This is the time that I have been looking forward to for the past 10+ years. The timeline of our countdown to reach FIRE – financial independence & retiring early – has gotten very short. Just 85 days short. I have known for a long time that once I got to the end of 2015, I would be so close to early retirement, that I could completely relax and savor the end of the journey.

That said, just before the holidays, I had a bit of a surprise at the office with an end-of-the-year department restructuring. I haven’t shared my plan to make an early exit from MegaCorp with my boss yet. I have decided to give him an initial heads-up next week.

The December financial markets put a negative spin on the end of 2015. The US stock market (-0.7%), International markets (-3.1%), and bond market (-1.8%) were all DOWN for the year. That was the first time that has happened since 2008. As a result, our index & bond funds were a big drag on our portfolio this year.

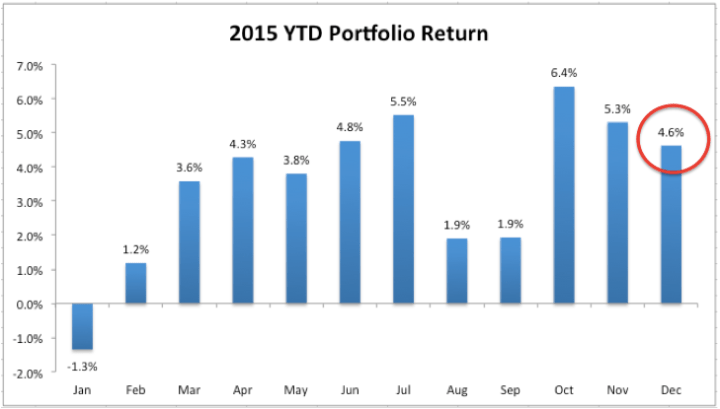

Fortunately, the only individual stock that MrFireStation has significant holdings in (stock options from a former employer) posted a terrific +8.1% gain for the year, lifting our overall portfolio was up 4.6%. All year I was concerned that the markets might go to hell in what I planned to be my last year at MegaCorp, so I am happy for any positive return. (We are also carrying about 3 years of living expenses in cash as a cushion against market downturns).

Here are the ups-and-downs of 2015 for our portfolio. There were some crazy days in August & September, but the market bounced back in the fall:

Additionally, It’s exciting to see the portfolio growth since we didn’t make any new deposits to our savings from paychecks since the end of March in 2015. All of our savings went into our new charitable giving fund (and will continue to until I leave MegaCorp). It’s great to see our nest egg grow, especially when no new deposits went to it.

It was a busy month at work & with the holidays, but here are the couple key things I worked on relating to our FIRE escape:

- Totaled up our year end numbers in our master spreadsheet and assessed our net worth vs. our goals. It was a good year in most lines. We established new goals for 2016, which was unique because the year has very little new “active income” in it.

- Sat down with Mrs.FireStation after Christmas and did a gut-check on all of our financial positions and planned spending from now until the end of our lives. Wanted to make sure we both had open eyes on what the numbers are, risks are, and opportunities are. With just 90 days to go, we both felt like our plans are made.

- Had a quick discussion with our financial advisor and sold some investments before 12/31 to book some losses before year end. That will help us on our taxes down the line.

- We did a deep dive on the cash flow considerations we would face in the next 12 months. We want: 2-3 years living expenses in cash and we are at 2.7 years right now. Considering the markets started January 2016 with such a severe decline (down -5%), it sure feels good to know we have that buffer.

Earlier this year I wrote about how relatively slow the countdown seemed to be going. I was still many months away and wasn’t sure about how likely I was to actually pull the trigger. That time has now arrived and time is flying. Work is incredibly busy at the start of the year and at the same time I am trying to increase my mindfulness at the office – to really live in the moment and savor what will be my last few months.

It is a really odd feeling that I don’t recall from any other experience in my life. When you are young and leaving college or getting married, you are always looking forward and think little about what you are leaving behind. Early retirement means you are leaving behind a resume of achievements that you have built over decades.

In a way, it feels a bit like getting ready to turn off the switch after reaching the highest level of an intense video game you’ve been playing for a very long time – knowing that despite all of your focus & commitment to the game, the screen will be now be blank (and the rest of your day open & filled with uncharted possibilities).

Welcome to 2016 everyone! Here is a link to last month’s countdown: November

Image Credit: MrFireStation.com

>>> “It feels a bit like getting ready to turn off the switch after reaching the highest level of an intense video game – knowing that despite all of your focus & commitment the screen will be blank…”

That’s a great analogy. For all the exciting things I’m looking forward to, there is definitely a substantial bittersweet feeling in leaving behind the career I’ve been building for years. I hope your next few months continue to go smoothly!

LikeLiked by 1 person

As much as I’m looking forward to moving on, I think it will feel pretty empty at first.

LikeLike

It did for me. It feels like a vacation at first, but then when it actually sinks in that you now have all of the time in your day it won’t be long before you start trying to find things to do. I ended up starting a career that I really enjoy.

LikeLiked by 1 person

Do you have any plans for yourself after FIRE? Or just going to do it touch-and-go style?

LikeLike

I’m a huge planner. I wrote a post about my “not bored list” of a 150 things I expect to occupy my time with. It’s the social connection I’m most concerned about losing.

LikeLike

I’m so excited for you! Congratulations on this very impressive accomplishment.

Mrs. Mad Money Monster

LikeLiked by 1 person

Thanks! In a year I will say this is the smartest decision I ever made or “Fool! What have you done!”

LikeLike

I’m so excited for you to hit that milestone that is so close now. Can’t wait to hear how it goes when you give notice, and when you pull off that last little post-it flag. Good luck staying mindful through the end of it. 🙂

LikeLiked by 1 person