I rejoined our neighborhood investment club this past Friday morning. It was a crisp 55-degrees here in Celebration FL, so we met inside the neighborhood clubhouse. There are quite a few Snowbirds in the group like myself who haven’t seen the other guys since last April.

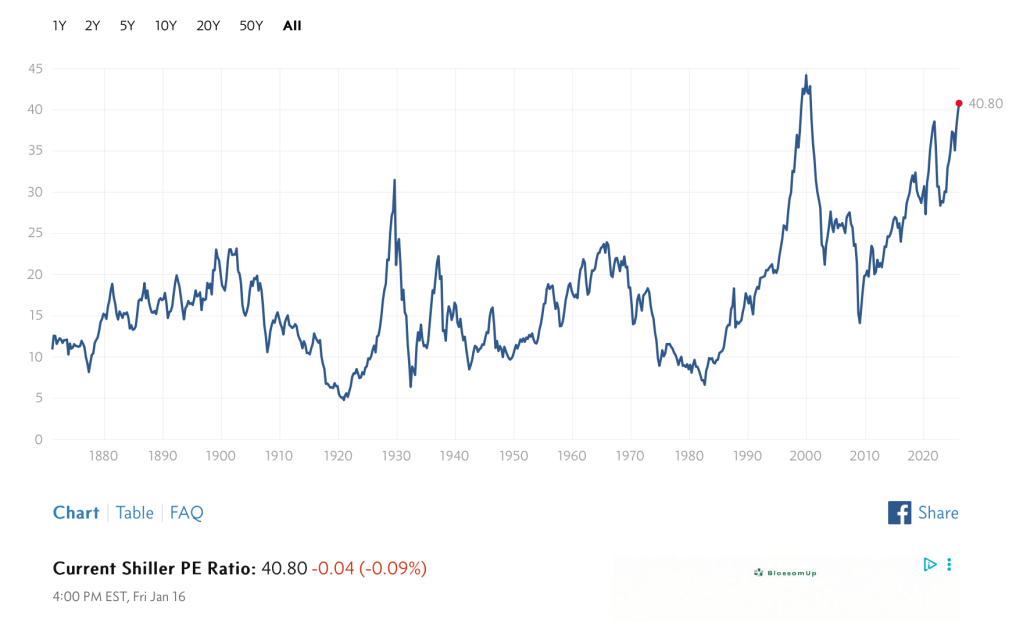

Rather than talk about how well 2025 turned out for most investments, the conversation was forward looking. We were all wary of the relatively high current multiple of the S&P 500 and many of us were sitting on some cash that we were unwilling to put into the market at such at such a lofty price. The Shiller PE ratio is almost as high now as it was during the dot.com boom …

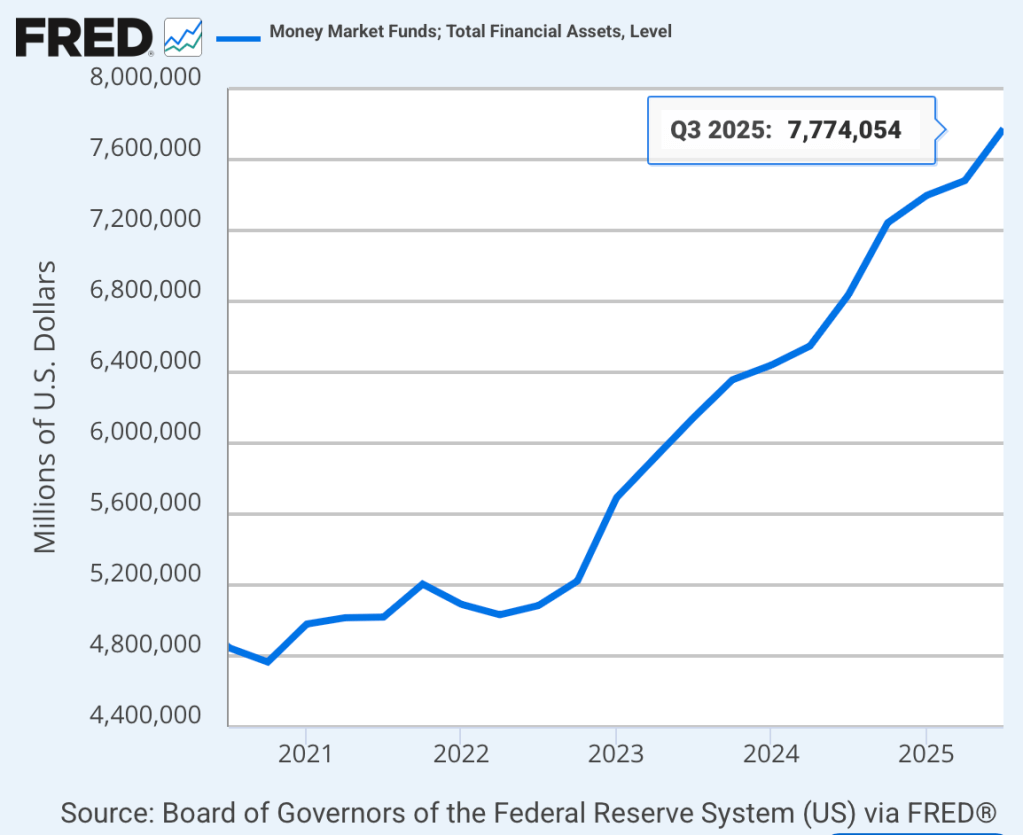

One of the club’s members noted that many people were doing what we were doing – holding extra cash – and that it represents OPPORTUNITY for the market, that could offset the risk. Money Market funds in the USA are holding a record ~$7.8 trillion in cash on the sidelines. I’m not sure what the “right” amount of money to be held in money markets is, but the balance has grown faster than the stock market overall, which is pretty impressive.

The Federal Reserve tracks the $ in Money Market Funds …

If half of that $7.8T was put into the stock market tomorrow, that would be about +6% growth for the stock market. In addition, he noted that there is significant cash in other savings vehicles (pensions & 401Ks, for instance). Perhaps all investors need to see is a strong round of corporate earnings, a further drop in interest rates, or continued good GDP growth to put their “dry powder” into the market.

We are in that situation ourselves. We have extra cash right now from the sale of our rental townhouse last year, but kept much of it out of the market. We are utilizing CDs and a “premium” money market fund that are all paying a bit short of 3.75-4.00% right now.

Do you have money “ready” to go into the market? What would cause you to push it into play?

Image: Pixabay

As a part of my dividend investing strategy, I screen for historically high current yielding stocks that have a good track record of long-term dividend increases. This means I stay away from the stocks that were responsible for most of last years above normal return of the market weighted S&P 500 index. Typically, these stocks are out of favor. Right the best bargains are found in Pharma, processed foods, electric utilities, REITS and preferred dividend CEF’s.

Maybe 2026 is the year that the Equal Cap Weighted S&P 500 outperforms the Market Cap Weighted S&P 500? Must be stimulating getting together with the investment group? Bet you don’t hear many talking about super boring dividend stocks that are like watching paint dry?

LikeLiked by 1 person

It’s an interesting group. Most of the members seem to be “boring” low-cost index fund investors like myself. We haven’t talked about individual stocks much, but tomorrow we might make 2026 predictions in which stocks are most likely to grow (or decline) the most as a friendly contest.

LikeLike

I have very little cash at the moment, and most is spoken for to pay taxes or travel. This isn’t to say that I am 100% invested in securities, I am not. Currently 70% US Equity, 21% Fixed Income, and 7% Non-US Equity.

I am not a market timer and only 10% of my portfolio is in deferred accounts such as IRA’s. I don’t trade much due to investments in long-term holdings and to minimize tax burden.

I am distributed among tech flyers such as Broadcom, Microsoft, Apple, Lumentum and Itron, as well as some tried and true places such as 3M and UPS (recently in at 85, now 106).

Securities such as Lumentum, Itron and 3M had great technology that no one paid attention to until they did and then it was a huge move such that my cost basis is now quite low and downside risk is manageable.

I admit that my investment horizon is the lifetime of my grandchildren who are age 5 and 11. The horizon would be longer except my brain is challenged even at that.

Money is made when you buy the stock at a reasonable price, even if it takes years to be discovered. Something can languish in a range of $30-$50 for two to three years paying a 3% dividend and then move to $150-$200 in the span of six months. Those are the unusual securities but it isn’t unusual for a 25% pop in under one year for a beaten up stock such as UPS has been for me.

I recognize people are fearful of the market heights, but inflation is down, energy is cheap, taxes are in check, fraud is getting attention, and the oldest Baby Boomers are turning 80. That means that more assets will be passed to new generations who will put that wealth to work.

We remain the safest and best place to invest in the world

My long-winded manner of saying that I don’t have any cash to put to work.

LikeLiked by 1 person

No, I’m not much of a “market timer” either. I do know quite a bit about one of those stocks you mentioned (MMM) – as that was where I finished the last few years of my career at. Their new CEO has the stock moving in the right direction, although still far below the $200/share they once peaked at.

Our investment group talked about grandchildren briefly last week. One neighbor commented that he is a “buy & hold” investor because he doesn’t want to pay the capital gains on his stocks. Better to hold them for his kids & grandkids someday – and they will get the benefit of the stepped-up basis.

LikeLike