Debt is a four-letter word for anyone looking to retire early. In fact, it should be for everyone. Still, despite our relative prosperity, Americans are more in debt than ever.

It looks like total consumer debt is 15% higher than it was before the pandemic. All of the stimulus money had only a temporary impact on debt levels …

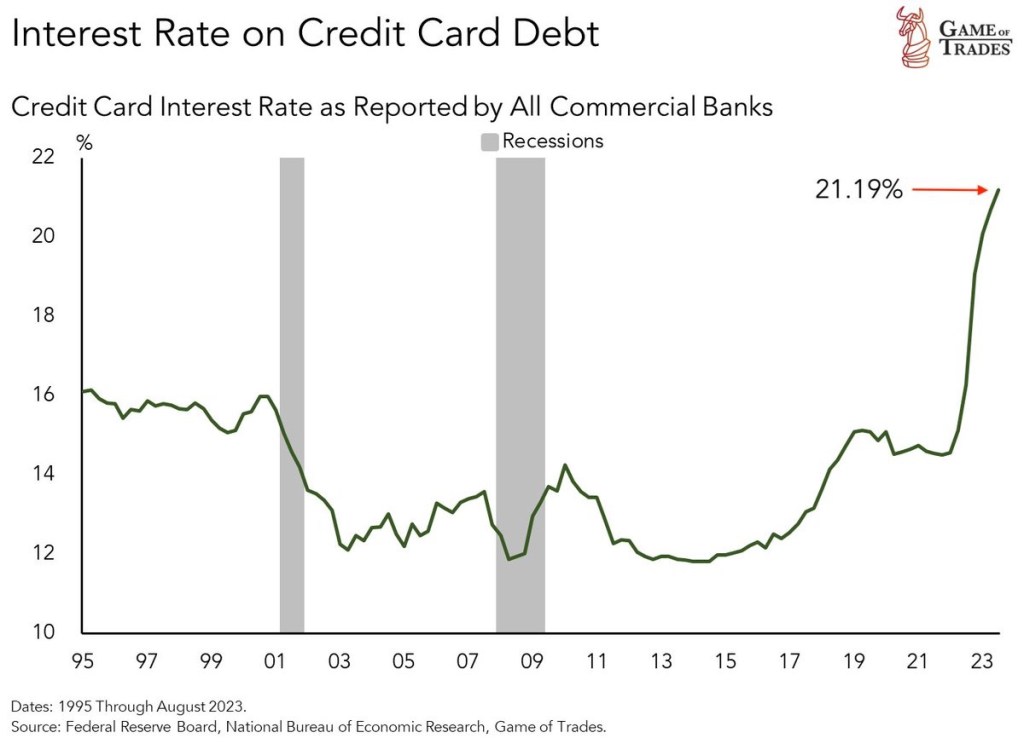

It’s one thing to be sitting on a lot of debt when interest rates are low, but that’s not the case anymore. interest rates on credit cards have absolutely gone through the roof – exceeding 21%. That’s higher than any point in the last 30 years.

I’ve always preached to “Live Debt Free” but that message didn’t have much bite when interest rates were low. Now rates are posting multi-decade highs, it’s become a necessity.

How much of an impact does the combination of high inflation and high interest rates have on your retirement?

Image: Pixabay

On the income side, I am seeing raising interest rates increasing income on bond and dividends. Our household is debt free except for an exotic inflation hedge we hold, a 30 Year Fixed Rate Mortgage at 2.65%. The main place that I have seen inflation takes its toll this year is on my homeowners and umbrella insurance policies. Gasoline is up dramatically, but we don’t drive very much since retirement. Through stamping out vampire fees, this year it was my satellite package and starting Medicare which dramatically lowered my medical insurance cost, my monthly run rate is down.

LikeLiked by 1 person

It sounds like you are doing well, as are we. I think folks that are living comfortably off investments are not feeling the bite the same way others are. Inflation & interest rates are a heavy tax on the young & poor. This all feels very similar to the early 1980s, doesn’t it?

LikeLike

It absolutely does. I used to cover South America as a part of a sales territory. In Buenos Aires, Argentina, the young and poor go home on a Friday happy and thinking that they are 2/3rds of the way to buying a condo. They wake up on Monday and their savings are worth a third of what they were on Friday. The young and poor can not save to get ahead and can not finance their way either, because interest rates very hgh. That was part of my wife’s reasoning behind keeping our 2.65% fixed rate 30 year mortgage. Let the Joe Biden pay it off for us.

Here is one other story. I went to a Fiat Plant in Belo Horizonte, Brazil. The plant manager told me that during really bad inflation days, his workers take their paychecks and hand them to their wives through the fence during lunch on Friday. The wives need to immediately deposit the check and buy the next week’s groceries. It they wait until end of work after the banks closed, the currency might move enough that the families cannot afford food for the next week.

As a parting comment to the financial illiterates in Washington D.C., Socialism and its inflation is not a way for a country to grow wealthy. From 1900 to the 1940’s, Argentina was the fifth wealthiest country on Earth. Socialism started by Juan Peron ruined the economy and it has never recovered. In 1950, Venezuela was had the third highest GDP on Earth and was still the wealthiest in Latin America in 1980. Venezuela is now one of the poorest. Promises to an electorate of free government services to buy votes wrecked both of these once thriving countries. “Those Who Do Not Learn History Are Doomed To Repeat It.”

LikeLiked by 1 person

Similar to Volker’s tough medicine – high interest rates might be the only likely “cure” to the inflation politicians (both parties) have caused.

LikeLike

I have to say that inflation has little impact on our day to day life. No mortgage or debt. We purchase very little gasoline and even if we do given that we get 50mpg on the hybrid, gasoline is much cheaper to move a vehicle 100 miles than it was 20 years ago so while it appears that the price of gas has increased, in real terms not so much. Our hits to inflation is the price of hotels and rental cars when we travel. Also don’t forget bond issues that schools and library districts want to issue these days. Like Klaus, returns from our fixed income portion of our portfolio are doing well.

LikeLiked by 1 person

I don’t notice it too much in gas prices, although I know they are high. They were also high ($4/gallon) back when Obama was in office.

What I notice most is in the prices of food (both groceries & restaurants) and entertainment (movies & concerts). Those prices are certainly way up.

LikeLike

At least the costs are on their top now I think.. Lets see what the future brings

LikeLiked by 1 person

They may have hit their peak, but the 10 & 30 year rates are about 4.0%. That suggests the days of very low interest rates won’t return for quite a long time.

LikeLike