Bernie says it. Biden says it. Our state governor says it all the time: “We need the wealthy to pay their fair share of taxes!” What’s fair? They never say. A great sound bite, with little actual substance.

A few years ago, I posted an analysis of what “Seizing The Rich” actually looks like. My goal was to put into context how small the wealth of the rich is relative to the massive spending & debts of government. In the 7 years since I posted it, no one ever disputed the facts.

Since it’s an election year, I thought it would be a good time to do an update …

If you …

💰 Seized ALL the wealth of America’s Billionaires: $5.5T (Forbes, 2024).

Then …

💰 Seized ALL the income of anyone making over $250K annually: $0.7T (IRS, 2022)

Then …

💰 Seized ALL the profits of the EVERY S&P 500 corporation: $2.9T (Fortune, 2023)

You’d have …

= $9.1T TOTAL SEIZED

That would only be …

🇺🇸 Enough to run the US government (Federal, State, Local) for about 10 months.

Annual government spending is 11.3T. (2024 estimate, USA Bureau of Economic Analysis).

Please keep in mind the following things that would be concerning if we proceeded down this path:

– You’d have to move fast because many of these billionaires – our nation’s greatest innovators & business people – would likely flee.

– Most of their wealth is tied up in corporate stock, so the government would now be running many of the biggest companies we rely on.

– The action might cause a huge financial scare, which we would likely never recover from (see: Venezuela).

– Many of our greatest companies – without their owners/founders/chairmen – would also likely flee.

– There would be no people / money left for any investment in innovation or new technologies.

– The money seized would not reduce the $34T in national debt that we already owe as a nation.

– The money seized would not reduce the $78T in unfunded Social Security & Medicare obligations we already owe as a nation.

– To keep going, you would need to do it again next year – but all the wealth of the billionaires would already be gone – reducing the coverage of government spending to just 3.8 months.

In short, there are far too few rich people and corporations and too many of us to make this strategy work for our nation. It just doesn’t add up. That makes it plainly intellectually dishonest for politicians to claim that we can’t invest in the future because of greedy billionaires, corporations, and executives.

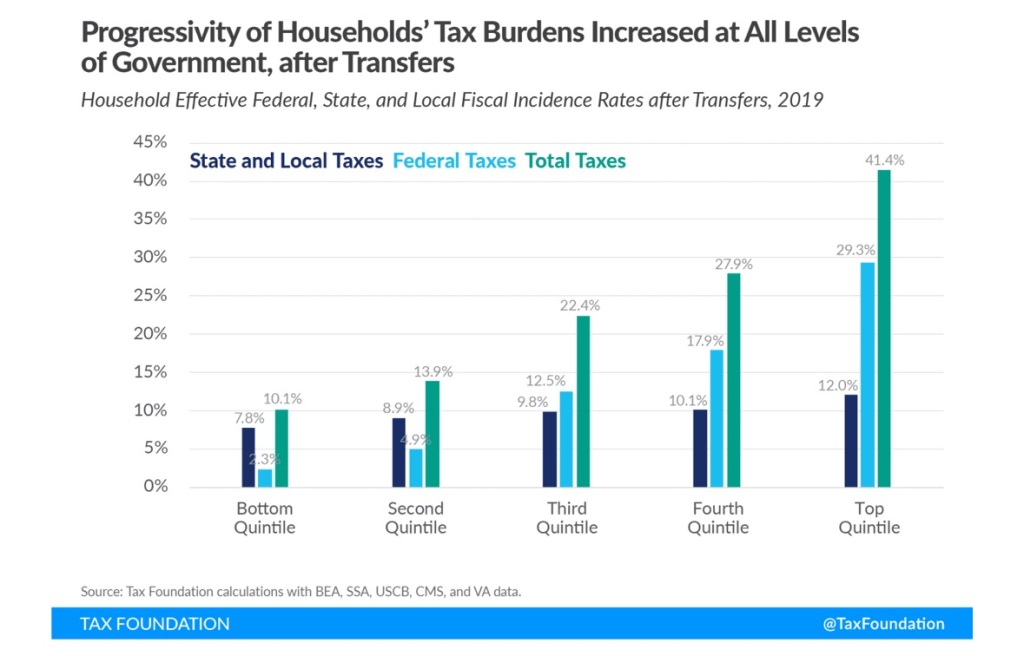

(I’ve included a couple of charts from the Tax Foundation below that show how actually highly progressive our tax structure is. It’s one of the most progressive in the world).

Are your politicians asking you to vote for them because they will “make the rich pay their fair share?”

Image: Pixabay

Great piece!

LikeLiked by 1 person

Thanks, this is your all time best. Here are some random musings.

Politicians are buying the votes of 51% of the voters by ripping off the other 49%.

Politicians have turned coveting into a virtue, instead of one of the sins listed in the Ten Commandments.

The word “politics” is a Greek word. The root “poli” means many and the suffix “tics” means blood sucking creatures.

LikeLiked by 1 person

Agree – those are profound and entertaining observations! 😄

LikeLiked by 1 person

Here is one other favorite. Margaret Thatcher said, “The problem with socialism is that you eventually run out of other peoples’ money.”

Regarding becoming an expatriate; if you expatriate without renouncing your citizenship, the USA still wants you to pay taxes. If you renounce your citizenship and have over $2M net worth, the USA wants you to pay an exit tax which is the equivalent to marking all you assets to market and paying a capital gains tax, less a non-inflation adjusted $821,000. The truly wealthy can have their fleet of tax attorneys and bankers help them wiggle out of it. This would hit people situated like most of your readers.

I recently had lunch with Ireland based friend and businessman I have done business with over the years. He is a Chartered Accountant (EU equivalent to CPA). He discussed how Ireland went from being really poor to having a per capita GDP 50% higher than the USA. They initially lowered their Corporate Tax Rate to 12.5% and raised it to 15% after five years. The country was very successful in getting intellectual capital based businesses to move their HQ and tax domicile to Ireland. The country is running a budget surplus and they are afraid to spend it because other countries will surely catch on and start competing. Countries like the USA are like the monkey who stuck their hand in a jar to get the peanut and cannot fit their greedy fist out of the jar’s neck.

LikeLike