If you ask most Americans what their biggest annual expense is, most will say housing or maybe transportation. In fact, for most people taxes are far in a way the biggest expense that they have.

That means that the taxes from the state you live in (we all see free equally under the Federal rules) are a pretty big factor in planning the financials for your retirement.

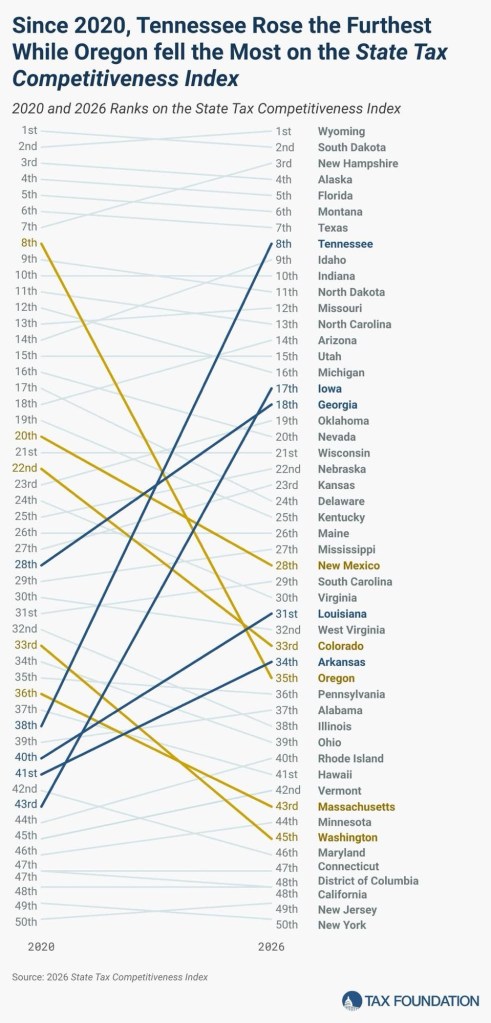

The good people at the Tax Foundation just published this interesting chart showing the 50 states and how competitive they are on taxes between 2020 and 2026. It answers the question which states have tried to be more competitive, and which states have not cared so much.

I noticed a couple interesting things as I look at the chart. First, the states at the very top of the list and the states at the very bottom of the list haven’t changed that much.

I guess that means some states are content to have very high taxes, and others have been more focused on being as competitive as possible in attracting people that want to move or businesses.

As a result, it is not very surprising that the big states at the bottom (NY & CA) are losing hundreds of thousands of businesses and millions of residents to the big states at the top (FL & TX). Our home state of MN – the 43rd most competitive tax state – is losing a lot of people like us to FL as well.

Next, I noticed that while some states are trying to become much more competitive – the five in the darker blue lines – just as many seem not to care and have really become less competitive. I see that many of the states that are getting worse are adjacent to other uncompetitive states.

Obviously, what a state spends is only meaningful in the context of what it provides. Still, when I look at education rankings (which accounts for about half of all state & local spending), there is little correlation with tax competitiveness. (Education: FL #2, TX #25, NY #17, CA #24).

Welfare represents roughly the other half of state spending and there is very little difference in the Supplemental Poverty Measure (SPM) between the large Red & Blue states (TX, FL, NY, CA). Surprisingly, NY spends 3x as much on Medicaid as FL, despite FL have 3 million more people.

Is the competitiveness of your state a surprise?

Image: Pixabay / Edited with Grok AI

You do know you are waiving a nice juicy steak in front of a Doberman? The People’s Republic of California being almost at the very bottom of the list is not a surprise at all. Despite the loss of population due to taxes, our Demonrat Government is dreaming up even more ways to extract more taxes. The Communist Service Employees International Union (SEIU) is trying to get a proposition on the ballot next fall to charge a ‘one-time’ 5% wealth tax on Billionaires. This proposition if passed would chase even more job creators and taxpayers who pay the lion’s share of State Income Taxes away to Florida.

The commies are also trying to come up with a new vehicle tax that taxes by the mile driven because the state is not collecting road use fees at the pump from EV’s. For gasoline car drivers this means that in addition to having the highest gasoline taxes in the country at around a little under a buck a gallon, they will also have to pay per mile driven. There is no correlation between road use taxes collected and the quality of our roads. California has crappy roads because too much of the road use taxes get directed to pet projects like the high-speed rail project that has been going on for over a decade without laying a mile of track, closing down car lanes to make dedicated bike lanes, and adding buses.

These taxes seem to be getting people pissed off. I am seeing an alternative proposition getting passed around that would mandate a 2/3rd’s voter approval for any tax increase. The people I see sitting outside grocery and big box stores collecting signatures do not look like who you would expect a fiscal Conservative to look like. One guy had piercings and tats and a guy I ran into yesterday was African American with dreadlocks. I commented about this to the guy with dreadlocks and he said all his friends are pissed off about all the taxes they pay and the crappy services they receive in return. I let him know that I am happy to see young people on board with hating high taxes and government waste. He said that is about all his friends talk about when they get together.

As a parting comment, where do my taxes go to besides bad unusable schools and bad congested roads. California has a third of the nation’s open welfare caseloads and half of their homeless. The current policies attract parasites and chase away the productive.

What is the vibe in Minnesota? Are people angry about the fraud?

LikeLiked by 1 person

The question is why do the electorate in those states at the bottom of the list continue to vote for folks that do not care about tax competitiveness? My left-leaning friends in MN honesty believe that they are getting good value for the money they force people to pay in. They snicker and laugh at states in the South, even as many of their neighbors move away. I hope that that people are waking up, but I see that your Governor is the Democrat’s leading candidate for the 2028 Presidential race – and has a good chance of being in the White House in 3 years. Why, why, why …?

Kalshi – 2028 Presidential Election

LikeLiked by 1 person

The car mileage tax will really hurt the Demonrat brand in California if it passes. California’s State Income Tax is very progressive with the thinking that only the rich will have to pay. The idea is to buy off 51% to vote for you by screwing over the other 49%. A car mileage tax hits everyone.

The Right studies Left more than the Left studies the Right because we want to understand what the Left is planning to ruin next. The Left are the product of the John Dewey dumbed down US education system that trains students to not think for themselves. Most Lefts I know immediately cover up their ears and start humming loudly, name calling or walk away when being exposed to a divergent viewpoint. They watch legacy media that agrees with their viewpoint. Nick Shirley’s first person reporting on the Somali fraud got him called a racist by leftist politicians and their complicit legacy media.

I bet most of you left friends have never added up the total cost of government and weighed it against what they are getting in return for their highest household expense. The US is rampant with financial illiteracy. My three sons never had a personal finance class in high school like I did. I taught all three. One of the lessons that they tell me made a real impression was charging them a 10% Dad Tax anytime they got a candy or a treat. They really hated paying their Dad Tax and tell me it got them thinking about how much worse government taxes are.

LikeLike