We just arrived in Florida for our ‘No Responsibility February’. I took this picture with my camera drone above Melbourne Beach on a beautiful 75-degree day. We visited with some Minnesota friends that are staying here with a beautiful ocean view.

Leaving cold high-tax Minnesota for sunny low-tax Florida inevitably brings up the “should we move to Florida for 6 months and a day?” conversation. We have some good friends who just made the leap and put down a deposit on a lot.

How much would it be worth to us? It looks like quite a bit when you see how different the states are in tax burden …

Minnesota is one of the highest states for total state & local tax burden (#8), while Florida (#45) and Arizona (#48) are among the lowest.

(Ignore ND, they have taxes for gas & oil they ship to other states. Consumers in other states pay them rather than their own citizens).

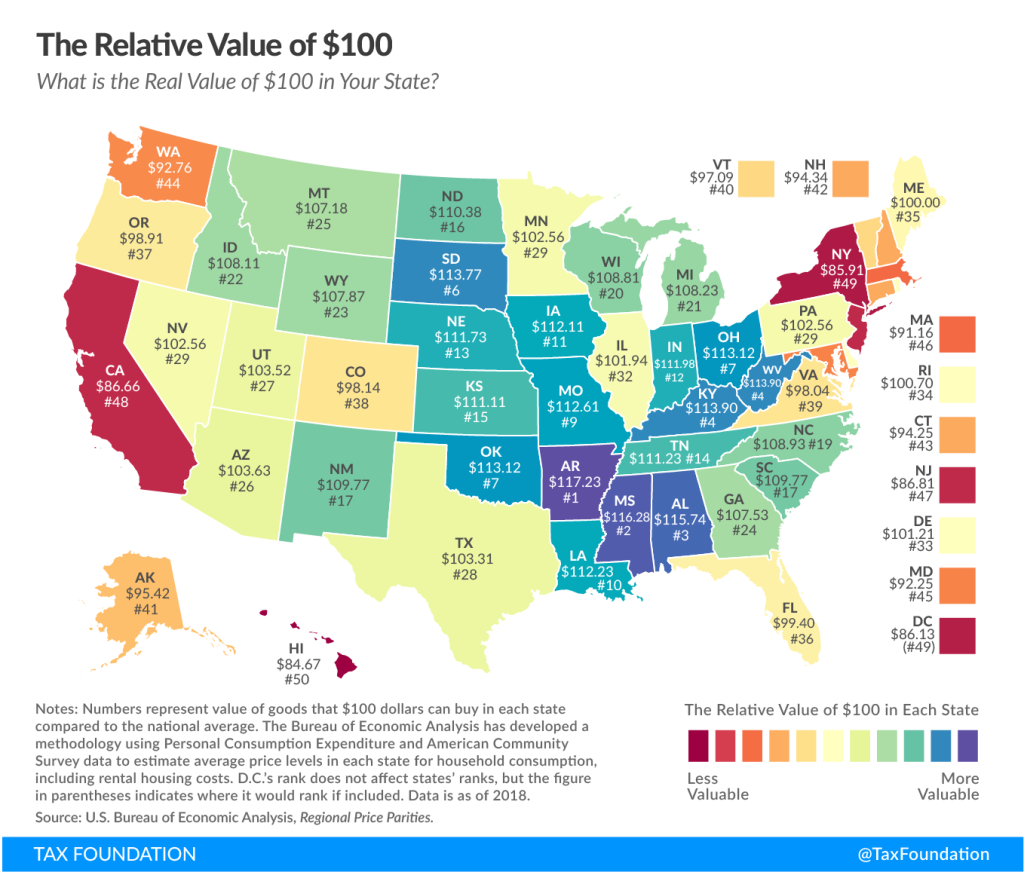

The other side of the equation is the cost of living across the different states. It looks like Minnesota is close to the USA average for the relative value of $100 in spending, so we’re not getting ahead on that count …

When you look at these charts together, it is no surprise that California & New York are losing population. Along with parts of New England and Hawaii, they are high tax and high cost of living.

At least California & Hawaii have nice weather!

How does your state stack up? Would you think about trading bitter weather for better financials?

Image Credit: (c) MrFireStation.com; Charts from TaxFoundation.com

What kind of drone do you have? I have no actual reason for buying one with the exception of it looking like something fun to play with, but I also don’t want to spend hundreds of dollars on it either.

LikeLiked by 1 person

I have no reason to own one other than the fun of flying it either, but it is fun to fly and people love the amazing pictures I post. Mine is a DJI Mavic Air 2, which is the one that everyone is buying right now. They just introduced a ‘Mini 2’ that is also getting good reviews. Mine was not cheap … $800. I think of it more as a high-end camera than a drone. It takes 48 mp shots!

LikeLike

Nice photo, Chief! You are living the life. Financially, living in CT is financially foolish, and has been for decades, and will be for decades to come. There is no cure for a one-party state that keeps raising taxes, while raising spending even more. Florida seems like paradise. But with all the New Yorkers and Yankees moving their, bringing their politics with them, Florida will eventually succumb to death by a thousand taxes.

LikeLiked by 1 person

Good observation – taxes seem to be an idea that spreads. As people move to lower tax states, they strangely bring their big government desires with them. I think the long arc of history will show the USA bending toward the European model. ‘Caring, but costly & ineffective’.

LikeLike

I’m not sure the average teacher in Florida would agree with your assessment about it being a “paradise.” According to the National Center for Education Statistics, the average teacher salary in FL is $48K, whereas the average in CT is $76K. Even adjusting for cost of living based on Chief’s “Value of $100”, the CT teacher makes significantly more. That difference comes from the taxes you’re paying.

As a rule, when discussions come up about where to retire, the top priorities are understandably taxes, cost of living, weather, health care, etc. But how does living in a community that reflects your moral values weigh in in such a decision? That’s a challenge for me because, although I appreciate the lure of lower taxes, I’m proud to live in a state (CA) where teachers make a very respectable income ($82K on average).

To be clear, I am not claiming that high-tax states are spending all of those tax dollars responsibly, but I certainly also appreciate that a good portion of my tax dollars won’t directly translate into services I receive. They are part of what helps make society more equitable and just, and those factors definitely have weight in our deciding what community we want to be a part of in retirement.

LikeLiked by 1 person

Respectfully, if it’s about the ‘moral value’ government does for people with higher taxes, I would be questioning why CA ranks so much lower for K-12 education than FL? What is important is what good is done – not what is spent.

In the latest US News Rankings, FL ranks #27 – not great, but average. CA ranks 10 places lower at #37.

https://www.usnews.com/news/best-states/rankings/education/prek-12

As you note, I find little correlation between government spending and ‘moral value’. I think in many cases government is probably the wrong tool for the job.

LikeLike

I tried to be careful not to state or imply that the extra tax dollars improve the quality of education, only that they allow us to pay our teachers a wage that better represents the service they provide to the community. I certainly agree that there’s evidence that spending more does not always correlate with better educational outcomes (although certainly there exists a lower bound of spending below which education quality will suffer).

But, it’s also true that raising the minimum wage doesn’t make my McDonald’s hamburger taste any better; nor do my clothes fit any better when I purchase them from retailers that refuse to use Chinese factories that use forced labor. My point was simply that we make moral choices when we spend our money (or pay our taxes), beyond what is measurable in the final product. The question is whether we’re conscious of those choices and if/how they would (or should) impact where we choose to live in retirement.

LikeLiked by 1 person

We keep going back and forth on the idea of 6mos+1day in FL for the taxes, but the discussion keeps coming back to the cost of homes in FL. Admittedly, we are very picky and would want to be on the water (why else live in FL!..right?) Waterfront homes can be super expensive and typically come with some hefty HOAs and insurances costs. I also question the overall lower taxes, as there are higher consumption taxes in FL verses VA, so I think it’s less clear after you dig into it. We’ve also owned a second home, and decided it’s more headache than it was worth for us, so we sold it. For now, we’ve decided to stay in VA, and rent for extended periods in FL (or other locations as we often choose to try new places). Since we own in VA and rent in FL, it’s not likely we could get away with claiming FL domicile even if we rented in FL for 6mos+1day. Leaving family in VA (permanently) isn’t really an option because we enjoy being close to our family, especially our new grand daughter. We also enjoy the four seasons of VA, but do REALLY enjoy spending half of our winter in FL, and travel to cooler places in July and August.

So for us, saving on taxes would nice, but having lots of options and the best of all worlds keeps winning out over (possibly) lower taxes.

Enjoy your stay in FL, we just got back a weeks ago and it was awesome. Let’s face it, 75F in February is hard to beat!

LikeLiked by 1 person

We’ve never had a second home, but are following the same strategy that you are. Just renting and enjoying the flexibility. I could see us trying Arizona or Texas, too. 2020 would have been the year to move somewhere for 6 Mos since our income was high from stock options sales. Our income will be low the next 3-5 years for sure.

LikeLike

I love Arizona. It’s a beautiful state and has so many unusual ecosystems, from deserts to snowy mountains, the Red Rock area, to the Canyon, all visible in a single day’s drive. Very unique to say the least. Texas has some nice places too. We spent time in Houston and San Antonio two years ago. I have no interest in going back to Houston, but we loved the River Walk in San Antonio. I would love to spend more time in the gulf coastal area or explore the north western portion of Texas. We are planning a cross country trip this year. Hoping to check off a few more National Parks. Should be fun.

LikeLiked by 1 person

We used to alternate winter vacations/spring breaks between Florida and Arizona and love both of the states. We had an ad agency in San Antonio and used to visit there quite a bit too. Looking forward to now ‘living’ there for a month or more.

LikeLike

I love Arizona. It’s a beautiful state and has so many unusual ecosystems, from deserts to snowy mountains, the Red Rock area, to the Canyon, all visible in a single day’s drive. Very unique to say the least. Texas has some nice places too. We spent time in Houston and San Antonio two years ago. I have no interest in going back to Houston, but we loved the River Walk in San Antonio. I would love to spend more time in the gulf coastal area or explore the north western portion of Texas. We are planning a cross country trip this year. Hoping to check off a few more National Parks. Should be fun.

LikeLike

I live in a coastal town in Southern California. Our house is paid off. My husband and I were both social workers (not high paying jobs)! He bought the house for $168,000 about 35 years ago. It’s current value is 10x that! We could not afford to buy our house now. Property taxes would be outrageous if we even could afford to buy it now. Fortunately, Prop 13 has kept our current taxes very affordable. We both saved and invested well and we can afford anything else we want to do. There are cheaper places to live away from the coast, so I’m guessing you could definitely afford to live in California. Just maybe not a house at the coast.

LikeLiked by 1 person

Nice! In MN, they would property tax you out of your own house if they could. That’s great that you invested well early on and can enjoy the benefits now.

LikeLike

😍😍

LikeLike