The Washington Post columnist, Ezra Klein, once quipped that our Federal Government should be described as an “insurance company with an army”. If you look at government spending, it is dominated by social insurance programs (Social Security & Medicare) and military spending.

Combined, these two areas account for about 75% of Washington DC’s annual outlays.

The billions of dollars of COVID-19 ‘stimulus checks’ that are going out right now are a new form of emergency “insurance” that we’ve never seen before. They were advanced on the notion that most Americans are such poor savers that they can’t make it a few months during the pandemic without having government provide them insurance benefits.

It made me wonder what has been going on with SAVING, EARNING & SPENDING in this country lately? In what was the best economy of our lifetimes (in many ways), were so few people putting money aside for a rainy day?

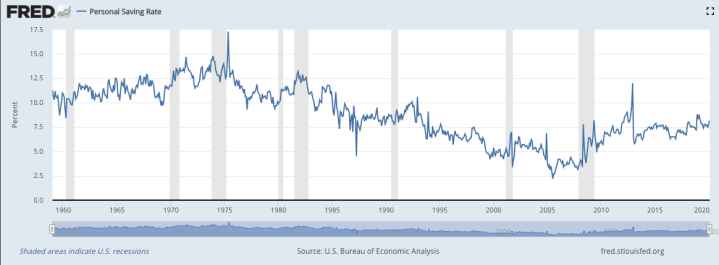

I found this trend graph of annual personal savings rates over the past 40+ years from the Federal Reserve:

As you can see, after a 30 year decline (1975-2005), the nation’s personal savings rate had bounced back over the last 15 years to 7.9% in January 2020. While still far short of the ’15% rule’ that most financial experts encourage people to target, but they are much better than the rates we saw in the early/mid 2000s, when rates bottomed out at 2.2%.

Still, our savings rate is too low – and much lower than it was a generation ago.

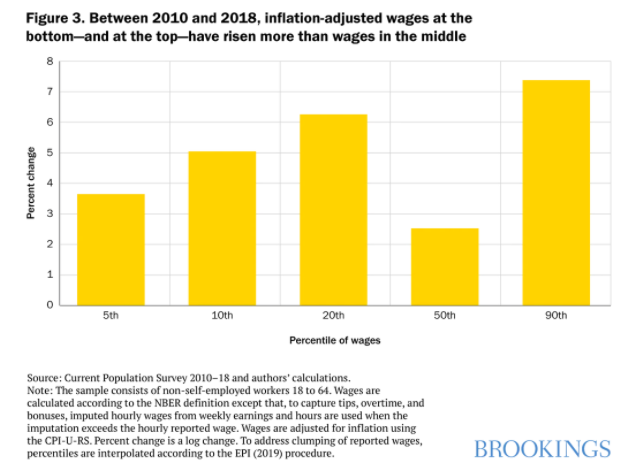

Switching gears to EARNINGS and you’ll see that broadly Americans had a huge opportunity to save money over the last 10 years. Inflation was low and higher wages – across every income groups – have been fantastic, averaging about 4% above inflation. This Brookings Institute chart shows how much inflation-adjusted wages have gone up annually across income groups …

Still, despite this real wage growth, many Americans say they can’t afford a simple $500 emergency. Even though people are making more, enjoying a lifestyle few in human history could ever imagine, they can’t save enough to weather a rainy day.

Something doesn’t add up.

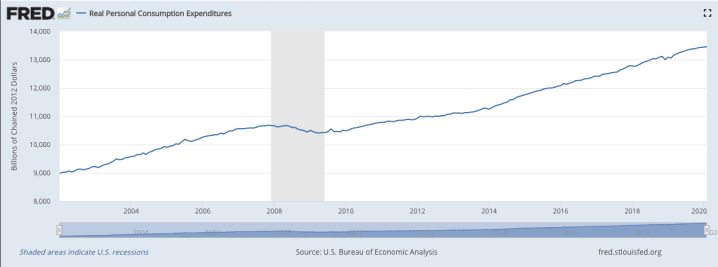

It doesn’t add up because people have been increasing SPENDING even faster than they are increasing their income. The chart below shows that real personal consumption (spending) has been growing at about 5% a year (above inflation). If you compare that to the wage growth, you’ll see that everything extra people were making (with a boost from credit cards) was going right into increased spending.

When you look at these charts, it is no surprise we are unprepared for our sudden financial crisis. While we’ve been incredibly prosperous as a nation, our high spending / inadequate saving ‘lifestyle model’ has left many in a financially fragile state.

It now requires the government to magically print stimulus money we don’t really have. In time, this will bring a significant risk of inflation and will prolong our ability to bounce back. (Inflation is better than deflation, so given the situation, most economists would say this is a good trade-off).

Sorry for the glum numbers on a Monday morning. I am certain I am speaking to the choir about the evils of not saving enough when it comes to FIRE readers. I just wanted to look at the mess we’ve gotten ourselves into in a little more detail.

Let’s hope that one of the key lessons of this crisis is that we need to dramatically boost our personal savings in the future and not leave the mess to future generations to solve.

Any Surprises To You In Looking At These Charts?

Image Credit: Pixabay

Yes America is terrible at saving money. I personally do not understand the stimulus check situation. Why do people that did not lose their jobs get money? Why do families making 150K+ need a check? Our entire nation from the top to the bottom has a huge savings problem. Thanks for the post!

LikeLiked by 1 person

Agree on the stimulus check situation. I guess they are just following the same playbook they used back in 2008-2009. Unemployment insurance was sweetened too.

LikeLike

I have been a reader of your blog for the last 2 years. I do enjoy your articles so please keep it up. I am from the tiny country Singapore and have been officially retired since 2017 at 45.

I worked in the US for 3 years (Chicago, Delaware and NJ) and I thoroughly enjoyed it. However, I was constantly surprised when I was living there by how much “crap” ppe buy over there.

It seems to me that the majority has confused their “Wants” with “Needs”.

People do need to save up more, much more. Even when I was living there, I was able to save more than 50% of my modest salary. So I am very sure others could do at least save 15-20% if they just understand what is a Need and what is a Want.

LikeLiked by 1 person

Great perspective, Lim! It sometimes helps to have an ‘outsiders’ view to understand the decisions we make. I looked up Singapore’s personal savings rate and see that it is about 24%. That’s 3x America’s savings rate in a country with about the same GDP per capita. Impressive!

LikeLike