Internet memes get posted by the millions each day and most of them aren’t worth the time you spend looking at them. That’s why today’s post is pretty silly. I saw this dubious meme tonight and got suckered into analyzing it five different ways.

There are a lot of dimensions to the claim in this meme – time, inflation, houses, cars, college – and for some reason it really drew me in. It’s one of dozens of memes like this that I have seen recently. I have well educated friends that post,nonsense like this.

Their purpose (I guess) is to create the perception that life is financially unfortunate now. That the “good old days” were better economically and that society hasn’t made progress. (It’s usually accompanied by comments asking for politicians / government to “do something”).

Let’s unpack the claim in the meme step by step … to see how silly it is:

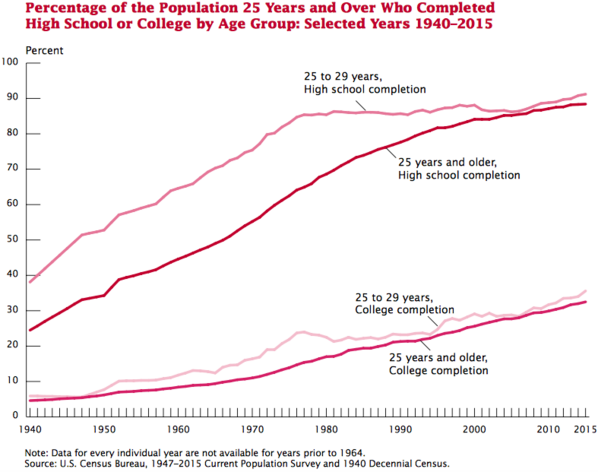

COLLEGE – Was it easy to pay for and go to college in the 1950s? Are less people graduating from college now because it’s so tough? No, not at all. It looks like fewer than 10% of people even got college degrees in the 1950s, based on this chart showing educational attainment by decade.

If “once upon a time” was happening in less than 1-in-10 households, that’s hardly a “a time” for anyone. Today (2015), about 4x as many people are getting college degrees (and 2x as many graduating from high school).

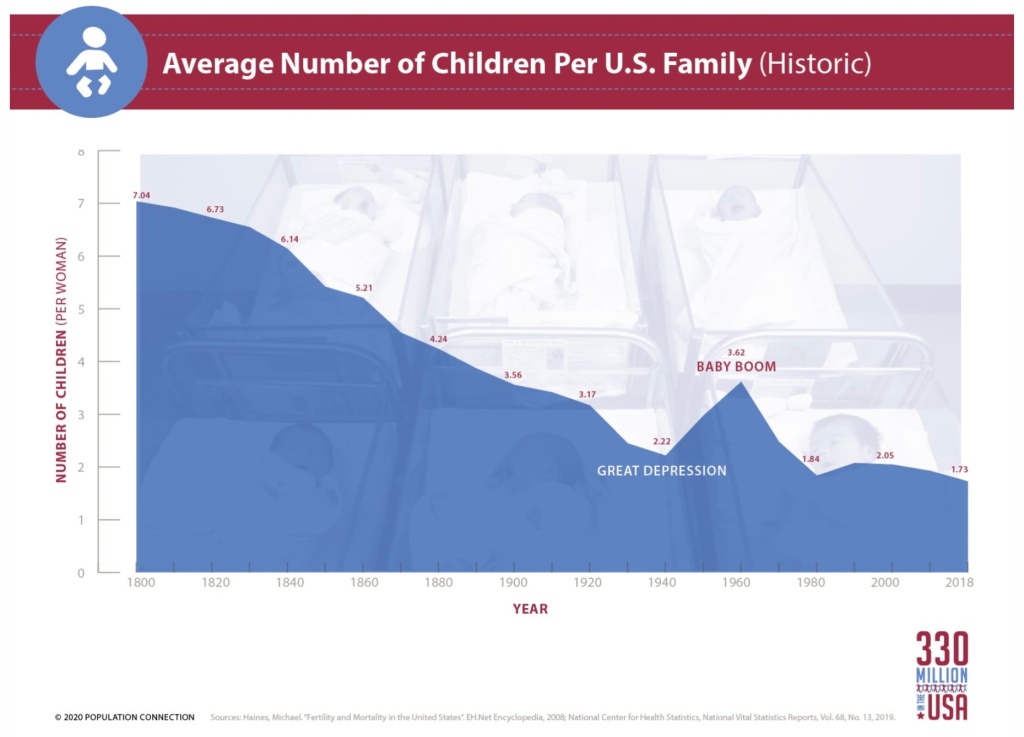

FAMILY SIZE – There are far less kids to even send to college today than there were in the 1950s. The average # of kids that parents need to support (and send to college) is only about half as many as it was at the peak of the baby boom (3.6 vs 1.7). Having just half the kids to pay for should make it TWICE as easy for Mom & Dad to afford, shouldn’t it?

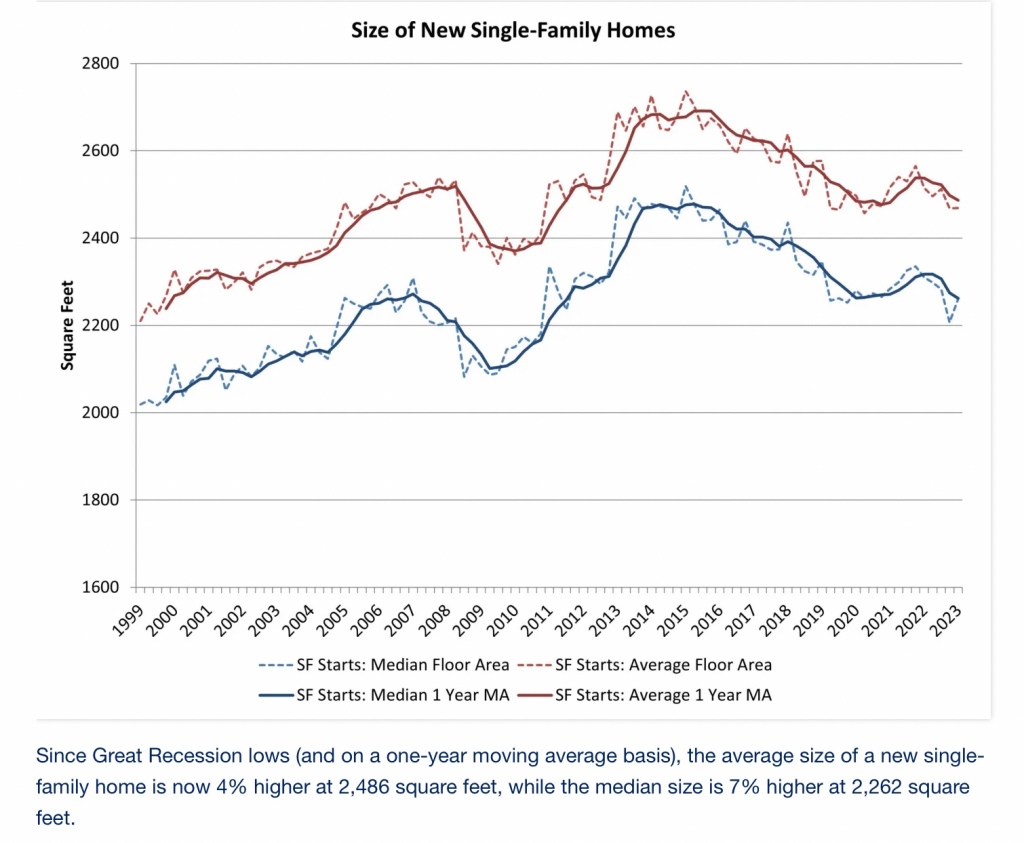

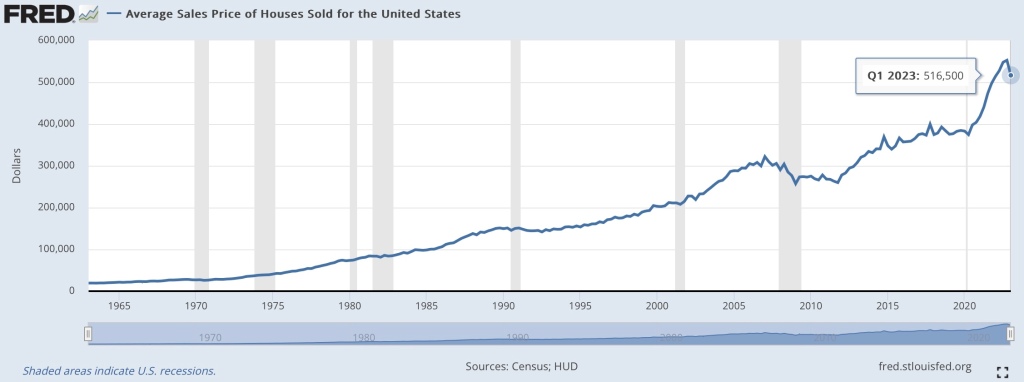

HOUSING – Houses in the 1950s were tiny and not very nice. They don’t compare at all with homes today that are much bigger & better equipped. In 1955, the average home had just 983 square feet. Compare that with an average of 2,400 in 2022.

HOUSING COSTS – If we adjust price & size of a house today ($516K average @ 2,400 sqf) with the size of a house then (983 sqf), the comparable price would be $211K for that 1950s-sized rambler. Moving to that size house would allow the average household to bank $304K for their kids college.

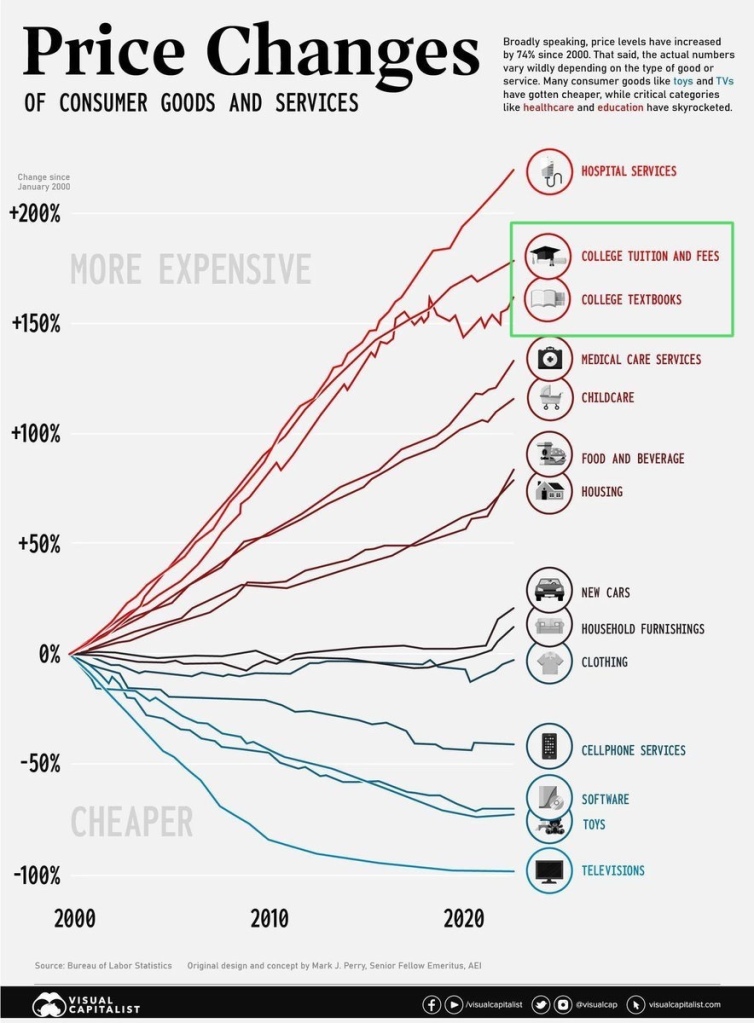

COLLEGE COSTS – It’s true that college costs have gone up faster than most things (first chart), but that doesn’t mean that it’s unaffordable.

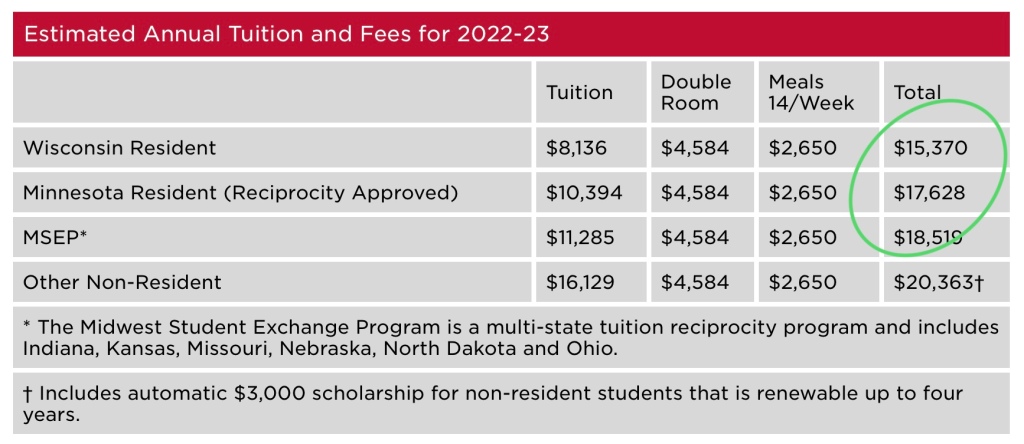

At our local university (UW-River Falls), $15K-$20K pays for a year’s tuition, textbooks, dorm rooms, and on-campus dining. In the summer, you can work & save money for pizza & things. (I can confidently say – from first hand experience – that you can learn enough at a school like this to climb the MegaCorp ladder, retire early, and spend your time analyzing memes).

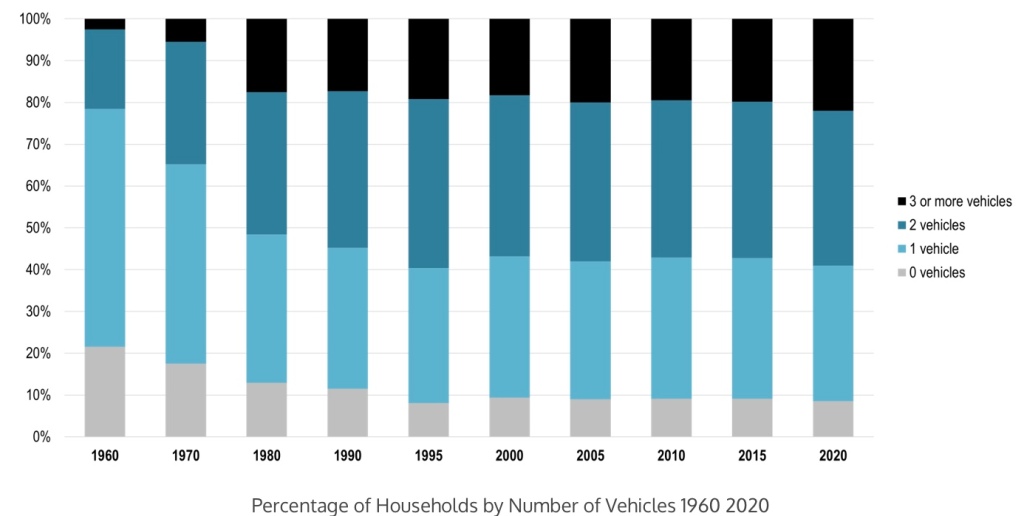

AUTOMOBILES – It’s weird that the meme even includes “owning a car” as part of its claim. Who owns ‘a car” – singular? The chart below shows that most households (not families, but households) generally own 2-3+ cars. In the 1950s, 80% owned zero or just one. (Cars are a money drain and choosing to own more of them doesn’t make it easier to send your kids to college).

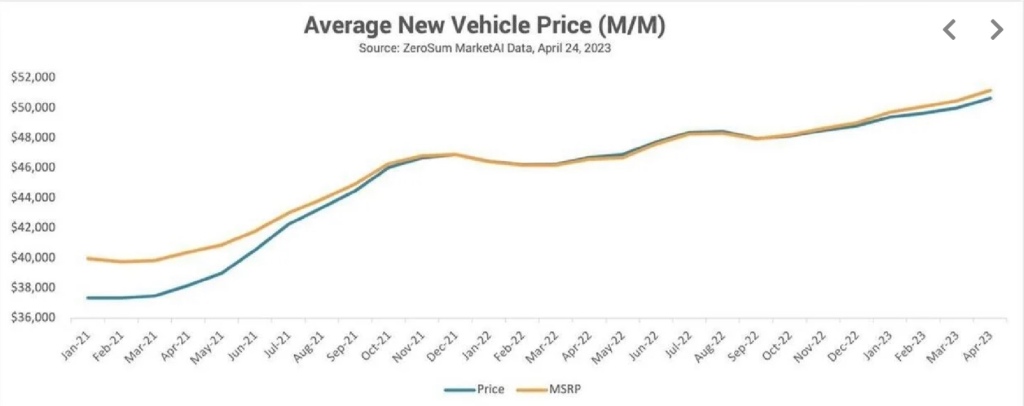

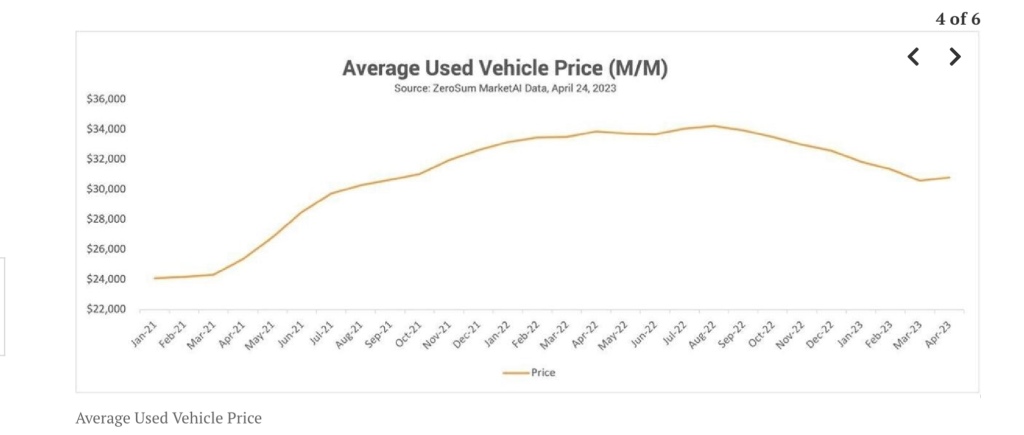

AUTOMOBILE PRICES – The current average price for a new car is $45K. Used cars average $30K. Just having one extra car (or 2) compared to the 1950s is enough to send a child (or 2) to college for a couple years.

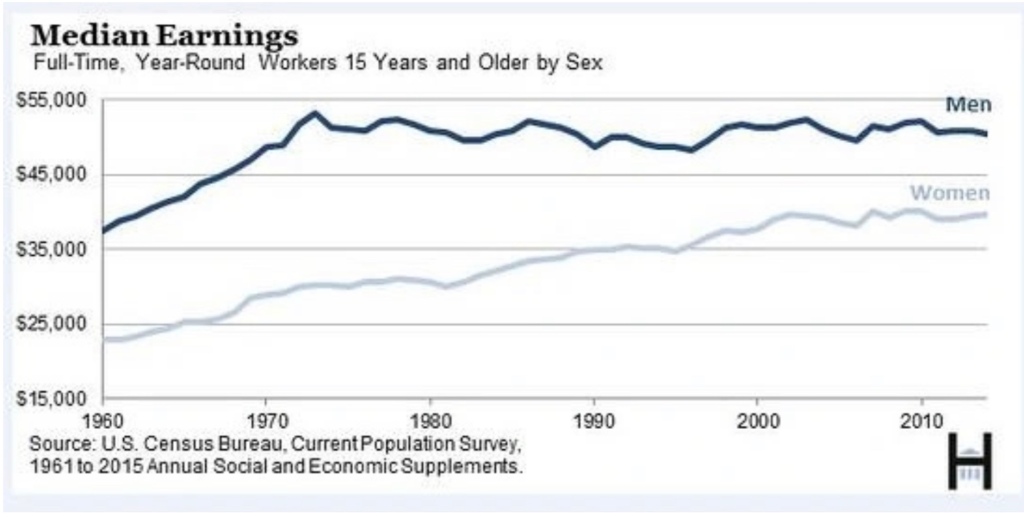

INCOME – How have incomes fared over this time? Pretty well, actually. Real income (adjusted for inflation) has improved markedly since 1960, especially for women. The difference between then-and-now, for either men or women, is almost $20K per year. That’s enough to send a kid to college.

IN CONCLUSION, these memes are about as phony as any that you see on political sites. The claim that “Once upon a time …” rarely happened and when it did it was because Mom & Dad were most likely willing to live in a very small house, with one car, and choose between their kids.

Parents today, have higher incomes (together & individually), but are more likely to be spending that money on much bigger houses and many more cars. College costs remain quite affordable relative to the other things Mom & Dad spend their money on.

Now should we look at how much Americans spend on travel, entertainment, sports, boats, and RVs/vacation homes compared with the 1950s? Anyone in the market for $1K Taylor Swift tickets?

Anyone want to move back to a typical 1950s lifestyle?

Image Credit; (c) MrFireStation.com with Midjourney AI

I disagree that college is affordable and that it is a good thing that more young adults are going to college.

I graduated from high school in 1977 and immediately started working a summer job in the tourist industry in Wisconsin Dells. Looking at my Social Security earnings statement, I saw that I earned $2,400 working 72 hours per week during between Memorial Day and Labor Day with a weekend or two thrown in. During the fall, I went off to UW – Eau Claire. The cost for tuition, room and board, plus they loaned you your books so you didn’t have to buy them, was $1,750. I was able to pay as I went by working only summers and not taking out student loans or getting any financial assistance from my parents who didn’t have any to give. Many of my peers were on the same program. Work a lot of hours during the summer and pay your own way through college. I was earning about 10% over the minimum wage.

Last time I checked, UW Eau Claire was about the same price UW – River Falls. Ask yourself these simple questions? If I graduated from high school today, could I work at a job that paid 10% over minimum wage and clear enough to cover the $15, 370 with plenty of spending money left over?

I just checked and Wisconsin’s minimum wage is $7.25 per hour. $7.25 X 110% X 72 hours per week X 13 weeks = $7,464. Instead of my experience earning 40% over the $1,750 that I needed to cover college in 1977, today’s young person would only earn about half their college expenses.

If you calculate living off campus in an apartment the numbers become worse. The simple fact is that college has risen 50% faster than inflation for decades, while entry level jobs have lagged inflation.

Now let’s consider whether more young adults going to college is a good thing. When I went to high school, guidance counselors and the classes were not geared to send everyone to college. They encouraged and started training students to go into the skilled trades. Many skilled tradesmen earn more than college graduates who choose dumb majors. Studies Departments and their graduate victims don’t want to hear this.

LikeLiked by 1 person

Hmm … Why would you use minimum wage as the basis of your analysis? Hardly anyone makes minimum wage. It doesn’t represent what people actually make.

It looks like I could be a “crew member” at the Culver’s in Eau Claire starting at $16/hour, according to a posting on Indeed.com. That would be $15K earned in your example of a hard-working summer.

Additionally, while summer work earnings may be a reference point for some, it would seem to me, that most would make their college decision on what they earn once they have finished their degree.

For the most recent year, a UWEC graduate commands a starting salary of about $51K, according to the university. That’s a good return on $15.3K a year tuition & room/board, isn’t it? Likely even better for those in STEM fields. I think that’s why more & more people go to college. It’s a market.

I agree that we probably have more people going to college. Then the economy needs. That said, it is their choice not mine. I didn’t say that it was a good thing, only that rising college attendance is a sign that college is more affordable than what the dubious meme suggests.

LikeLiked by 1 person

Good hearing that kids are earning more than Wisconsin’s minimum wage. That was what I earned slightly more than in 1977. Here is where the Culver’s job in Eau Claire comes up short; $16 X 72 hours per week X 13 weeks = $14,976. So instead of covering the bills at UW Eau Claire with spending money left over, you are coming up short. I doubt a business would let you work 72 hours per week these days. Many of these jobs want young adults to cover only when they are busy.

Another part of the plan that I executed on was living at home during the summer, so I had no rent payment. Wonder if the same $16 per hour is available in Wisconsin Dells. Last time I was there, there were a number of outside employees brought in from Eastern Europe, instead of every local working long hours during the summer.

My ROI was even better than your example of today’s numbers. Lumping in UW – Eau Claire where I lived in the dorms, and UW – Madison where I shared a two bedroom apartment, my total cost for four years was around $15,000. My first year out of college, I earned $23,461, so I earned back my investment in less than one year.

My beef with high school education is that most schools used to include introduction to a trade and life skills as a part of a rounded education. I learned auto mechanics and personal finance. Of course I am passing this on to my sons. My sons are always commenting, why don’t they teach this in school?

Not ending on a curmudgeon note, I would like to add an area where the current times are much better than the ‘good old days”. Investment costs are much cheaper than the good old days when you had to go through a full commission broker. My trading cost is $0. I also have access to great information that wasn’t available before the internet. As late as the early 90s, I had to trek to the local library over lunch to read through their Standard and Poor’s Reports to look for stocks. I also have benefitted from 401-k’s which started about the time I graduated from college. I personally like having more control of my financial destiny and not having to rely upon a former employer to run the business well and not touch the pension funds.

LikeLike

I grew up a child of the 50’s. I loved it. No bike helmets (or locks). Drink water from a garden hose. Free-range neighborhood until dark. Everyone knew everyone. Dads worked. Moms ran home & family. Kids played. Both my grandfathers were college grads, as was my dad. It was expected for me. At public university, it was possible for me. I always taught my kids that “education is its own reward.” From the day each was born, I began financial plans for their college costs. Now I do it for grands. That may or may not yield economic benefits for them in life, but it’s not why I do it. I do it to honor family and those who were before me.

LikeLiked by 2 people

Great thought, John. I inelegantly put it to my son this way, “a good education makes you less a pain in the a** for everyone else to deal with!” 😉

LikeLike

Great analysis. I think we tend to remember the good things better than the bad, and this tendency often leads to overstating how good the old days were.

You putting facts and numbers to it cuts through much of this clouded perception. If you were to step back further in time, I heard Warren Buffet say the average American today, lives better than John D. Rockefeller. Health care, housing, education, entertainment, travel, etc–our advantages are remarkable compared to the richest man over a century ago.

LikeLiked by 1 person

Better than John D Rockefeller… That’s quite a comparison isn’t it! Yes, I think that we often fail to see what amazing economic benefits we enjoy versus previous generations.

LikeLike