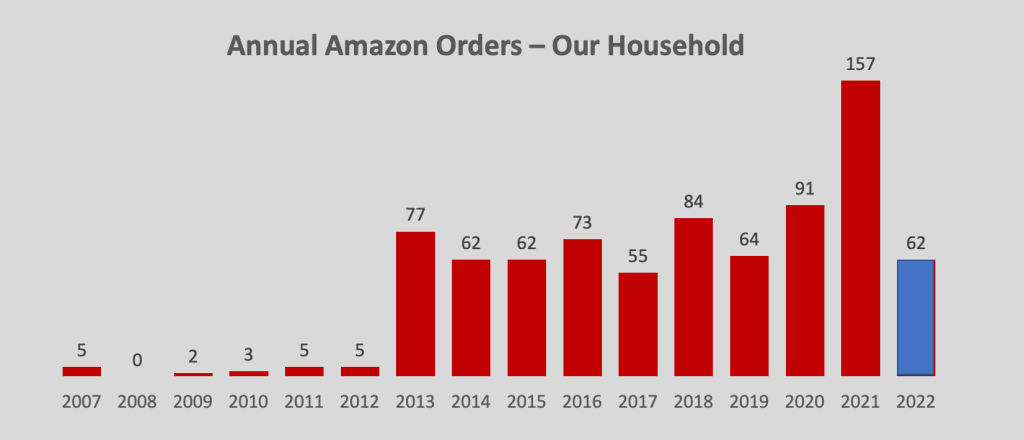

If I had only paid more attention to my own behavior, I would probably be a much better investor. I noticed on the Amazon website that it lists your annual orders under the ‘purchase history’ feature. My own use of Amazon seems to mirror their stock performance.

As I jumped from just 3-5 orders a year to over 100, their stock shot from $12 a share to almost $140.

That’s an amazing +27.6% annual growth rate for a decade!

Maybe I should spend more time paying attention to how my own behaviors are evolving?!

Related: The Worst Stock Bet I Ever Made

What behavior changes that you’ve noticed in yourself have resulted in successful investments? Which ones led you astray?

Image Credit: (c) MrFireStation.com

This is a great topic. I must put a disclaimer in place that I too did not buy Amazon, even though I started buying books from Amazon in 1997. I looked up AMZN history and the stock went public on May 14, 1997 at an adjusted closing price of 7 cents. If you had bought on opening day and held until today your return would be 1826X or 35% compounded annual return for 25 years.

However, the top of the market for tech stocks was March 31, 2000. I know this because the company I was working for at the time was sold on exactly that date, and the primary investor invested in a hedge fund that was designed to make money when the market tanked. You would have suffered a 50% drawdown owning AMZN from March 31, 2000 to June 30, 2000. Many internet stocks didn’t make it.

Peter Lynch, who is recognized as having the highest performing mutual fund ever when he recorded a 29.5% return over his tenure at the Magellan Fund wrote a book on this topic, “Beating Wall Street.” The main gist of the book was to buy stocks that you did business with or worked in the industry. He attributed his wife with bringing him some great ideas back from the mall. He also suggested keeping a journal about the stocks you buy, to remind yourself when times get tough why you bought the stock.

Here are some of my hits and misses.

In the early 1990s, the IT crowd I was selling to keep mentioning Cisco, Cisco, Cisco. Did I buy the stock? Of course not. Did Cisco do well? Of course it did.

Here is another miss. In 1986, Qualcomm was one of my customers. In the early 1990s they lost a military contract for spread spectrum radio sets, so it didn’t look like they were going to do well. Their spread spectrum technology was beaten into a plowshare and became CDMA that Verizon uses in the mobile phones. Qualcomm was the highest performing stock between 1990 and 2000.

Here are few hits.

I bought Cedar Fair ticker symbol FUN from my experience working my first three years through college in Wisconsin Dells. I remember the President of the attraction I was working with telling me, regional attractions do well in both good and bad times. When times were bad like they were in the late 70s, people downsized their vacation and instead of going to Hawaii, they went to Wisconsin Dells. When times are good, people who cannot normally go on vacation can now afford to go to the Dells. This investing hypothesis worked out great and the distributions paid one of my son’s way through college.

Unfortunately, FUN cut their distributions during Covid-19 and the President of the Attraction, which was a very well run business, decided to close its doors after 75 years because they were not able to open for two seasons. The majority of the business was liquidated by selling off the real estate.

Home Depot around 2010 was not looking so pretty on the surface. There was the housing debacle and they had a bad CEO who was an alumni of GE who was laying off helpful employees and thinning the inventory. At the time I bought, the bad CEO had just been replaced and I noticed that HD was paying a 4.5% dividend and the dividend had been raised twice in the previous year. I had been going to HD for years, and often looked at the stock and concluded it was too expensive. It wasn’t in 2010. I bought HD for the current yield with 20% dividend increases keeping me ahead of inflation (even Joe Biden style).

Another stock in the technology industry was Microsoft in 2010. At the time the were seen as an also ran technology company and their revenues were reducing year over year. If you took the time to understand why, you would have learned that they were switching from selling boxed software to selling monthly subscription based software which offered more stable financials. What really caught my eye was MSFT had over a 4% dividend yield and it was growing around 10% annually. I bought and got more than the sum of the current yield and dividend growth rate. Microsoft’s Office 365 subscription based product is a runaway success, and they are growing the footprint to take over other areas of technology including telephony, corporate IM, Identity Management, and more.

My final thought is yes by all means take a look at buying stocks of companies you do business with, but you don’t have to be the first to the party to make a nice return.

LikeLiked by 1 person

It sounds like you have done better than not, by investing into areas that you had some first-hand understanding. FUN runs Valleyfair here in MN and I remember going to Cedar Point when I was a kid. I can’t think of the last individual stock that I’ve bought. I have just tried to stick to the big index funds. I added some high-dividend yielding ones inspired by your prompting. 🙂

LikeLiked by 1 person

The Mall of America used to run Peanuts themed rides that were part of their operations.

Direct ownership of stocks allows one to track their performance by annual income and income growth. I get to choose when I realize capital gains. With mutual funds, you are in the same canoe as people who chicken out and sell when they should be buying.

LikeLiked by 1 person

That’s right – what was originally ‘Camp Snoopy’ got rebranded as ‘Nickelodeon’ around 2002. I wish it was still Peanuts, since Charles Schulz grew up here in Minnesota.

LikeLiked by 1 person

Klaus brought up memories of learning about risk tolerance and the long run.

As a young claims adjuster in 1986? In Northern New Jersey I handled a matter for an older woman whose son if I recall was CFO of a company in California named after a fruit. He and his new boss a guy known as Sculley as in John Sculley had recently been in town and she had dinner with them. She said, nice guy Sculley, the company will do well. I didn’t buy.

October 1987 Amgen a small biotech dropped in the crash and I sold my position….should have stuck it out.

First Gulf War begins. What do marines buy when they return from war with cash? Motorcycles, especially American made Harley’s. I sold after the investment doubled.

My point is pay attention and while you might have losses early on, they aren’t losses, but the price of education

LikeLiked by 2 people

Sculley was pretty hyped when he went from PepsiCo to Apple. I was a big Apple fan boy and left for college with a new Apple //c. Even almost 40 years later I remember some advice Sculley shared in his Playboy interview that year. He said success in life is being at the right place at the right time with the right set of skills. It’s hard to predict where the right place & time will be, but we can all develop our skills.

LikeLiked by 1 person

You should take another look at AMGN. I did and bought within the past year. The yield is 3.2% and they have grown their dividend around 12% per year for the past five years. I would expect to make a minimum of 15.2% per year (sum of yield and growth). You can make more than 15.2% if the stock becomes more popular.

LikeLike

I like a 3.2% dividend on a biotech company. Dividends much better than bonds. My view is that financial people convince people to buy bonds out of fear. Investing is about the long run measured in decades. I consider my investment horizon to be my grandchildren’s lifetime. Any longer is a challenge to fathom

LikeLiked by 1 person

We don’t have any grandchildren, but I really respect your thought on investing for “my grandchildren’s lifetime”. Being able to provide inter generational wealth is a real legacy. That is the kind of ‘privilege’ that we should all aim to pass on – along with expectations on how one lives with it.

LikeLike

I find that the older I am, the more I appreciate the philosophy of living below means with a longterm perspective. So much of society is now focused including “meet the quarterly numbers”, FOMO, Buy my stuff, don’t miss out. The FIRE movement is part of this. FIRE isn’t a destination but rather a process. I’m not saying don’t have goals, please have goals. Too many reach the destination and then wonder what is next. A passive income stream which allows for a standard of living at age 40 doesn’t always work at 50. We are in a constant change until we assume room temperature. Twenty five years ago I dealt with an issue involving dozens of disgruntled mobile home residents most of whom retired from aerospace at 55 and sold the family home, bought a mobile home and now couldn’t afford the space rental in the mobilhome park. They were bitter as the home they sold for $100,000was now worth $400,000. Many felt the dream they were sold at 55 disappeared. Don’t retire with enough, retire with enough plus.

LikeLiked by 1 person

There is something in our human nature to pursue the ‘fast buck’ for sure! When we were in our twenties, we sat down with my parent’s financial planner and I remember him telling us to play for the long game. He had a sign on his wall with the equation: principal x rate x time (PxRxT). He explained that the ‘T’ made the biggest difference for all of his clients. I just picked up a Dave Ramsey book that looks at long time horizons as well. The focus is on building inter-generational wealth. Haven’t read it yet, but looking forward to how he frames the opportunity.

LikeLike

I’d be interested in your thoughts on the Ramsey Legacy book. I listen to the podcast, but I tend to think that he might quote too many “made up truths”, scripture in the book. While I am not anti-beliefs, he goes a bit far in the same fashion he gives Presidential praise or blame for things that a President seldom is responsible for. To me his advice is to be listened to, then verified.

LikeLike