Some friends and I were trying to solve the world’s problems over a beer this weekend. Someone asked if we are going to go into a recession or not over the next year. I replied that the economy just seems really “wobbly” right now … I don’t know if it will tip,over or not.

Another guy said he read that there was a 99% chance of a recession in the next 12 months. That seemed ridiculously high to me, but when I looked it up, I saw the The Conference Board was actually predicting that …

They were not alone in calling out the risk of a recession. The Federal Reserve of New York tracks the likelihood of recession based on the interplay of bond yields of different time horizons. They are showing a 70% probability of a recession before May 2024. (A year ago in May, they projected only a 4% chance of recession).

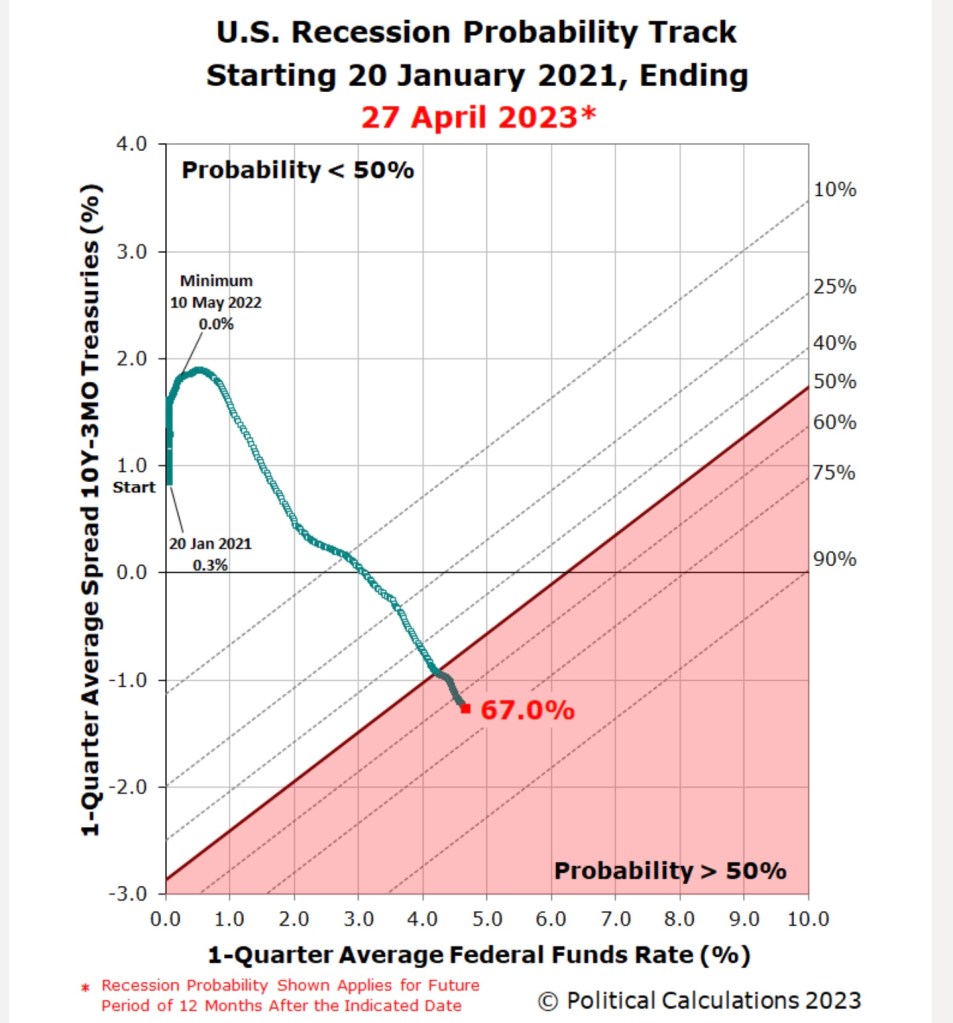

The National Bureau of Economic Research – the folks that claim the authority to formally pronounce a “Recession” – are also quite bearish on the economy. They predict a 67% chance of a recession in the next year …

I don’t claim to have any economic insights that are superior to these three esteemed organizations, so I guess I need to update my own expectations for the next year. Maybe we are past “wobbly” and definitely showing a big tilt toward recession.

What’s your read of the economy right now? Recession coming?

Image Credit: Pixabay

Good Morning Mr. Firestation. Tough call predicting events like a recession. From my vantage point, there are still tons of job openings, and maybe a little wealth effect kicking in via the surging equity indexes. However, the data points you highlight are also solid indicators going the other direction.

LikeLiked by 1 person

Good morning! Yes, lots of jobs still open. For some reason, less younger people working right now than before the recession. I’m not sure I would call the equity indices “surging” though. Yes, the S&P is up about 12.5% YTD, but still down versus a couple years ago. Has to get +500 pts / up above 4,800 to be “new wealth”.

LikeLike

Like you, Chief, I don’t have the credentials to challenge expert prognosticators. My guesstimate is recession is more likely than not. I always find them unpleasant to go through, but perhaps not more than inflation. Either way, we take a conservative, well-diversified approach to investments, hope for the best, plan for the worst, and always seek to spend less than we earn. Forewarned is forearmed.

LikeLiked by 1 person

“Forewarned is forearmed” … you always have a nice catchy phrase to keep things in perspective. You should think about a career in … ! 🙂

LikeLike

We have a war economy, we’ll be broke until we don’t

LikeLiked by 1 person

Both parties love to pump up the military don’t they? I thought the Democrats were supposed to be the doves, but they are the hawks today in Ukraine.

LikeLike

The historical methods of predicting recessions are not as accurate in todays world. What is more important is the level of support for those in need at the state level. What do I mean by that?

I live in the Peoples Republic of California where if you don’t have high income, you are entitled to a slew of benefits. If you have high income you get taxed heavily. This skewing of income taxes and the emphasis of relying on taxing the rich works in times of high income such as rising stock prices and options issuance but when the market is flat or worse, options don’t get exercised and thus income tax receipts drop. This is made worse due to the fact that when times are good, benefits to the dependent class increase yet are not adjusted downwards when times are bad as in lower tax receipts.

This also applies in “low tax” states where taxes continue to be cut such as in Kansas.

I am not arguing to increase support, rather I point out the we should keep an even keel and when times are good, pay off debt rather than increase programs. Note that I will never run nor be elected to public office.

For those who are financially wise, recessions should not impact us to any great degree. Those who live for today and spend all that they make is a different story. Make hay when the sun shines and prepare for rain……it will come and you better be prepared.

LikeLiked by 1 person

I can relate, Dave! My state of Minnesota has a lot in common with California. Kiplinger’s rated us “the least tax friendly state in the nation”. That was before our Democrat leaders started their latest term: $18B surplus completely spent; No refunds or tax decreases; $10B in new taxes; state spending up +38%; and $3B in new bonds/debt. Wealthy people are leaving MN for Florida in droves.

LikeLike