There was a recent article in the Wall Street Journal talking about how expensive it has gotten to go to Walt Disney World. Friends have been asking me about it since we live a few miles from the World Drive Main Gate and go over there quite a bit.

There’s no doubt the price of a trip to Walt Disney World has gone up, but just how much? How much since a generation ago? Warning … this was a deep rabbit hole!

We have a unique data set for this questions since we went to Walt Disney World for our honeymoon in August 1990. It was the first time either of us had ever been there – only the second time we had been on an airplane!

Since money was tight, we wrote down everything we spent on our honeymoon trip. We still have the notecard with all of the details – diligently logged day-by-day by Mrs. Fire Station.

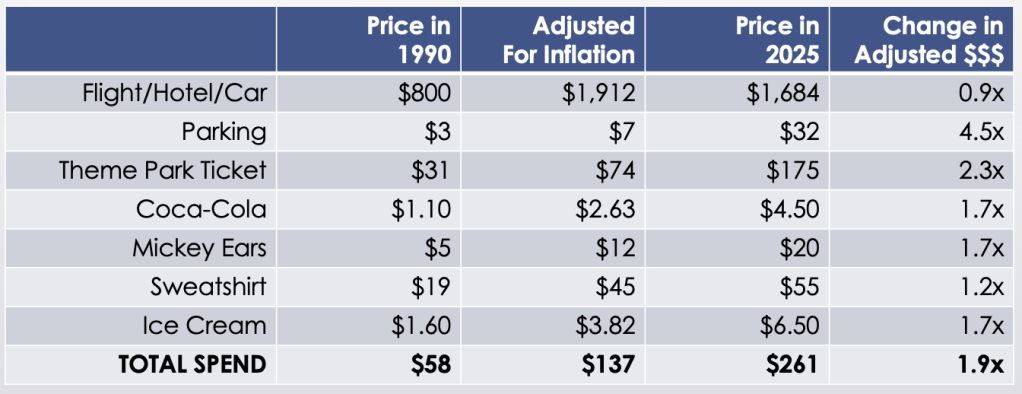

Looking at it now, the numbers look quaint, but adjusted for inflation the analysis is quite unexpected. First, the big expenses are cheaper, when adjusted for inflation than they were back in 1990.

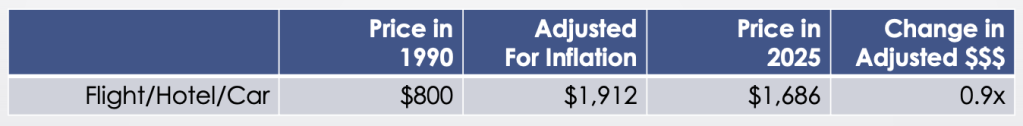

Our Northwest Airlines flight, “basic” Wynfield Inn hotel, and Pontiac Sunbird rental car cost $800 at Dayton’s Travel. Adjusted for inflation, that’s $1,912. Still, today that same trip priced out on Orbitz (for the same week of August) is $1,684. Amazing to think that the same basic trip is over $200 cheaper today.

The Disney part of the trip is much more expensive. The Wall Street Journal article said inflation-adjusted prices are up about 30% since before the pandemic, but over the last 30 years, they are up almost 200%. This table I put together shows the quaint prices of 1990 with the prices this week. Parking is especially through the roof …!

Still, given the savings on air/hotel/car, I think newlyweds could largely take the same trip today for about the same inflation-adjusted dollars that we took 35 years ago. We went to the parks (Disney + Universal) about 4 times, so I think it would only be about $250 more today.

To put this spending in perspective, I looked at disposable income through the Federal Reserve website (FRED). From 1990 to today, real disposable income went up 2.4x (from $7K to $17K). No surprise that the travel industry has tried to tap into that.

Do you recall prices from a long-ago trip that you could compare to today?

Image: World of Disney Store; (c) MrFireStation.com

You and Ms Firestation celebrating 35 years this Aug. I’ll bet THAT trip will be a lot more expensive 🤣

LikeLiked by 1 person

Thirty-five years with me affords her any trip she wants!

LikeLiked by 1 person

That would be 245 in California Marriage Years, because every year counts as 7.

LikeLiked by 1 person

California Dog Years?

LikeLike

My wife and I went to Europe on our Honeymoon in 1994. We flew coach to Paris. Stayed a couple days in Paris, took the TGV (bullet train) to Geneva Switzerland and stayed for a day, then took other trains to Florence and Milan Italy, and took trains back to Paris to fly out. This was back in the day when France had the own Francs, Switzerland had Swiss and Francs and Italy had their Lira. The total cost came out to around $3,500. I didn’t keep itemized records like you do, but the cost seemed reasonable.

I also remember going to Disney World around 1980 and I remember the cost was around $15.

Flying has become much cheaper thanks to the airline deregulation act of 1978 which was sponsored by Ted Kennedy because he wanted to make flying more affordable. This is about the only thing Ted Kennedy ever did that I approve of.

However, domestic flights have had a commensurate degradation in the quality of their service level. Small seats, meals are no longer served and nickel and diming for everything.

LikeLiked by 1 person

$3,500 in 1980 would be worth about $7,500 dollars now. Airfare looks like $1K/ person round trip non-stop from MSP. Add in $3K for 10 nights hotel, and I think you could still do it.

LikeLiked by 1 person

I checked flights and most of them from LAX to Paris were around $1,000. There was one called Norse Atlantic Airways that had $555 available if you fly on Mondays. I also checked LAX to London Heathrow and Virgin Atlantic had a bunch of flights offered for $630.

What’s changed since 1994, is that you can take a train from Central London to Paris Gard de Nord through a tunnel that goes under the English Channel. I prefer taking the train from London to Paris because it is much roomier and is a wash or better for time when you consider the time to get outside London to Heathrow and having to pass through security.

I checked LAX to Orlando Roundtrip and found it is a highly competitive route with lots of choices between $200 and $300 Roundtrip.

MSP has always seemed like a tight market, and when I used to fly to the Midwest, I would shop Madison and Milwaukee and found that they were often cheaper despite having to fly through MSP.

Flights are a relative bargain, especially when adjusted for inflation. Consumers also have better shopping data than ever to find bargains and try different options such as going to Minneapolis or Madison, or going to Paris or London. I have heard from colleagues that they have put together really cheap family trips to Europe by booking through Iceland having a stay there as well, and that they really liked Iceland.

LikeLiked by 1 person

We just paid $550 for a couple flights between Orlando & Minneapolis. That’s quite expensive. I think there is currently a Spring Break premium.

LikeLiked by 1 person

I agree how despite poor service, flights today domestically are far cheaper in real dollars today, in fact I booked a return ticket April 15 Burbank to Sacramento same day $111! Even with my Prius I would almost spend that much in fuel to drive.

Disney…My office was less than one mile from Disneyland and I looked out of my window on the tenth floor and could see the park, Anaheim Stadium and the Arrowhead Pond, now Honda Center. When co-workers in the 90’s complained of traffic and tourists in the Resort District, I would remind them of the privilege to live here as many of those visitors saved nickels and dimes and vacationed with their tent trailer at the river in the mid-west for years to save for such a vacation.

We had passes when the kids were young from 1995-2010. They were inexpensive for locals with a lot of black out dates and an annual parking pass was less than $100. Those passes increased in cost tremendously and I remember shaking my head when my eldest around I’m guessing 2018 bought annual passes without blackout dates for both he and his girlfriend!!! He was and is a hard worker but the cost of around $1500 for both as my memory serves was to me an actual waste of money but then to each his own and we all learn from purchases good and bad.

Disney acknowledged in the 90’s when planning that they made a mistake not buying more land in the 50’s because in Anaheim they didn’t control all of the visitor’s spending like they do in Florida. But remember that in 1955 Disneyland was a very risk venture to build in unknown backwater of Orange County.

People forget that Disney sold off the Disneyland Hotel years ago as they were not in the hotel business. They paid dearly later the buy it back and it was and excellent decision to bring it back to Disney ownership.

LikeLiked by 2 people

We’re reading the Michael Eisner biography right now. The Disney company had screwed up a lot of things in the late-1970s / early 1980s – including the Parks. Despite owning all of this land in Florida, the company only had 3 hotels in 1985. Now there are 25 – plus the Four Seasons.

We paid $1.1K for each of our current WDW Passes. That’s good for parks & parking. Pricey? Yes, but we have to go about 6x for it to pay out. Very easy as close as we are.

LikeLiked by 1 person

I am wondering if Eisner included Roy Disney’s open letter to the Wall Street Journal that “Eisner needs to get fired before he can pay himself again.” I am having trouble finding a link to this letter. This played out around 2004. Most of Eisner’s good part of his Disney run happened while Frank Wells was President and COO until his untimely death in 1994.

The gist of the letter was that Eisner had surrounded himself with crony board members that approved excessive pay. Another big part of the Roy’s complaints were that Eisner was solely focused on the stock price to the determent of product quality.

I bought Disney stock after reading this letter and held the stock until 2020. My return was around 15% over 2005 to 2020. I sold my shares soon after the dividend was suspended due to Covid-19 park closures. The stock price had an initial bump based on the promise of great returns coming from the streaming business. However, the dividend is currently at around 50% of pre Covid-19 cut and the stock price is has been flat over the past five and ten years.

There was a similar situation with Home Depot’s Robert Nardelli’s CEO tenure. He did do one good thing and that was getting Home Depot in the e-Commerce business and they do it fairly well. The downside was that he was fluffing up the books by not properly stocking his shelves and firing helpful staff with product knowledge. I bought Home Depot around 2008 soon after he was ‘resigned’. You also had the housing and mortgage debacle built into the price. HD was paying around 4.5% current yield at the time and was growing its dividend around 20% annually. My yield on cost is around 34%.

Nardelli’s next stop was Chrysler which went bankrupt around 2009. He occasionally makes an appearance on business shows.

LikeLiked by 1 person

Eisner & Wells were quite a team together. Like Walt & Roy. Amazing what they accomplished. Really expanded the company and made them a huge force in the entertainment industry. Stock grew +24% a year for 10 years, behind their leadership. After Wells passed away, only grew +6% a year until Eisner left. I read a recent interview with some Disney Imagineers that said Eisner was just overwhelmed after Wells passed & Katzenberg left.

LikeLiked by 1 person

My family always liked Knott’s Berry Farm that is close by Anaheim in Buena Park. They had a nice mix of thrill rides for older kids and Camp Snoopy and shows for young ones, and their Mrs. Knotts Chicken Dinner Restaurant is nice. Hopefully the don’t change too much as a result of being acquired by Six Flags.

LikeLiked by 1 person

Our Mall of America (MN) theme park was branded Knott’s Camp Snoopy for its first 10 years (when my son was little). Charles Schulz was from here and it was nicely themed. For the last 20 years, it’s been Nickelodeon themed.

LikeLiked by 1 person

Hi Mr. Fire Station,

Thanks for sharing, it was really interesting to read your cost comparisons from 1990 to today. We have two very young children and have been talking about going when they are older so it is nice to know that Disney World is not as expensive as we have been led to believe. We cannot wait to hopefully visit and make memories with our children there one day!

LikeLiked by 1 person

We first took our son to Disney World when he was just a little guy in a stroller. No, he doesn’t “remember it”, but we have some really fun pictures!

LikeLike

Klaus,

I think Eisner was the first of the mega rich, meaning net worth of hundreds of millions and perhaps billions in which net worth did not arise from being a founder….he was always an employee, albeit one with generous stock options.

I still can’t believe that Disney allowed him to buy both the Angels and the Ducks, both of which were sold relatively soon after purchase. The purchase of the Ducks as a new NHL franchise was something Eisner could do on his own. His children liked hockey! I occasionally had tickets to the Suite next the the Disney Suite. The City of Anaheim owns the Honda Center and as an Administrative Manager I had the occasional ticket thrown my way. I would see Eisner regularly and at the NCAA hockey Championship in the late 90s when my Alma Mater University of Maine won the title Eisner was entertaining Kurt Russel and Goldie Hawn and we high fived each other as the front row suite seats abutted each suite.

Henry Samueli of Broadcom fame bought the Ducks from Disney and has been a very good owner with a focus on community and philanthropic ventures.

LikeLiked by 2 people

I agree, Eisner and Iger both paid themselves very well at Disney shareholders’ expense. Nelson Pelz had an alternate proxy named “Restore the Magic” where he pointed out the hundreds of millions Iger and his board members have paid themselves, while their shareholders have made absolutely no return over the past ten years. I read the plan carefully and he seemed to have a handle on how to position Disney to start making money for shareholders again.

For a short time, Iger was able to sell a rosy picture of future earnings from their investments in streaming. I just looked and Disney is right back at where they were stock price wise five and ten years ago.

Broadcom ended up buying out the company that bought out the company that holds my Deferred Compensation Plan. I was happy to see a company that is doing well become the paying entity.

LikeLiked by 2 people

I have zero complaints on the returns i have enjoyed from AVGO, the tech giant that avoids bad headlines

LikeLiked by 1 person

A Facebook friend posted a candid photo of Disney CEO Bob Iger at Disney Springs yesterday – chatting with Amazon CEO Andy Jassy & Jeff Bezos.

LikeLike