The pandemic seems to have changed a lot about the workplace & retirement, but one thing it hasn’t changed is the average age of retirement. The Gallup organization tracks the age at which people retire annually and for 2022, it remained constant at 61 years old. It’s been 61 every year but one (62 in 2020) since 2016.

If you look farther back in history, it has changed quite a bit … for the worse. According to Gallup, it was 57-58 years old in the early 1990s, when I was early in my career. It’s interesting to think that despite the information & productivity revolution driven by the digital communications, people are working longer careers, not shorter!

The government’s push to increase national pension / Social Security retirement ages has undoubtedly been a major driver, but given the relative prosperity we’ve seen in the American economy over the last few decades, you would think people would be better prepared for an earlier retirement. Yet, that’s not the case.

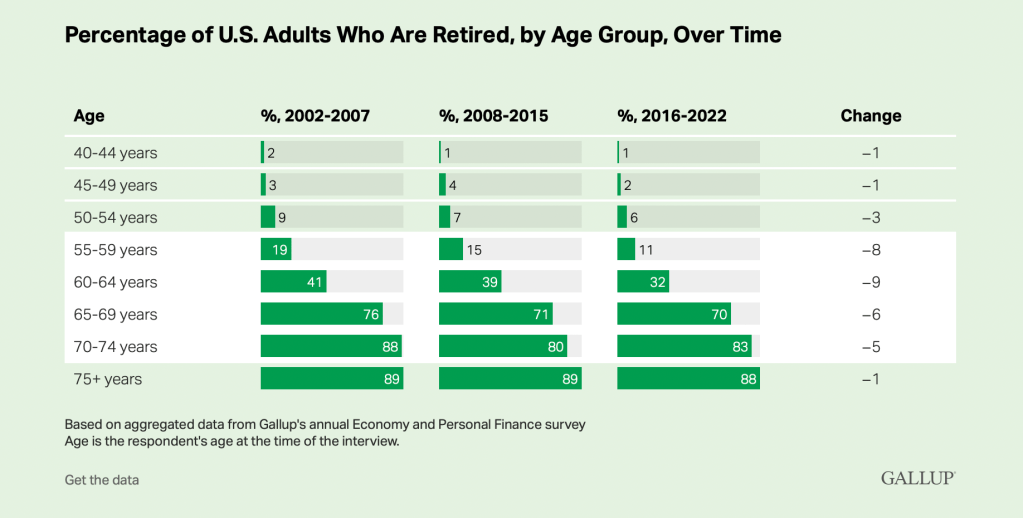

Gallup shared this great chart that shows the % of workers who report being retired by age bracket, across three periods of time. You can see that less & less people are opting for an early retirement. The percent of people retired at age 55 has declined from 19% to 11% over the last 15-20 years.

Source: Gallup.com

We have some good friends who are planning for retirement in a few years. He just turned 60 years old and they are thinking that 63 would be a good age to hang it up. Given the long-term trend of retirement, that might be average age by the time he punches out of work in 2026.

Have you seen your friends delaying their retirement compared with 10-20 years ago? What do you think are the major drivers?

Image Credit: Pixabay

I have friendships with those ages 40 to 85. The ranges of planned or actual retirement age varies tremendously. I actually attended a retirement luncheon this week from someone who used to work for me.

He is 69 and was financially not ready when I hired him 9 years ago, a big part of his coming to work for me was to take on a new challenge but also to fund a better retirement as he had not been fiscally prudent at younger ages. His wife plans on another 18 months of work as she is only 60.

I also know many in my building single women in their mid-seventies who lament not being able to afford a better lifestyle due to divorce in their 40’s and never partnering up again which led to depression and hatred of work leading to retirement at the first opportunity.

I think average statistics are that, average. The age of retirement at the individual depends upon such a varied amount of factors and in ones circle of friends, often they and you are the company you keep. Extravagant people hang out together and frugal people likewise. I know people who like new cars, sporting events and golf which all require expenditures of money. They also say that they “have to work until 70” Why?, that is simple wants and perceived needs. That is ok I don’t judge. People might judge my flying business class international…one of the reasons why I consult part-time, to fund my fun without drawing down investments.

To each his or her own

LikeLiked by 1 person

The impact of divorce on retirement is tough to watch. I have a friend who thinks he is heading that way right now and thinking through the financial ramifications. As I heard Dave Ramsey once say, “divorce turns a marriage into a business transaction.” No fun for either party and they both must live with less than they expected- unless they find someone else to pair up with.

LikeLike