Happy New Year!

Before we get too far into the new calendar year, I wanted to look and see where we finished 2023.

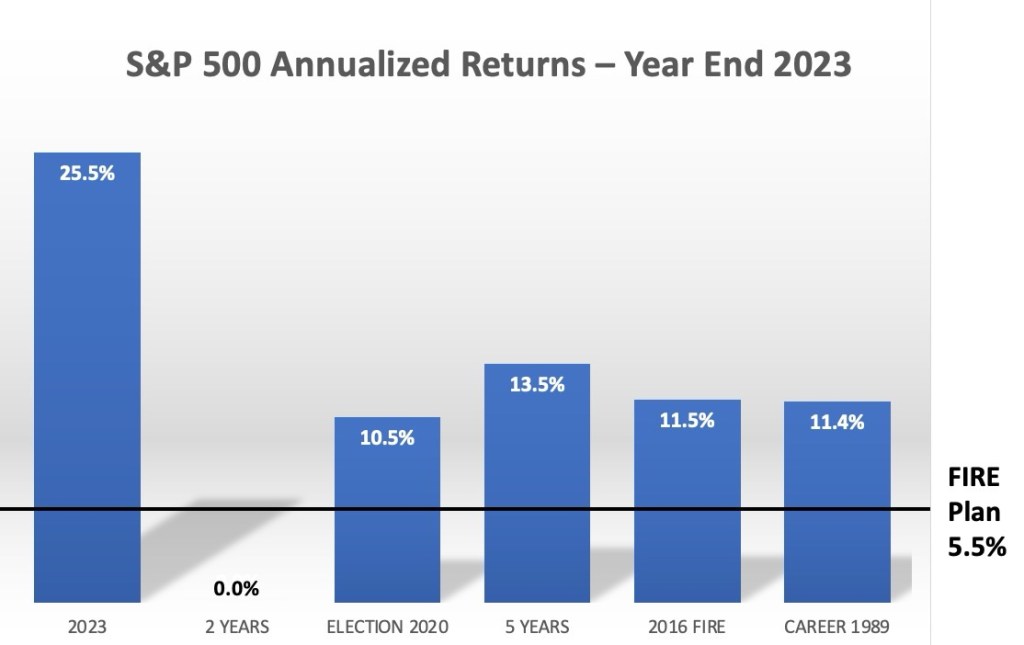

The stock market had quite a bounce back in 2023. After a -20% loss in 2022, the market jumped +26% this year. That nets out to exactly flat (+0.0%) over the full two-year period. Quite a volatile ride.

Over longer periods of time, returns look terrific …

Our retirement plan was conservatively based on 5.5% equity returns (not including dividends). The market has trended WAY ahead of our plans over all of these periods.

Other parts of our portfolio – bonds, CDs, & real estate – were a drag on our returns in 2023. Against inflation, these parts of our retirement nest egg certainly lost ground.

Still, there was a time when I worried that inflation was the biggest wild card in our portfolio. I worried that a period of high inflation might torpedo all of our plans. Now, after good portfolio returns during the worst inflation in 40 years, I’m feeling pretty good about our nest egg’s durability.

How did your portfolio finish the year?

Image: (c) MrFireStation.com

The past four years which coincides with my retirement has been a pretty significant stress test of investing methodologies. I track my progress primarily by the annual income that I will receive from dividends, and look at market value secondarily. The goal of my investments are to cover my income needs with current yield and stay ahead of inflation through dividend increases and rebalancing from stocks that have had a runup in market price into stocks with higher current yields. My annual income has increased every year to beat inflation.

During 2022, I was able to move into some beat up stocks that offered higher current yields, yet were still safe. This increased my annual income from dividends by 29.27%. My market value return was -4.09%.

During 2023, I had a couple stock selections made in 2022 that turned out to have degrading business models, so last year’s focus was moving to higher safety. I was able to squeak out a 5.08% increase in annual income with a 5.98% increase in market cap.

These numbers are inclusive of my entire portfolio that includes bonds, fixed income, and Real Estate (primarily in the form of REITs).

LikeLiked by 1 person

Increases in 2023 on top of increases in 2022 should have you in a great place. Are you spending your largesse, or reinvesting it for the future?

LikeLiked by 1 person

I am doing a little of both to keep ahead of inflation and give myself a nice raise every year.

LikeLike

Well done, Chief! In 2023, we had a healthy financial year. I choose to simplify into one “master number.” That’s our highly-diverse investible assets (stocks, funds, bonds, CDs, Structured, Dividends plus Alternatives). It does not include real estate. Net gain: 14% – twice our annual desired goal. More importantly, we remain on track with our overall strategies since leaving full-time work a dozen years ago: 1) Protect Capital; 2) Fund All Expenses; and 3) Maintain Purchasing Power. The third is hardest to achieve during high-inflation, but we’ve managed over time to do it.

LikeLiked by 1 person

Nice close for the year! Our all-in number is about +12%, so I’m happy with that, too. The high-Inflation of 2022 & 2023 really made me nervous, but I guess we all got through it OK.

LikeLiked by 1 person

I am finishing a trip of two days in Auckland, three days in Sydney with a fifteen day cruise in between. I say that as my numbers are rough in that I have yet to update month end spreadsheet. We are up about 12% for 2023 after a distribution for taxes, investment fees, and travel. I am pleased to have topped our previous net worth high excluding real estate which is our condo. The plan is that the condo will easily fund skilled nursing care for the surviving spouse.

LikeLiked by 1 person

Twenty days “down under” sounds fantastic right now. I have a friend that did a similiar trip on Viking just before Christmas.

+12% is right where I netted out across all of our assets. Spoke with my financial advisor today and we both commented on how the economy seems to be stabilizing again. Hopefully interest rates will ease back down in 2024, as well.

LikeLike