I recently listened to an interesting podcast with investor Peter Schiff of Euro-Pacific Capital. He’s the guy that earned the title ‘Dr. Doom’ when he correctly forecast the housing bubble that led to the Great Recession. He wrote a book about it two years before it happened.

Schiff – a self-described libertarian capitalist – did a 3 hour interview with Joe Rogan recently. He raised the specter that our recent, record prosperity (pre-CV19) was a debt-driven bubble (government & personal) that has gotten worse in response to CV19.

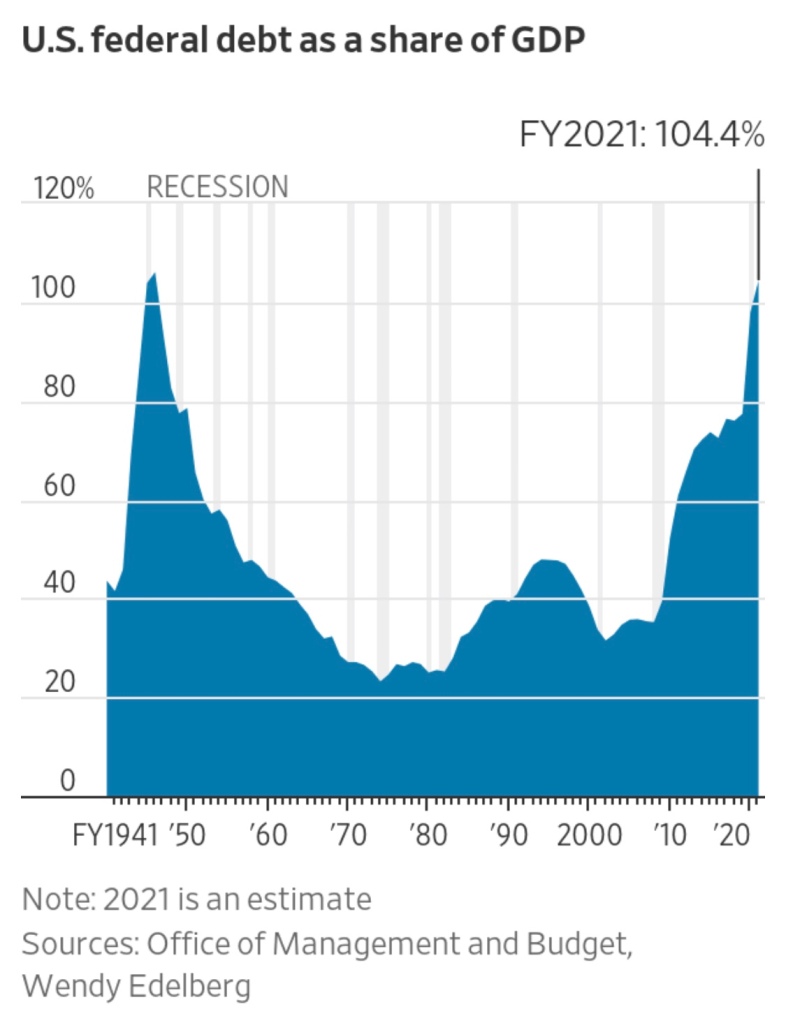

His thesis is easily shown in 3 charts. First, government debt is through the roof. It is as high as it has been as a % of GDP (104%) since WWII. Even before the pandemic it was needlessly growing …

Second, the stock market has been overvalued for some time. The Schiller PE Ratio is sitting at a 30 multiple – almost 2x the long term market average (16x). Even if you think the market deserves a higher valuation now than in decades past, its current level is concerning …

Third, household debt-to-income is down from the Great Recession, but still very high (1:1) relative to the 1980s-1990s and before. Consumers have become increasingly comfortable with debt of all kinds: mortgages, cars, credit cars, and student loans.

Those three charts add up to a scary outlook: dollars are worth less, investments are worth less, and consumers are upside down in debt. It’s hard to see the next Bull Economy springing from where we are right now, isn’t it?

Schiff argues that the CV19 response has made things even more perilous. Added ‘stimulus’ required $3T in additional federal debt and we lowered interest rates to near 0%. Yes, people are starting to save more in response to the CV19, but a lot of that is ‘magic money’ printed and handed out by the government. It carries with it the risk of much higher inflation – which may be more expensive than CV19 in the long run.

Schiff contrasts these actions with the nation’s response to WWII, since that is perhaps the historical financial territory we are in. Then, government asked for real sacrifices of the American people, including much higher income taxes and borrowing trillions (today’s dollars) through War Bonds. Despite a decade of Great Depression, Americans responded with unity and turned over their savings to help the country through the war.

I’m not quite ‘Dr. Doom’ myself as I’m not cashing out my stocks for gold or real estate. But, I do worry about what the future holds despite the V-shaped recovery on Wall Street. We have enough cash set aside that I figure we can weather a pretty big storm, but it does seem as if the storm clouds are gathering.

The crazy thing about bubbles is that they are very obvious once they pop. I can’t be the only one worried about the way these indicators look. Do you think we are on a debt bubble right now?

Image Credit: Pixabay

Good Morning Mr. Firestation. There are so many ways to substitute products today if inflation were ever to became a problem. I’m guessing that the only way for inflation to become problematic is through a super tight job market and that seems so far away. I concur the numbers look tough for the short term but lending standards are still pretty high and most of the debt appears back by the FED that can print money. I don’t know how this cycle ends.

LikeLike

Thanks for your comment, Dali. I worry we are already seeing signs of inflation due to the government’s loose money policies. Consider the housing market right now. Housing is the biggest expense people have. Boosted by stimulus from Uncle Sam, there are a lot of dollars chasing a low amount of inventory. Prices in our metro are up almost 10% versus year ago and inventory for sale is down 35%. What is the substitute for that? Rent is also up year-on-year, but not quite as much. I worry that the generous unemployment from the government has created circumstances similar to a tight labor market – more money in people’s pockets.

LikeLike

Very curious on real estate. I can’t figure it out. Yes, cheap money is fueling investing and tons of new development. Then, you have WFH so if you don’t like the prices (rent or own), you just move further out of the city.

LikeLiked by 1 person

Just saw that the WSJ just published an article on the national impact of rising housing prices and falling inventory today.

LikeLike

Worrisome indeed, Chief. In Biblical Times, once every seven years (or so) came a Year of Jubilee, when the slate was cleaned and debts forgiven, in honor of God, from Whom all forgiveness flows. We live in times when God is ignored. Years of Jubilee come no more. Our public debt in the US is unconscionable and unsustainable. I’d suggest is already can never be repayed. It would be foolishness of us to expect our primary debt holders to forgive those debts. Instead, they will eventually leverage our penury into their hegemony. This is the way of history. Our “empire” has lasted for 75 years. But anothrer rises in the East to eclipse our time as we continue to throw good money after bad. To ensure no change in our spendthrift habits, we keep electing “leaders” from the same two parties that led us to debtors prison.

LikeLiked by 1 person

I agree that it seems like it will never get paid back at this point and lead to a slow choke of our ‘empire’. The days of Ron Paul, Jack Kemp, or Steve Forbes (among others) calling for a balanced-budget amendment seem long gone. I keep hoping we tune into what countries like Denmark have done, where they simply hold government spending growth below government revenue growth. Rand Paul proposed something like this, but e two parties basically yawned and kept spending.

https://qz.com/936836/denmark-has-repaid-all-of-its-foreign-currency-debts-for-the-first-time-since-at-least-1834/

LikeLike

We said the same things in 2007-2010,

yet here we are riding a rocket high. I don’t claim to comprehend it, and it certainly “feels” like the ship is ready to tip over at any moment, but hey, we thought the same thing before and yet we continue to sail into new highs.

On the other hand, I do continue to hope more prudent keepers of the flame will improve our country’s course on debt and waste, but I just don’t see it in the cards. Instead we burn our own cities and argue over colors, sports, and COVID-19 numbers, while our international adversaries grow and build for their eventual 2048 global dominance. I fear we will all soon be looking back at what could have been, but was wasted.

…just kidding, the market always goes up! Right?…

…And just like that, the whiplash of back and forth buying and selling continues…

(Stay long and well diversified, and ignore the noise, and enjoy the sarcasm!). 😉

LikeLiked by 1 person

It’s much better than that … sure, we burn our own cities, but we are finally changing the brand name of our MAPLE SYRUPS! Progress!! 🙂

LikeLike