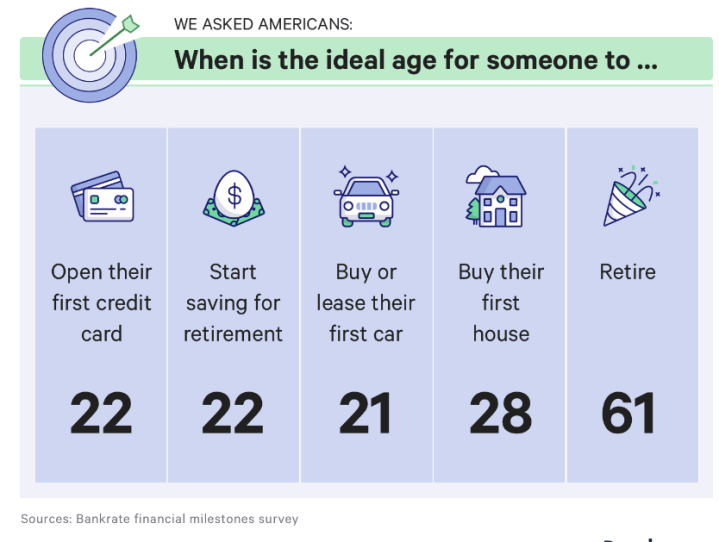

BankRate.com recently published the results of a survey where they asked people about what the “ideal age” was for certain personal finance milestones. I thought it was interesting to look at the results and compare to our experience (and our son’s) in reaching FIRE (financial independence & retiring early).

Here are some of the milestones:

FIRST CREDIT CARD – My son is 21 right now and still hasn’t gotten a credit card. My wife and I both got credit cards when we were 16 from the local Dayton’s Department Store, which offered ‘Student Accounts’ with a $100 limit. Dayton’s became Target Corporation and you could use the cards there.

I got my first bank credit card when I was about 20 from Citibank and I still have it. Unfortunately, I used it way too much in college and left campus with a couple thousand dollars in debt! I would argue that perhaps there isn’t an ‘ideal’ age to get a credit card. It would be good to not need one at all, other than as a convenience.

START SAVING FOR RETIREMENT – I started saving for retirement in a 401k account at the first MegaCorp I joined when I was still in college. I was probably exactly 22 years old – the same as the survey’s ‘ideal’ age. We were pretty aggressive savers in the plan from early on and it’s amazing to see how much it has grown too.

My son has beaten us by a few years. He socked $1500 into an IRA when he was 19 years old. It’s grown nicely since that time – I think he is up about +15% since he bought it. Investing isn’t a priority of his now since he is still in college, but that’s a great start.

BUY OR LEASE FIRST CAR – I was probably 20 when I purchased the first of several clunker cars that got me through college. I had a 1971 Oldsmolbile Vista Cruiser, a 1973 Ford LTD Country Squire, a 1976 Ford Torino, a 1979 Ford Fairmont Wagon, and my beloved 1979 Toyota HiLux Pick-Up Truck (the ‘Zipster’).

I didn’t pay more than a few hundred dollars for any of these vehicles, so that explains why there were so many of them! My son doesn’t really need to buy a car because we kept my wife’s old car for him to use when she got a newer one. It’s a 2004 Acura TSX sedan. Very practical and dependable, but getting up there in age. With 14 years on it – it’s older than almost all of those cars I had in college!

BUY THEIR FIRST HOUSE – If a condominium counts as a first ‘house’ we beat this ideal age by a few years. My wife and I were about 24 years old when we bought a 650 square foot condo in a small development (with a pool!) in 1990. We had a good friend from college that bought a unit there too. We were able to get in under an ‘Assumable Mortgage’ – which meant the seller could simply assign their current mortgage to anyone that wanted to buy it from them. Super easy. I think our monthly mortgage payment was $314, plus $100 for association fees.

RETIRE FROM WORKING – This is the one we really beat the ‘ideal age’ by quite a few years on. We early retired at 49 – just a couple weeks before my 50th Birthday.

I was surprised that 61 is listed as the ‘ideal age’ since the average age of retirement in the USA wavers between 62 and 63. The study says that Gen Xers (that’s where we fall) are the most optimistic with a goal of 60 years old.

As I’ve written before, if you save half of your income, one could retire in just 20 years – that’s in your late 30s or early 40s. While it may be difficult to save that much early in your working careers, it is possible (particularly if you are married and both partners are working). Still, I think that many people just default to what’s typical and deny themselves the chance to really go for it from early on.

How do your milestone dates line up with these “ideal” expectations?

Image Credit: Pixabay; Survey data & chart from BankRate.com

I was a little later than some of these miles stones. I didn’t buy a new car or house until I was 29 and start saving for retirement until I was 24. I’m pretty sure I had a Credit Card at 21, which was not good. My twin son and daughter already have me beat, they have retirement accounts open! I’m hoping the will avoid buying new cars and stick with gently used ones, and have no need for credit cards. They have already seen a few friends get into some trouble.

LikeLiked by 1 person

Some of these “ideal ages” for personal finance milestones are a little dubious. You could argue with avoiding cars & credit cards as long as possible!

LikeLiked by 1 person

I am pretty close to the “ideal” so far! 21 for credit card and saving for retirement, 22 for car purchase, and 26 for house purchase. Like you, however, I’m hoping to beat the ideal retirement age of 61 by 12 years!

LikeLiked by 1 person

Sounds like a perfect plan!

LikeLike

First bank account – 12,when I started working

First credit card – 15

First car – 16

First house – 35, but paid cash for it

Retire – 39

LikeLiked by 1 person

Clearly you were way ahead on most everything! I had a bank account (my parents set up) when I was in grade school. My Dad taught me ‘interest’ when we withdraw about $5 to buy my first tennis racket! That was a year’s interest on $100 in the 1970s!

LikeLike

I love the idea – I’m far from average as well!

First credit card – 18

Retirement Savings – 23

First car – 11

First house – 19

Retire – Aiming for 39

LikeLiked by 1 person

Wow – those last three are really impressive!!

LikeLike

First credit card – 18

Retirement Savings – 20

First car – 17

First house – 19

Retirement – 51

As a side note, I had my first passport savings account at 5 years old. I used to love making deposit entries and watching the interest accrue as a child! It was likely one of the best things my parents could have ever taught me. My kids are now in their mid twenties, and both are well on their way to their own FIRE.

LikeLiked by 1 person

I used to have these little ‘coin passports’ when I was a little kid from the bank. They were made of cardboard where you would save dimes or quarters in. A book might have slots for 20 quarters = $5!

LikeLike

Very interesting! I opened my first Roth IRA at 18 with $5500. Living up to what other people view as the “ideal” financial journey is definitely a great goal to beat.

LikeLiked by 1 person

It is superb blog and i really appreciate your blog. It is because i always like the informative blogs. You did a great job and thanks for sharing.

LikeLiked by 1 person

Thanks for the nice compliment – I really appreciate you saying that! 🙂

LikeLike

good one!!!!!!!

LikeLike

WOW! Interesting article when I start reading this article many things in my mind.

First Bank Account- 19

First Job – 23

First credit card – 23

Start saving for retirement- 25

First car – 30

First house – 32

Retire – 55

LikeLike

Thank you for this post, I am a big big fan of this internet site would like to go on updated

LikeLike

i missed all of the milestones I think i am worst in managing finance

LikeLike

Not to late to start, all the same!

LikeLike

Your post really a great post. I inspired from your this post. I want to do something awesome for me. Please write more like this for US.

LikeLiked by 1 person

Glad you liked it! 🙂

LikeLike

The best type of post, especially for me as a newbie.

LikeLiked by 1 person

We all start somewhere. The road to FIRE is steady with milestones like these!

LikeLike

I love your post you have shared here on your site. I would like to share it with my friends on all my social media accounts. Thanks for writing such an informative content.

LikeLike

Thanks for the compliment. Feel free to link back to this site. Thanks!

LikeLike

I love the idea – I’m far from average as well!

LikeLike

thanks a great post and a wonderful sharing. I like your site very much.

LikeLiked by 1 person

Good. Thank you for the detailed information. Tuz Lambası

LikeLiked by 1 person

Thanks for information..

LikeLiked by 1 person

I did a few similar things in car finance. Thank you.

LikeLike

thanks a great post and a wonderful sharing. I like your site very much.

LikeLike

Thanks!

LikeLike

Thank you for the detailed information.

LikeLike

Good. Thank you for the detailed information. Yaban Mersini

LikeLike

Thanks for this good information. Keep it up!

LikeLike

Thanks for information.

LikeLike

tuz lambası içerisindeki ampulün yanması ile ısınır ve odanızın havasını temizler.

LikeLike

Good! You are the best one. Your place is valuable for me.

LikeLiked by 1 person

Thanks! 😎

LikeLike

I glad to visit again this Because of interesting blog!

Keep update more related to money!

Thanks!

LikeLiked by 1 person

Glad to hear it!

LikeLike

I’m close to most of them, have just started saving for retirement this year too. Thank you for the information.

LikeLike

Indeed a nice post to have come across, I must admit that you have done a great work

LikeLiked by 1 person

I’m close to most of them, because, a few days ago, I have started to save my cash and other few financial items regarding my business. After retirement, this idea ll be works and useful for all teenage or elders.

LikeLiked by 1 person

Milestone rule applied in software project for maintenance of a project. But it is also useful for the accountant because accountant using the milestone logic in financial account improvement.

LikeLike

You are the best one. Your place is valuable for me. I must admit that you have done a great work

LikeLike

Thanks for sharing this informative content. it is really helpful for me.I like your way of explanations about the finance milestones.

LikeLike

Very informative, piece of content and kudos to you for it!. I think Saving For Retirement, is what has striked me the most. We need to save for future, and just enjoying the present, without any kind of savings, is not a great plan for life!!.

LikeLike

Keep your money for tomorrow but never forget to spend at correct time

LikeLiked by 1 person

We loved your post thanks for this wonderful post

LikeLike

One of the best site I found ever, thanks for sharing this quality and informative post.

LikeLiked by 1 person

Thank you for sharing this personal finance article, really helpful 🙂

Keep Sharing

LikeLike

Thank you for this wonderful post, we also advice people for saving and proper investment to save them self from loss.

LikeLike

Thanks for sharing a great article. I appreciate it.

LikeLike

Yes, People are sticking to the Ideal age as you said. Everybody likes to retire as soon as possible and possibly some of them are trying to grab that fruit.

LikeLiked by 1 person

Great Article! thanks for sharing this informative with us.

LikeLike

Amazing article !! I really appreciate your work…

LikeLiked by 1 person

Thanks!

LikeLike

Thank you for sharing such an amazing info

LikeLiked by 1 person

Nicely put, Thanks a lot!

LikeLiked by 1 person