When I was working, it seemed that the climb toward our FIRE escape from MegaCorp was slow and steady. Each year our nest egg grew bigger. Sometimes faster, sometimes slower. Even in a very bad year like 2008, we managed to eek out some growth.

It felt like the cards we were being dealt were always resulted in a pretty good hand.

That has not been the case in the first 4 years of early retirement. Instead of having a big income to supplement investment returns, we are now drawing off of our savings and investment returns have played a bigger role.

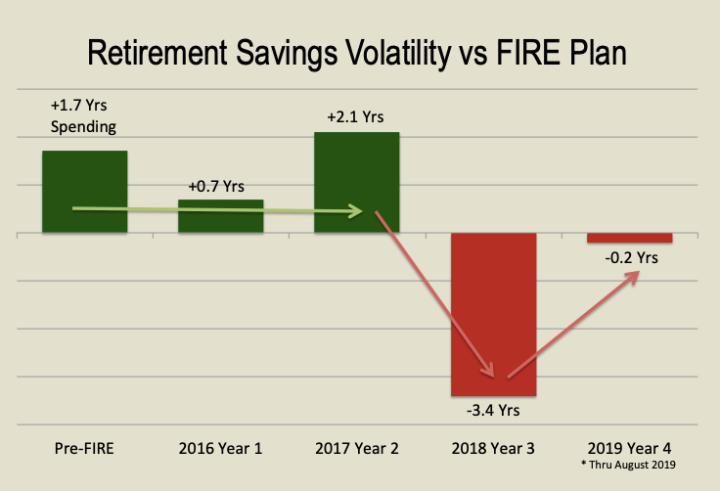

Since early investment returns are more critical to long-term retirement plan success than later returns, I thought I would share the volatility we have seen year-by-year – by showing how many years spending we have gained and lost on paper …

You can see that we have had some pretty big swings. We started with almost 2 years ‘buffer’. Despite ‘losing’ one full year of that right off the bat, we were in the positive and it grew back in 2017. I was feeling good at this point – having not worked at all and having a bigger nest egg than we started with.

Year 3 changed all of that as the stock market fell sharply at the end of 2018 and our MegaCorp stock hit a 7 year low, seriously affecting our stock options. Thankfully, everything recovered pretty quickly in 2019 and although we’ve lost our buffer, we’re back where we expected to be in our FIRE Plan.

While I don’t watch investment returns as closely as I did when I was working (goofing off too much now!) it has been disconcerting to see the numbers dip into the red so quickly. Our Monte Carlo simulation didn’t actually change to much, so we didn’t adjust our lifestyle, but it’s definitely no fun to see that you are ‘off track’.

I think the key learning I’ve had is that you should probably expect to see a little more volatility in your nest egg when you are into retirement. Unlike when you are working, you don’t have ‘new money’ regularly coming in – smoothing out your nest egg. It’s like being in the casino and getting a few extra cards each hand.

How much volatility have you seen in your retirement nest egg compared with when you were working?

Image Credit: Pixabay

Chief, like you we’ve seen more volatility than we like over past couple years. I don’t track that dimension as closely as you, because it interferes with my psyche by making me angry at forces (and people) over which I have no control. By activating levers I do control (eg., speculative funds to take advantage of volatility), I feel confident we have a plan built to withstand decades of ups and downs unavoidable in markets.

LikeLiked by 1 person

I haven’t gotten too caught up in the swings. Like I said, our Monte Carlo projections have stayed pretty much right on track the whole time. While our nest egg has risen and fallen a bit, we’ve also taken 3+ years off our retirement by getting older. Not a bad trade versus working those 3+ years!

LikeLike

You started about a year ahead of us, so I’m only counting since May 2017. Like everyone, our net worth has been a little volatile based on our stock market allocations. Our overall net worth is up 10.6% after our first 28 months of early retirement. I’m happy with that result given the volatility we have seen, and given that we’ve traveled extensively and spent pretty heavily over that time period.

Our early retirement segment of our plan is reliant on our rental real estate cash flow, so we haven’t touched our more liquid assets and don’t plan to for at least five and a half more years (at age 59.5). On the non-real estate asset front, I have begun to shift our stock allocations in recent months to a slightly more defensive alignment, based on two primary factors: One is our age (54), which puts us right at the five year point prior to possibly starting to draw funds from our more liquid assets. I’m sure you know, but for your readers, the five years prior and subsequent ten years after beginning to draw down assets is the biggest opportunity (risk) of SOR losses. Factor on top…my second reason, the current overall high market PE (~29), likely indicating a lower future return by the market for the near future, I’ve defensively shifted (dynamically reallocated) about 20% more from my equity (stock) indexes to more defensive funds (bond indexes). Who knows what lies ahead with all the trade/tariff discussions and ongoing political storms. We seem to be in somewhat uncharted territory with the China trade talks, so who knows whether the market will perform in typical fashion moving forward. Either way, it’s my nature to play strong defense. While I may be taking some growth opportunity off the table, I’m hoping this defensively sets me up to avoid (or at worst…reduce) any future hits from SOR over the next five to ten years. Real estate cash flow also provides us a strong hedge on that front, but my conservative nature likes multiple opportunities to win in the long run. Here’s to hoping I get it right…Cheers!

P.S. BTW…the Little League World Series was awesome!

LikeLike

I enjoyed watching a bit of the LL World Series on TV. Minnesota had a team in it, representing the Midwest region, but they were out pretty quickly.

Being defensive is exactly the right play in FIRE. The downside is much greater than the upside – especially with that PE so high. I think I might be due for an adjustment, too. Probably time for me to get over to our financial advisor and get his take on how the market is valued right now.

LikeLike

Yeah, the LLWS is something worth seeing at least once in person. Those kids are amazing. There were a few that will be playing in the MLB one day. You can see it, even at 11-12 years old.

I don’t know if you’ve ever read the blogs at EarlyRetirementNow or Micheal Kitces blog. While they each have slightly different spins on their own SWR (safe withdrawal rate) segments, they are both great references on dynamic SWR planning and glidepath diversification models. If not, take a look at those blogs (ERN’s is now over 30 segments, so it takes a while to read). These are pretty straight forward concepts that are relatively easy to execute, and provide a simple means for self management. (Disclaimer: I am in no way connected to either site, I just find them vey knowledgable. As always, do your own homework.) Those articles helped me devise my own dynamic planning model, and just may help you decide on what’s best given your own age, early retirement status, and just as importantly, takes into account current (and therefore better projections for near term future) market conditions. I found them super useful. Hope you find them helpful too.

LikeLike

Thanks, Thom – I will check them out! I’ve honestly done very little planning on withdrawal strategies. We have a bunch of MegaCorp stock options that expire each year, so in the short run (until 2022), we just live off of those. After that, it will get more complicated.

LikeLike