The housing market has done quite a flip in the first half of 2025 and we’ve gotten caught up in it. Our rental townhouse is still sitting unsold after almost 90 days on the market.

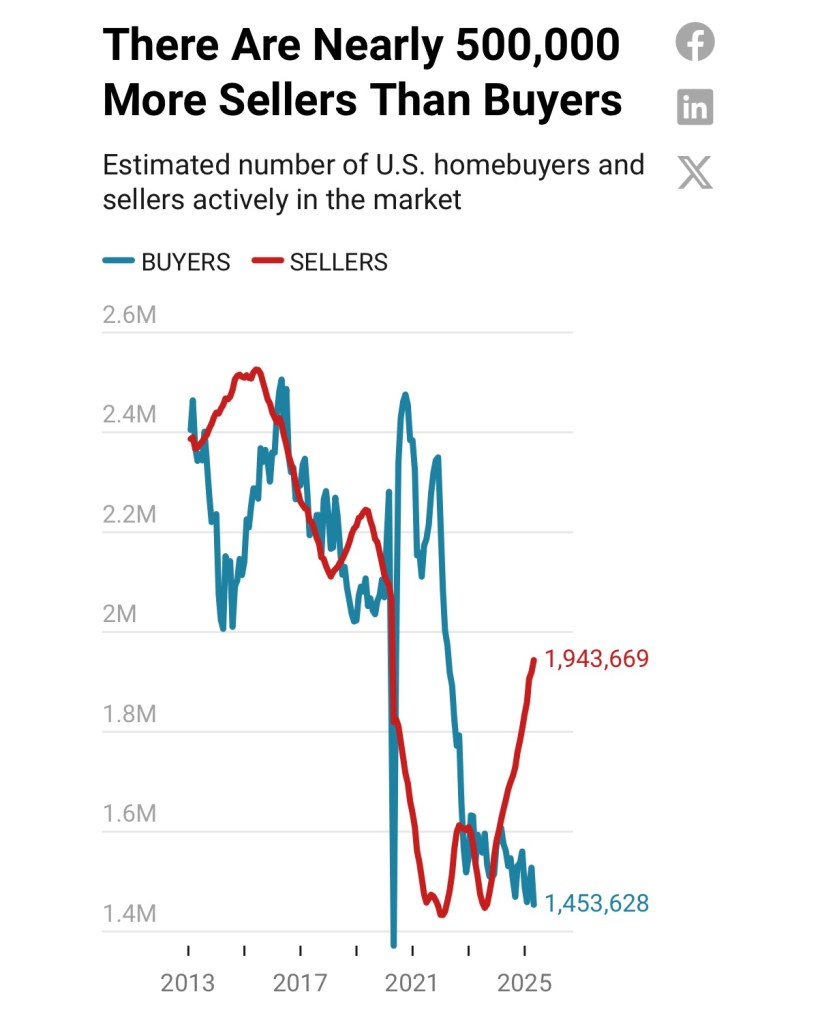

After several years of low real estate inventory, homes for sale have started to surge as buyers have disappeared. This chart from Redfin shows the issue …

Even as more homes have come to market in 2025, buyers have stayed away. We’ve sold 6 properties in our lifetime and this is the longest wait we’ve ever had for a buyer to come along.

We’ve dropped the price two times already (by -$25K total) and are currently having the unit completely repainted and recarpeted. It’s currently priced at what we paid for it 3+ years ago ($365K). Our monthly “burn” is a little over $1K – for property taxes, HOA fee, and utilities.

According to the Redfin analysis, buyers are being kept away by high prices, low wage growth, high interest rates, and general economic uncertainty. This unit is priced as a “starter home” so folks in this segment of the economy are quite pinched right now.

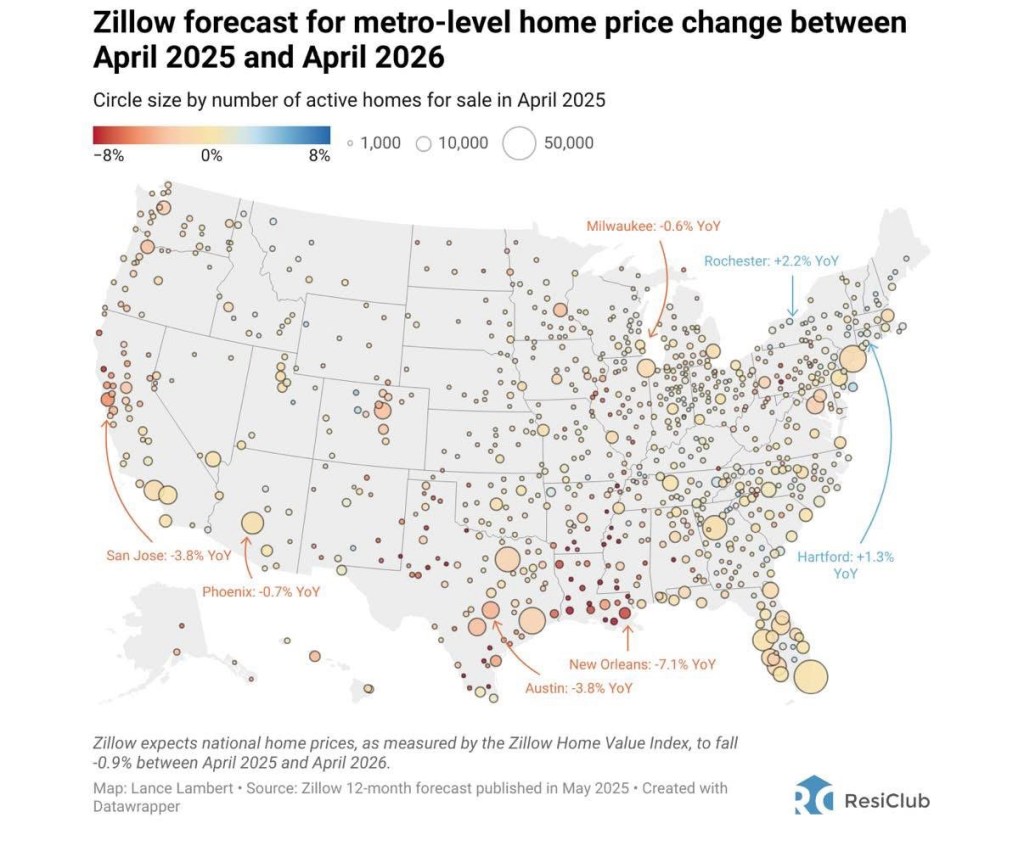

It’s not just our area – Zillow is forecasting trouble for almost all USA markets right now. Very few blue (positive growth) markets on the map …

How is the market in your area?

Images: Our Listing

Our local market is still robust, but then again six months ago 5,000 dwelling units were destroyed by the Eaton Canyon Fire so that sucked up inventory.

Speaking of disasters, we ate at the Water Grill downtown LA before the Opera yesterday. We took the train to the 7th Street Metro station and walked to the restaurant. All storefronts in the area were boarded up due to the anticipated protests which actually caused little damage in that part of town.

The restaurant was very glad to have our business.

LikeLiked by 2 people

Yeah – I suppose a wildfire really does a trick on the housing market. How many houses is 5K of the total in the area? Is that x% roughly? From the news, it seems like all the homes are gone, but I’m guessing it’s a fraction. Not sure.

LikeLike

The challenge is that the geographic footprint of the Eaton Canyon fire area is not large, despite 5,000 structures lost. A friend who lost there house is in a rental in Glendora 30 minutes away. It is a fraction of the total housing stock, but we are talking about a population of a few million people within a ten mile drive. It is challenging to comprehend how 5,000 dwellings lost is still a small percentage of the total inventory.

Altadena, despite the calls from the nonprofit community will be radically transformed in a decade. No longer a community of older homes with large lots occupied by generations of families. It will be modern high end homes with owners demanding amenities that the community never had…..or wanted.

This is not a commentary on change, just a dose of reality

LikeLiked by 1 person

Amazing how dense that is … “a few million people within a ten mile drive”. By comparison, the Midwest is incredibly sprawling. Minneapolis, which is probably about 10-miles by 10-miles only has about 350K people. The total metro area is 3.5 million, but it takes about 40 minutes to get from one side to the other in regular traffic.

LikeLike

So far housing prices are holding up in our area. Could be a combination of many housing units being burned in the area and the houses not being starter homes? Another cost driver for non-starter homes is the $500,000 capital gains per couple limit that hasn’t been adjusted for inflation.

Are your primary and vacation condo values holding steady?

LikeLiked by 1 person

Three of our neighbors in MN sold this summer – all very quickly, but all >$1 million homes.

In FL, Zillow lists it as a “buyers market”. The one unit for sale in our building has an asking price about equal to 2018 / pre-pandemic.

LikeLike