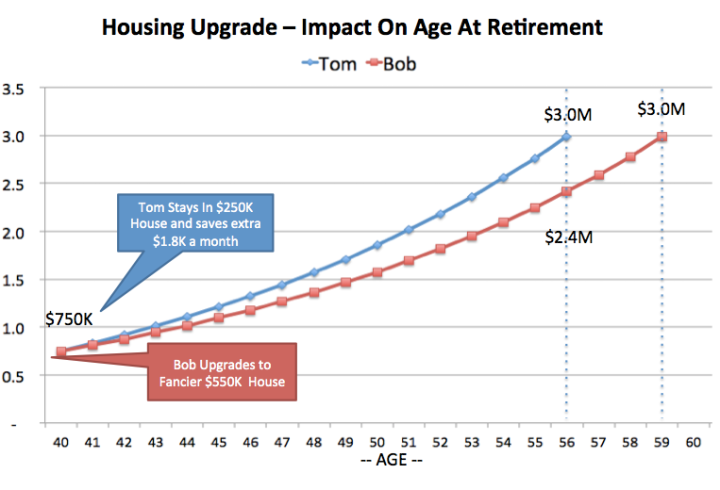

At 40 years old, they are both Tom & Bob are making six-figure salaries – and have $750K banked for retirement. They are working toward having a retirement nest egg of $3 million. They both are at a comfortable point in their careers, expect to continue to do well, and are thinking about their next steps financially. Should they continue to save, or now take some money to spend?

At this point of their lives, they make different decisions. Tom and his family stay in their $250K house, while Bob and his family trade-up to a $550K “premium home”. A bigger home is certainly a big luxury for Bob and his family – but since things are going well for them, they decide to make the move. They hope to benefit from the extra elbow room and may also find themselves in a neighborhood with better schools for the kids.

In doing so, they are taking on a bigger mortgage spend (about $2,300 more a month, including taxes & insurance), since they are using a fifteen year loan. The fact that they can make the payments on a 15 year loan says to them that they are making a choice that is affordable for the success they have achieved. The loan is somewhat offset by the mortgage interest deduction for their income tax (~$900/month), but the larger home comes with added utility/upkeep costs as well (~$300/month, assuming they bought about 1500 extra finished square feet).

Tom and his family, in the meanwhile, are able to put an extra $1,800 a month into their retirement savings. Holding all other savings contributions constant, it is amazing how much sooner Tom hits his retirement goal than Bob does. The chart shows the distance between their early retirement savings trajectory.

The extra retirement contributions mean that Tom will reach his $3 million savings goal at age 56 and will be able to retire before 85% of Americans. Bob, on the other hand, will have to wait until he is 59 years old – three years after Tom. Since 62 is the average age of retirement in the US, you could say that Bob is still able to retire early, despite upscaling his family’s home – and the added luxury cost him only 3 more years working.

This example keeps home appreciation out of the equation. Since Bob now has a more expensive home, he would likely benefit from about 3.5%-4.0% appreciation each year, using the Case-Schiller historical average (adjusted for constant square footage). This gain would be another benefit for Bob – over $500K before he retired – although the AARP notes that only a small percentage of people sell their homes when retiring, as people typically prefer to “age in place”.

(Since the appreciation benefit is ‘locked up’ – in the planning horizon of this analysis, I kept it out of the numbers. That says, it is likely significant to your total net worth. That said, not every house goes up in value, as I wrote in this post about one of our ‘Financial Failures’ on our way to FIRE.)

When it comes down to it, the example illuminates the basic question many of us ask on the route to early retirement – what is the ultimate luxury? – a premium home, or an extra few years of early retirement leisure?

Each of us has to make this choice for themselves – and some are lucky enough to be able to swing both. We were fortunate enough to purchase an upgraded home almost 8 years ago and retire early – at age 50. While that worked for us, I’ll be the first to say the home we built wasn’t a financial success as more expensive homes are more risky investments.

In the comments, I would be interested in your thoughts about this tradeoff. How you have you – or will you – approach it on your journey to FIRE? Any other considerations?

Image Credit: Pixabay; Chart: © MrFireStation.com

Interesting Post! I’m curious if the $3 Million they both end up with is their net worth total including the value of the house or just money they’ve been able to save? If it’s the latter, then while Bob did have to work 5 more years than Tom, wouldn’t he have a $300k higher net worth?

Either way, I think your point remains the same. My wife and I have been wrestling with this exact question for a couple of years now. We are still in our starter home, but as our children get older, we’ve debated upgrading our house. I’ve been on both sides of the debate and we still haven’t decided what we are going to do. The primary motivation for upgrading our house is for the outdoor space for our kids.

This post is a great reminder that if we do decide to upgrade that will likely add some years onto our working career. Thanks for sharing!

LikeLiked by 1 person

Yes – trading up your home impacts the timing of your retirement, but it is an asset you get to enjoy everyday. It’s a personal decision. (Yes, BTW – the example is merely looking at the cost of trading up vs. time. If you choose o work longer, you’ll have more to save).

LikeLiked by 1 person

It’s amazing seeing how big the difference in retirement timelines is keeping all things equal. We don’t plan to pay off our current house early, but we did just buy a piece of property that we want to build our FIRE house on. Even planning on keeping it to around 2000 sq ft since there is us and the 2 kiddos, it will possibly be a spendier decision than just looking for a house where we want to move. But, even if it adds another year on our timeline for making the move out there, I realized last night that I’d still only be 42, which is awesome, but then made me think OMY wasn’t a big deal. Yep, 2-3 yrs out and I’m already thinking, well, one more year won’t hurt and would cover any surprises that pop up while building…

Our original plan was to buy a place outright when we left the workforce, and the house and land should still come in close to that original estimate, so at least we’re still on track with our plans. Trying to estimate costsis tough because we’ve heard everything from $120-$130/sq ft on up… We’re working on finalizing a house plan sooner than later so we can better estimate those costs, but it’s definitely something we weren’t originally planning to do. I’m excited about it though, even if it does add another year to the timeline.

I won’t quit until the house gets built and finalized just out of a comfort factor to be honest. Even if there are no surprises, I’d just feel better knowing that I have an income while that’s going on. So yeah, I guess housing choices do add more time to delaying retirement even if you have a solid plan to retire early, lol.

LikeLiked by 1 person

There’s nothing more fun than building a house – we’ve built two! If you are deciding between FIRE at age 42 or 43, you are SO far ahead of the crowd, I wouldn’t worry too much that you are succumbing to OMY-itus. I would keep working, build your dream house and build a little cushion at the same time. 45+ years is a long time to be retired!

LikeLiked by 1 person

One item not placed into the equation is the income tax benefits, both state and National which significantly reduce Bob’s monthly housing costs. I am assuming both are in a 50% tax bracket – which would allow Bob to bank an additional $900-$1,000 a month. That could be eaten up by the furnishings and utilities. You also didn’t calculate in the value appreciation of the housing asset and whether Tom’s family would need to move – and purchase or rent a new home for retirement. Appreciation at 5% – pretty typical if you take out the bubble years on a $500K house is significantly higher than that of $250K home.

Another factor – which is not included is school district considerations for the “2 kiddos” which may have been a consideration for Bob when moving to a larger property.

Your analysis is correct in that living frugally is the best bet. That goes for cars, vacations, boats, etc.

LikeLiked by 1 person

Yes – good additional considerations, especially the tax deduction and appreciation potential. There are a lot of “what if’s” in these examples, but these would be likely benefits for Bob versus Tom (although 5% seems a bit rich for annual appreciation). I will update my analysis and post a comment with these considerations. Thanks!

LikeLike

We’ve actually been thinking about this quite a bit lately. We got a fantastic deal on our house about 8 years ago in a great neighborhood. I like the house, but I hate that it’s more house than we actually need.

We’re about 8-9 years from having it paid off, but if we don’t retire early to Panama, we’re going to downsize in the next year with the main intent being to reach FIRE even sooner.

— Jim

LikeLiked by 1 person

Mr. Frugal Turtle and I have talked about moving up in house from the starter home we’re in now. But, both of us would rather be free from working first. So we’re staying here until we hit our FIRE number. After that, I’ve told him I want to slow travel the U.S. for a while and then maybe we’ll move to a cheaper country, like Ecuador.

We’re pretty far away from early retirement so the plans might change, but either way I’m so excited to be done!

LikeLiked by 1 person

“Slow Travel” – I love the sound of that concept! A lot of people look at moving internationally in retirement, but we haven’t explored that. Sounds interesting!

LikeLike

Fantastic point! Houses nowadays are the most expensive (dumbest) thing we can commit to.

Why don’t more people buy alternative homes, such as land, mobile homes, tiny homes, modular homes, or anything cheaper than the typical ‘McMansion’.

Everyone wants to ‘maximize’ their home, which I think is the best way to never reach financial independence.

LikeLike

I love your analysis and wish more people realized the impact of their homes on their financial goals. Some people still find houses to be a priority over retirement, and that’s their choice, but I think more people would choose differently if they knew early retirement was a real option.

I’ve been in my 950 sq. ft “starter” home for 16 years now and, over that time, I’ve fielded many questions about when I’ll upgrade, since my income is more than twice what it was when I bought it. But it’s paid off and the utilities and property taxes are reasonable for my 3-bedroom house. If it ever made financial sense to move to a one or two bedroom, I wouldn’t hesitate but that time has yet to come. Meanwhile, I can’t think of any reason to upgrade (no kids in my future) so the house or additional years of freedom choice is an easy one for me.

LikeLiked by 1 person

That sounds like a very healthy attitude, Kate! Fact is, isn’t it funny that the same people that stretch to get into a trade up or premium home are the ones that are quick to downsize later?! We have a big house and are enjoying it now, but it does take a lot of time & money to keep up and we are often talking about downsizing. I think we will in about 3-4 years, which means we only had our ‘big’ house for about a dozen years.

LikeLike

My wife and I still live in the first home we bought 39 years ago. It was modest then and now, even after 30 years ago we added a substantial addition to accommodate our growing family. Though our children are grown with children of their own, we continue to live here. It is neither too big or too small for a retired couple, with room for family to visit. Most importantly for us, we know all our neighbors and socialize with them. Though the families have changed many times over the years, there are always many children playing in our neighborhood. To us, neighborhood is the most important dimension of a home. These decisions also enabled us to invest in other real estate, education, and retirement. In my view, the primary decision is to determine what your most vital life values are and align all other decisions accordingly.

LikeLiked by 1 person

“Neighborhood is the most important dimension of a home” is well put. I have to say we’ve lived in neighborhoods where the neighbors made or broke the experience. Although we’ve moved a few times, we’ve been lucky enough to have good friends from each neighborhood we’ve lived in and still keep up with many of them. I also like that you’ve been able to invest your money in other things – including other real estate!

LikeLike

Very interesting post. We will stay in our starter home. We have about 1700 sq ft for two people and a small dog. That is more than enough space. I don’t want the larger mortgage, tax bill, heating bill, and other expenses. We rather get to FIRE sooner.

LikeLiked by 1 person

We had a 1600 sq ft house at one point and it had plenty of room for the two of us. I’ve read that every sq ft adds about $20 of cost per year.

LikeLike

Yes. On top of the extra money going out, many times you refinance and get a new loan from scratch resetting the 15 or 30 year period. Very bad deal even if just moving and buying in the same price range

LikeLiked by 1 person

Yes – great comment. I read somewhere recently that half of people who retire are still carrying a mortgage. I suppose there could be a lot of reasons for this, but a lot of them are bad!

LikeLike

We’ll probably have to move at some point. Our place is only 1,000 sq feet and that’s too small for 4 people. My mom lives with us about half time. I’m not looking forward to it at all because we like where we live. Also, our expense will most likely increase once we move. Maybe we need to move to a cheaper location…

LikeLiked by 1 person

Yes – 1000 square foot for 4.5 people does seem pretty tight. It’s doesn’t make sense to be frugal for discomfort’s sake – an average home is 2,600 square feet now. If you can’t add on, getting a little more space probably makes sense.

LikeLike

We had a similar choice in my life. My house is paid for and at one point, we were contemplating moving closer to my work and upgrading to a higher end house (~750k). We chose to stay where we are and use the difference to buy several rental properties.

LikeLiked by 1 person

That is a smart option – you get the benefits of owning real estate AND the passive income from your renters!

LikeLike