We’re over in Europe right now for a Danube River Cruise starting on Sunday. The trip includes stops in lovely Prague, romantic Vienna, and mysterious Budapest.

Incidentals for the trip would have been a bit cheaper a month ago, before Trump’s trade strategy beat up the stock market, bond funds, and … the U.S. dollar. What was set to be our best exchange rate ever against the Euro, is now moving back up to where it was during the first Trump Presidency …

I highlighted on the chart the last time we were in Europe. Then it was $1.06 to the Euro – probably the best we ever did (and in inexpensive rural Italy). Now it is $1.13. The Euro has gotten about +7% stronger against the dollar, just in the last few weeks.

That said, you can also see from the chart that it used to be much higher. In 2021, the Euro was worth $1.20+. I’ve been on many trips when it was in the $1.30-$1.50 range, although it’s been about 10-15 years since it was that high.

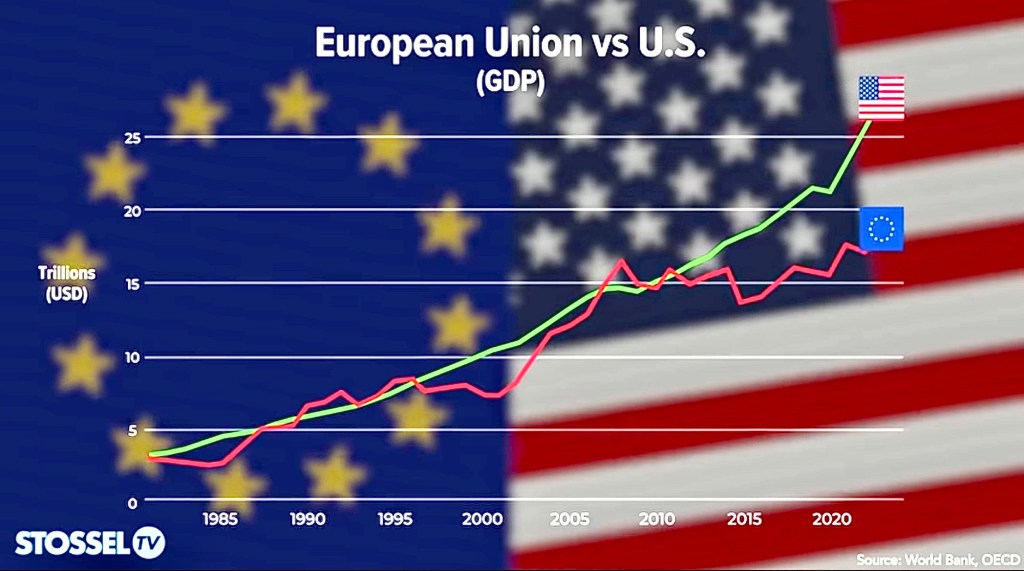

Not a lot Americans realize that Europe has really fallen off economically in the last 10-15 years. John Stossel featured the stagnation in a VIDEO recently. The US GDP is now >50% higher than Europe, despite the EU having almost 200 million more people …!

U.S. Treasure Secretary Scott Bessent was on the news yesterday trying to better position the Trump administration’s approach to world trade, so hopefully that will calm the currency volatility a bit.

Do you have any overseas travel planned in the short-term?

Image: Pixabay; Vienna, Austria

May 6 we fly to London for four days, then Lisbon for three and then 8 days on the Douro River followed by three days in Barcelona. I figure the change in exchange rates will add perhaps $50 to our trip. Our hotels are paid via frequent flier miles, we are looking at tube rides, taxis and meal costs as impacted by exchange rate.

Given that you are used to paying high prices for food and drink in Disney parks, such costs will be much cheaper in Europe.

On the flip side, Japan last fall was very cheap

LikeLiked by 2 people

My son has a friend from Catholic High School who moved to Japan to teach English years ago. He owns his own house and is constantly telling my son about how affordable eating out is. He has built a solid middle class life for himself in his mid-20s.

LikeLiked by 1 person

My son & his girlfriend are going back to Japan in a couple weeks after just having been there last summer. The airfare from MN can be pricey, but he said the rest of the trip is super inexpensive.

LikeLiked by 1 person

That sounds like a terrific trip! Portugal 🇵🇹 sure has gotten popular over the last few years. We haven’t ever been there, but a friend told me recently that his son is doing a destination wedding there. I love Barcelona – so colorful & great walking city. Which cruise line are you on? (We’re on Viking).

Yeah – $50 isn’t much. We are in Prague now. After I wrote that post, I realized that our air, hotels, and cruise cost had already been paid (last year) when the dollar was stronger. We skipped the expensive cruise line excursions and have just been using Uber to get around the city. It’s been great

LikeLiked by 1 person

We are also on Viking, our first traditional river cruise. We did the Nile with them and on Ocean we have done Istanbul to Venice, Auckland to Sydney, and Tokyo to Hong Kong. We don’t like deviating from Viking although we took grandchildren last month on Disney, loud and lousy food and we have a cruise with Oceania Tahiti to Los Angeles in October.

LikeLiked by 1 person

We’ve only been on board a couple days, but so far so good with Viking. This is our 9th cruise – but with 6 different cruise lines. We haven’t been too loyal so far. (Viking, RCL 2x, NCL 3x, Disney, Celebrity, and … we sailed in the Costa Concordia about a year before it sunk!).

LikeLike

Great video by John Stossel which should serve as a warning to the US.

A couple observations I have about Europe. Several of the countries with Ireland being the worst offender, offer very low corporate tax rates. US based companies place a subsidiary in Dublin to ‘own’ the company’s intellectual property. The US based part of the company pays license fees to the Dublin based subsidiary to avoid US Corporate Taxes. Ireland is syphoning off quite a bit of US’ Corporate tax base this way.

The wealth in Ireland is not trickling down to working people such as engineers. I had an inquiry from business acquaintances in Ireland, where my work quality is known, and their going rate for consultants was about 20% of what I make working with US companies.

Belgium plays the same games.

No plans here to go to Europe. We spent two summers in Europe when our children were in high school and took them around to a lot of places they would be reading about in their history books. We leveraged a lot of frequent flyer miles for flights and hotel points for lodging too.

LikeLiked by 1 person

We

LikeLike

There is a MN company that does an Irish “tax inversion” … Medtronic … that makes pacemakers and other med-tech. They bought an Irish company (Cogent, I think) – and use it as their corporate parent.

LikeLiked by 1 person

We seldom use frequent flier miles for flights as there are too many challenges. We do use them for top hotels such as Brown Palace in Denver, Chateau Frontenac in Quebec City and next month Hilton Paddington Station which makes it easy London Heathrow one train ride and go upstairs to hotel.

LikeLiked by 1 person

I’d like to go to Quebec! I’ve been to Montreal a few times, but not Quebec.

LikeLike