Many are calling the COVID-19 crisis the end of the FIRE movement (financially independent, retired early). The narrative is that no one can now afford to retire early since the market fell apart last month. Many expect that we’ll see a huge number of people retiring much later, but I don’t think that will be the case.

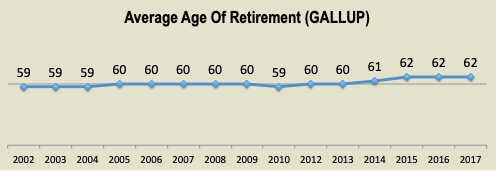

First, the average age of retirement has not seemed to move much in good times or bad historically. It has been steadily rising, due to changes in the minimum age to reach Social Security, but even the Great Recession didn’t change that trend too much. If anything, GALLUP shows that it dipped a bit for one year in 2010 …

Second, anyone getting close to retirement should be relatively insulated from the recent market decline if they were serious about building a strong, diversified portfolio. They should have their nest egg ‘bucketed’ into short, medium, and long-term investments that will allow them to weather the current storm.

Lastly, while some people may decide to work ‘One More Year’ until the market recovers from CV-19, their numbers will unfortunately be offset by others that have their retirement sprung on them through job layoffs earlier than they expected. It would be very disappointing in the middle of all of this to lose your job, but for many people this crisis will be the ‘final straw’ to their working careers.

If I was getting close to my retirement date during the COVID-19 crisis, I think I would be among those moving forward to early retirement anyway. The market was actually amid a sudden -10% ‘correction’ when I announced my resignation in early 2016 and I didn’t sweat it too much. I trusted that the savings we had put away were enough to ensure our resilience in through a bad market. All of the modeling I had done for our FIRE Plan included the possibility of a -40% decline at some point, since that’s what we saw in 2008.

If you are close to your target retirement date, I appreciate that you certainly have some serious thinking to do. If anything, this crisis should have you well-tuned into the strength of your FIRE plan. If your retirement is more than a few years away, I wouldn’t worry too much about the immediate challenges in the financial markets. A lot will change over the next several years and hopefully this will be remembered only as an unfortunate ‘blip’ that we’ve put behind us.

How close are you to your FIRE date? I you holding off? If retired, would you recommend others hold off for another year?

Image Credit: Pixabay

I’m retiring in a week. I gave 8 weeks notice before COVID-19 flared up. I asked if pausing was an option and they said no. I have enough cash to last a while and am counting primarily in real estate income. I’m planning to avoid touching stocks if possible.

LikeLiked by 1 person

Well, congratulations! As long as you can sit out the market a bit, I think you’ll be fine. The market is actually almost half back from its bottom already.

LikeLike

My recommendation remains the same: If you fully enjoy your work and the people with whom you work, continue working – until your psychological benefits or physical ability become outweighed by other considerations. In my opinion being retired is intrinsically neither better nor worse than working. Everything depends one’s personal attitude, preparedness, personality, situation, lifestyle, expectations, relationships, and (of course) finances.

LikeLiked by 1 person

Well put, as usual. If work is fun, there is no reason to look elsewhere. Seems to work for Tony Bennett. That said, if all you do is work, you might not have time to fully develop outside interests. As long as you are being thoughtful, you find the lifestyle that works for you.

LikeLike

My wife and I had planned to give our 30 day notices to our respective employers on 3/20/20, begin FIRE end of April, then leave for a 6 week trip to Europel. Then this craziness hit. We canceled the trip then each started working from home. We decided to play it week by week but recently decided to stick it out until the lockdown is over. Our roles at our employers are even more critical at this time and we do not want to leave them in a bind as they have been good to us over the years. In a way, it seems almost a blessing to still be working while being stuck at home. The transition to retirement would have been much more difficult being stuck at home for the first 2 months. We remain focused on FIREing as soon as things return to relative normal. We also have planned financially to ensure our resilience through a bad market.

LikeLiked by 1 person

That sounds like a great approach, especially if your jobs are helping the world function right now. We need as much as that as we can! Hopefully, you’ll get a chance to rebook that trip to Europe soon. We spent 3 weeks there last fall and am happy to look back on those memories when I see how devastated Spain, Italy, and France are today.

LikeLiked by 1 person

We are much like Brian F, I gave notice a month or so back with an end of May finish and my wife told her work last week. Due to COVID I am glad to be helping out at work for another 7 weeks. My wife, who is critical to her organization getting back on track after COVID, will stay on for a few months, with no formal end date until she is happy to leave knowing she helped out. Although seeing the market drop wasn’t in the plan we’ve a couple of years of cash to see us through before we need to think about drawing down. We are also Brits living in the US who will eventually move back to the UK so will take account of a lower cost of living than California !

LikeLiked by 1 person

Great to hear you are still moving forward to retirement. The final chapter of your working career will certainly be an interesting one!

LikeLike

Yes, the multi years living expenses cash/alternatives we kept out of the market heading into FIRE are looking very good now. That cushion is helping us sleep thru the night of late and keep on our path.

LikeLiked by 1 person

Yes – having the ‘cash stash’ is the key. At some point, holding onto what you have is much more important than accumulating more.

LikeLike

We are a bit under 2.5 years away from our projected FIRE date. We are not promising to never work again for a W2 but if we do, I want it to be on my terms.

In some ways I see the financial challenges of this event to be a blessing (as cold as that may sound because the human loss is very sad). I would rather get a bear market and recession out of the way before we FIRE even if that means we delay briefly in 2022 to 2023.

LikeLiked by 1 person

2.5 years sounds like plenty of time to get the economy strong again. A lot of things can cause a sudden bear market, but the bulls always return. I agree that it could be good timing for you.

LikeLike

Count me among the “impacted,” although I was laid off on Jan 1, so it predated Covid-19. It’s about 3 years before my planned early retirement date. The good news is that I took an assignment in Ireland, so I got a large bundle of “disappointment money” for my trouble. Between this and my banked home equity, I have more than enough cash for whatever happens. And the opportunity to invest after the fall has given us a chance to catch up fully to the “nominal” scenario. We had planned to stay in Ireland through the school year, and catch up on our travel bucket list in Ireland and across Europe to build some fond memories, and not let the layoff sour our view of the country. That’s now a to-do for an extended summer holiday some time in the future.

Now I just have to get us home, as soon as travel opens up! We are headed to Houston for family reasons, so I expect I will stay retired, and perhaps pick up a bargain on a house.

LikeLiked by 1 person

So sorry to hear that. Being in Ireland while all this happens certainly complicated things. I saw a headline that home prices dropped a lot in March. I’d guess that will be the trend – especially in Houston with the added impact of low oil prices. All the same, congrats & welcome to retirement!!

LikeLike