Do I stick to a budget? No, I don’t even have a budget anymore. I’ve become completely un-analytical in retirement.

I used to be good at it. When I was working, I built complex spreadsheets to track our annual budget, our net worth, and projections of what we needed in retirement.

Since retiring, much of that has gone by the wayside. I stopped tracking our annual budget years ago. I couldn’t exactly tell you what we spend – only a rough range. I’m wondering if my ‘rough range’ might be out of date given the amount of inflation we’ve seen.

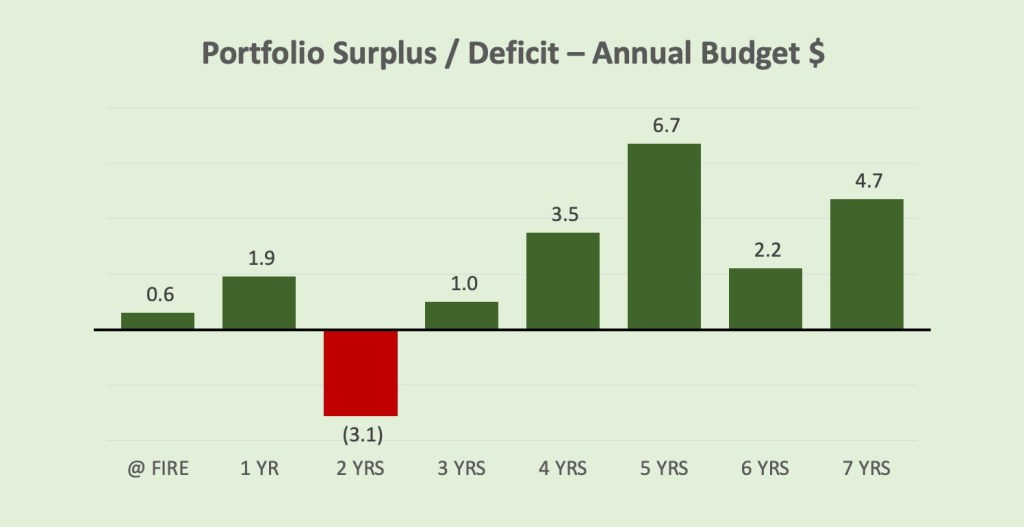

I do roughly check on our portfolio balance – our Net Worth. As long as the balance sheet is ahead of what we expected when we made our FIRE escape, all is good. I still compare it to our “plan annual budget”, and as long as the numbers are green, I’m good …

You can see – as of yesterday – we are good. We’ve had some ups-and-downs, but that’s 5 straight years of green bars and a healthy 4.7 ”extra years” of spending available too spend. It will probably be invested in a Florida vacation place at some point.

How closely do you follow your annual budget?

Image: Pixabay

We budget and financial plan in four main areas to avoid having a structural problem where we cannot cover our monthly expenses:

1) Plan taxable income for the upcoming year and try to avoid triggering Medicare IRMAA.

2) Track the following fixed household budget items including Mortgage, Health Insurance, State Farm Insurance for everything else, Electricity, Water, Mobile, Internet, and Satellite to look for financial vampires to slay.

3) Plan household maintenance and improvements.

4) Plan and track overall income. The main driver of increases in our income are dividend reinvestments in accounts that we are not drawing from, dividend increases, and deferring my wife’s and my start age for Social Security to age 70.

We don’t worry about discretionary non-fixed household expenses including groceries, clothes, eating out, entertainment, and travel.

Our health insurance, which was a planned expense skyrocketed when we retired. We just received our biggest inflation surprise last week from State Farm for our Fire Insurance Renewal. Our annual State Farm Insurance bill will be going up $3,800 starting in September. Looking on the bright side, I am starting Medicare next month and my health insurance cost will reduce $12,000. We are finally going to see the reduction in expenses that so many articles mention!

LikeLiked by 1 person

Do you do that budgeting on an annual basis, pr a monthly basis? I roughly do those things annually.

That’s quite a home insurance increase! I’m sure it would be much more if you hadn’t done the mitigation efforts they asked for. We haven’t gotten our new home insurance estimate yet. Still waiting for that shoe to drop. We’re at a reasonably affordable $3.7K/year now.

Congrats on the jump to Medicare. Did you have to buy a ‘gap’ policy to supplement it?

LikeLiked by 1 person

I put together a rough plan annually so I can into the year with any adjustments I need to make and then review monthly, or after receiving a surprise high bill. My fire insurance went up from $4,511.38 to $7,791.00, which is a 73% Year over Year increase. The remaining $300 was spread across four autos and earthquake insurance. It was holding stable, and then boom got hit with a big increase.

Fire mitigation both protects my property and allowed me to stay on State Farm Insurance instead of going on to CA State Government run Fire Insurance called the CA FAIR Plan. I have had several panicking neighbors call me when their private fire insurance got cancelled, but it was a little too late for them to manage their situation. Their combination of Private Home Owner’s Insurance (for everything else) and the CA FAIR Plan fire insurance is running about twice what I am paying.

I signed up for a Medicare Advantage Plan that allowed me to keep the same Insurance with $0 copays and a very low $995 max out of pocket. California has lots of competition for Medicare Plans which holds the cost down and forces the providers to offer benefits to earn your business. I have compared costs with my brother-in-law in Wisconsin and think we are better off in California. There seems to have been too much consolidation in WI. My neighbor who works for the largest health insurer is a recent transfer from Washington State, and he has made the same observation of Washington versus California.

LikeLiked by 1 person

As usual, you are much more ‘on it’ than I am. You should be writing these personal finance posts, not me! 🙂

LikeLike

This is the time of life to reap our just rewards. No budget here. I track value of all accounts monthly. I watch my start and end of month checking account for deficit or surplus on income/expenses. The only time I pull from investments is for big travel or sometimes quarterly tax payments. Yes, recognize that I am fortunate, but that came from smart lifestyle for decades. Our three largest expenses are travel, investment advisor fee, and taxes. Our largest income depends on the year either pension or investments, most years it is investments.

LikeLiked by 2 people

“The time of life to reap our just rewards” … I like that! I used to track the accounts monthly, but now I’m down to just twice a year. Once in the summer, once at the year end. I’m too busy goofing off to do it more often.

LikeLike

I just glanced again at your chart that shows years of surplus you have available at any given moment and would like to highlight how I track my safety margin from a Dividend Investing perspective.

I track three numbers. Annual Dividend Income, Current Dividend Yield, and Dividend Growth Percentage. Covering with your annual spend with Annual Dividend Income, or less, means that you never touch the principal. The Dividend Growth Rate keeps the income stream ahead of inflation. A Current Yield of 4.36% more than covers the 4% that many target for retirement income. A 3.6% Dividend Growth rate keeps ahead of inflation during normal inflationary times.

The Market Price of a dividend basket of stocks bounces around some, but not as much as the overall market. Over the long haul the market price will follow roughly the sum of dividends reinvested and dividend growth.

LikeLiked by 1 person

The 4% Trinity “safe withdrawal rate” is a perfect reference for building a dividend stock portfolio, isn’t it? I haven’t specifically tracked how much we earn in dividends, but as long as our nest egg is going up, not down, I guess we are spending “safely” and ahead of inflation.

LikeLiked by 1 person