We’re enjoying a sunny trip in the Caribbean right now with our son who is off from college. We left right after New Year’s, so I never got a chance to look at our final spending numbers for 2018.

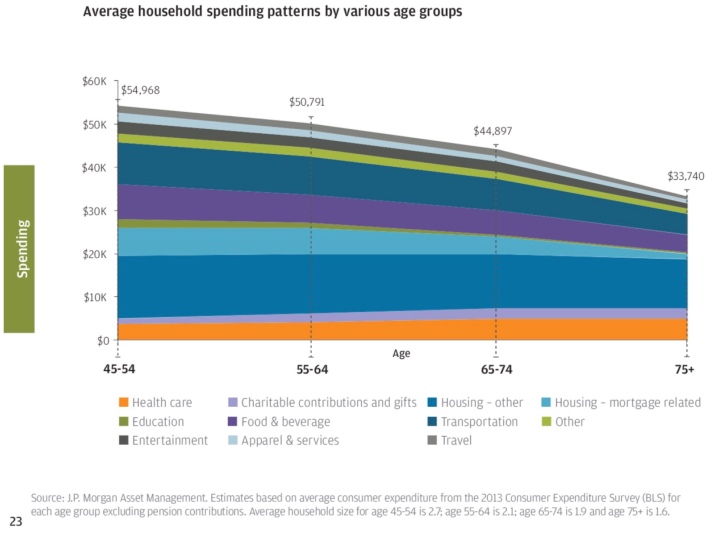

That said, I ran across this interesting chart from JP Morgan’s Consumer Expenditure Survey that looks at how much people spend annually as they get older, that I thought I would share today:

At first glance, it looks like planning for retirement spending gets easier the older you get. Spending in your late 50s-early 60s is 8% lower than a decade earlier, followed by 12% and 25% drops in the decades after that.

It’s quite a downward slope overall. The final 75+ stage is almost 40% lower than the first stage on the chart. Housing costs – particularly mortgage related – make up for the most of the decline. Food/beverage and transportation also drop quite a bit, while healthcare costs go up.

As they say, the devil is in the details, and the footnote of this chart also notes that the spending is for a household, not for an individual, and less people live in a household as time goes on. From 2.7 people in the first stage of the chart (age 45-55), when kids are probably still at home, to 2.1 people, then 1.9, and finally 1.6.

That’s probably not too alarming between 45-54 and 55-64 as kids grow up, finish schooling, and get “off the family payroll”. Income is likely still solid and so the financial situation still nets out to a positive.

The challenge comes in later years when the number of people at home slips below 2. That likely signals that a spouse may have passed away, or there was a divorce. In the case of someone passing away, income is also likely reduced as social security and pensions do not pay as much to the sole survivor as they did to both household members. That leaves a lot of bills for the surviving spouse on less cash flow.

Other than our son’s college costs, we have planned our annual spending flat until age 75, when our spending is reduced 1% annually for the next 10 years. Our overall nest egg isn’t really impacted much by this reduction, but I did want to at least reflect that we are likely to spend less. Looking at this chart caused me to go back and also reduce the monthly pension benefit that we have coming in.

How have you planned out your spending across a long retirement?

Image Credit: Pixabay

I just need to know how to start spending. It is ingrained in me to save, save, save. We actually have to look for ways to spend.

Get Outlook for Android

________________________________

LikeLiked by 1 person

One time I had this conversation with a colleague. He said he needed to cut back on spending and go on a ‘fiscal austerity plan’. I said I was always too reluctant to spend too much and needed the opposite – a ‘ fiscal frivolity plan’! 🙂

LikeLiked by 1 person

Rightly or wrongly, Chief, we’ve planned for “constant spending” from 65 to 95. This does not include adding funds to offset inflation every year. Consequently, our annual spending-power declines at the rate of inflation. Because we do not have any pensions, we provide ourselves an annual stipend (delivered monthly) from diversified personal investments. As long as we do not dip into capital, that remains our nest egg. Our big change comes at age 70, when we must take social security and RMDs from IRAs. The plan is to reduce investment withdrawals accordingly at that time to compensate for new revenue streams. Our Monte Carlo calculations show >90% of achieving goals (using worst 30 year span of market performance to put our plans to the “acid test.”)

LikeLike

We include a 2.5% inflation adjustment in our annual spending. To the degree that investment returns ‘float’ with inflation, which they typically do, I think you are fine and the Monte Carlo would show that. I would wonder if a period of very high inflation like the early 1980s was included in the scenario. I’m not sure how investments performed then.

LikeLiked by 1 person

The period of stagflation starting in the 70’s is actually the defining event for the 4% rule. Unfortunately, it tanked the cohort who retired in the late 60’s–they couldn’t see it coming. This period was more taxing, from a retiree’s point of view, than 1929 / the great depression. Of course, very few people were really living off their investments then; I am sure the psychology and associated rash / bad decisions were much worse.

LikeLiked by 1 person

Torture-test monte-carlos for every 30 year span (including ugly 70’s-80’s) still give us high confidence levels. Thick skins and steady hands needed to weather volatility and downturns. Conservative-approach, long-horizon, and luck at beginning of FIRE help. Today, we have so many investment vehicles for diversification, at low loads, which were not available before this decade. So past results are not future guarantees. So we live every day to its fullest while trying our best to sleep at night given fluctuations.

LikeLiked by 1 person

>>In the case of someone passing away, income is also likely reduced as social security and pensions do not pay as much to the sole survivor as they did to both household members. <<

That's no doubt a factor in the drop between 65-74 and 75+. I'm also wondering if a large chunk of the drop from 55-64 to 65-74 is simply due to the transition from a salary to Social Security. Most folks retire on SS, some home equity, and fairly modest savings. For them, a significant decline in annual spending may not be voluntary.

LikeLiked by 1 person

For sure! That’s the biggest risk of this chart …

LikeLike

We were thinking to move in a mall studio when our child will move away. That’s how will reduce dramatically house costs ( by rent/sell the big one) , lower house tax+energy bill etc. but having less stuff and less to clean/spend for.

Our accountant suggested to buy now the studio and rent it until to move. Wee are not decided if is perfect for us to buy in the center of the town, to have access to all the events/museum/expo etc. by food or to find out of the center, but close to a train/tram to bring us anywhere we want.

Yep, luxury problems 🙂

LikeLiked by 1 person

We’ve talked about downsizing, but not taken any action. We like some nearby association-maintained villas and said we would buy one to rent out, even if we weren’t ready to move ourselves. None of the ones we would be most interested in have come for sale in the last couple years.

LikeLike