Last year, I wrote a post on the rising cost of home insurance premiums. In the post (LINK), I included a link to the cost of insurance across the 50 states. No surprise, the state that we are buying a condominium in – Florida – is the highest in the country.

As we prepare for closing next week, I’ve learned a lot about Florida’s unique insurance woes. The average annual premium is 2.6x higher than the national average ($4.7K vs $1.8K).

The causes are both long-standing & acute. Here are some of the headlines …

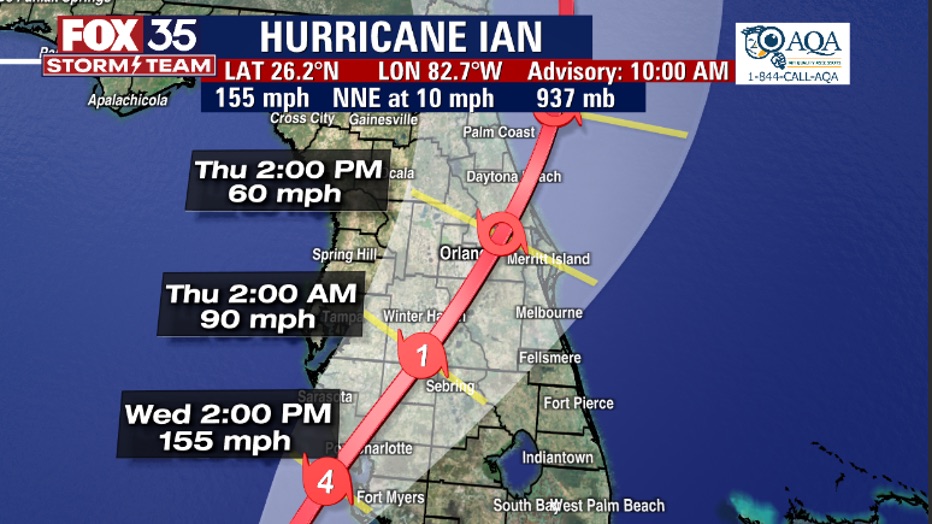

⁃ STORMS: The state of Florida has always had high home insurance prices. The primary driver is the incidence of natural disasters – particularly hurricanes, wind, and heavy rain. During the Hurricane Ian storm two years ago, Orlando – which is 159 miles from the landfall at Cayo Costa – had catastrophic flooding following 15” of rain.

⁃ HOME VALUES: Prices for homes in Florida are not as high as California or Hawaii, but they are much higher than the national average. The median home price in Florida is about 25% higher than the US median and the median in our home state of Minnesota. More expensive homes simply mean more expensive insurance.

⁃ SURFSIDE: The horrible condominium collapse in Surfside, Florida, three years ago significantly changed the insurance market here. Insurers reassessed coverage requirements and policy terms, both adding additional cost into premiums. Condominium associations, in particular, have had to issue assessments to ensure new structural standards are met.

⁃ FRAUD: Somehow, Florida has become the nation’s leader in home insurance fraud. More than 15% of national home insurance fraud cases originate in this one state. The fraud is often linked to the chaos that follows a natural disaster. Out-of-state, unlicensed contractors come in after a storm, take money upfront to do a job from homeowners, and then disappear.

Our new Florida condominium owners H06 policy is about 3x what we pay on our Minnesota townhome that our son rents from us. (One insurance quote was 7x higher). This is despite being a stronger building with mostly masonry / cement block building.

We’re also far from the coasts. In fact, a USA Today study last year found that Orlando/Kissimmee – where our place in Celebration Fl is located – is the actual safest place in the entire state.

In addition, insurance companies are forcing our new condominium HOA to do some structural work that will result in a special assessment, or temporary dues increase in the coming year. They say that they are not yet in a position to estimate exactly how much the work will cost.

While the HOA carries a healthy reserve (2.2x annual spending vs. just 10% requirement), we don’t know if it is going to cost us $5K, $10K, or $20K more. We bid low on the property and asked for a seller’s concession to help cover it. That was accepted, so we should be good – but now we’re on our own.

How are home insurance premiums in your state looking in 2024?

Image: Hurricane Ian, Fox 35 Orlando

Yup. Welcome to FL! I’m going through the insurance renewal process myself. Painful! If you think home insurance is bad, auto insurance can be just as bad, especially with teenage drivers thrown into the mix!

LikeLiked by 1 person

I’ve heard car insurance is very expensive in Florida. I see the billboards for lawyers wanting to sue everywhere! We will keep our cars insured at home in Minnesota for now.

LikeLiked by 1 person

I just checked and my homeowners insurance increased from $4,511.38 to $7,791 per year. I also have Earthquake insurance that remained at $1,050. Add Auto Insurance and an Umbrella Policy into the mix, and I am sending State Farm $15,861 annually. They are now my second biggest expense after government.

Getting insurance in California, especially if you live in a designated fire area makes it more difficult. I am grandfathered into State Farm. My neighbors would love to have the same deal I have. Their Home Owners Insurance alone where they have to buy insurance from the government exceeds just my Home Owners Policy.

State Farm sent a Fire Inspector out a couple years ago, and forced me to take remove ivy from the front of the house because of fire risk, infestation risk, and damage to stucco risk. I tried to make the case that the Fire Department Inspectors told me that didn’t see the risk with the ivy. I have lived in my house for over 30 years, and if you think rat infestation was a problem, I would have seen but now. To protect my irreplaceable Home Owners Insurance I had to take down the ivy and do tendril removal, painting and replanting of acceptable landscaping. I also have annual brush clearing with Fire Department Inspections. All this adds to my cost.

The People’s Republic of California also has its issues with Personal Injury Attorneys. I think the Attorney’s Bar is the number one donor to Demonrat Candidates. My family has personally been involved in two attempts at insurance fraud by staged parking lot accidents. I was very aggressive and called State Farm up and helped them build case that the other party was attempting insurance fraud. Neither scammer got anything, and I protected my insurance.

The last time I was called into Jury Duty, I was called up for voir dire and it turned out to be a personal injury case where the plaintiff was around a 70 YO woman who was part of an ethic group known for committing insurance fraud. The plaintiff was walking in a parking garage and the defendant backed out of her parking spot and knocked her over. The defendant’s auto insurance had already payed for the plaintiff’s shoulder replacement (my wife the RN told me she probably already needed it) and offered her $100,000 for pain and suffering. Of course the Defendant accepted no personal responsibility to make eye contact with drivers before walking behind their cars. The plaintiff’s attorney was asking for $6,000,000.

When I was called up for my jury panel vior dire, I commented, “For $6,000,000 I thought I was going to get to meet Steven Hawking. The woman looks okay to me. She is a member of an ethnic group that is well known for committing insurance fraud.” I was quickly excused from jury duty. If I had still been selected, I would have tried to award the Defendant attorney’s fees from the Plaintiff. These parasites run up the cost of insurance for everyone and can run up tabs that make losing your house to fire, hurricane, or earthquake seem like small potatoes. Umbrella Policies are very important in states with overactive parasite attorneys.

LikeLiked by 2 people

We made the move from the People’s Republic of California several years ago to FL for many of the same reasons you mentioned. We’re loving live on the Suncoast of FL. It’s not without it’s warts but we couldn’t be happier.

LikeLiked by 2 people

High taxes, dreadful politics, and terrible weather make MN a tough place right now. Our family/friends are there and it’s beautiful in the summer, but it will be nice to have a winter getaway. Where on the Gulf Coast are you?

LikeLiked by 2 people

My wife and I think the people in Florida seem friendly. We have had friends invite us out for a visit to Sarasota and they always tell us we are a better fit for Florida than the People’s Republic.

LikeLiked by 2 people

Sarasota is a gorgeous area

LikeLike

We actually live not far from Sarasota. We’re just outside of Lakewood Ranch proper in a gated community with lots of nature Loving it here!

LikeLiked by 2 people

Nice – we have good friends that live in LWR. They are in the Waterside neighborhood. A board buddy of mine is in LWR Golf & CC. My wife really likes LWR. Outside of Celebration, I’m sure that’s where she would want to be.

LikeLike

I would be very much interested in seeing a list of your pro’s and con’s for Florida versus California. What was the last straw for you? What city or town did you move from?

LikeLike

Yikes +72%! That’s a huge jump for one year. I remember you writing about the ivy issue.

I too nipped a car accident scam in the bud. A guy bumped into me at the car wash line. His jeep hit the spare tire in my jeep. He had rubber marks on the fender of his Jeep that he filed an accident claim against me on. Thankfully, I had a bunch of pictures and offered to “be the first one in the courtroom” if he wanted to proceed. The claim was quickly dropped.

LikeLiked by 2 people

Here is my most recent scam. My wife drove our 1 ton van to the gym one day, because I was working on her car. When she came out there was a woman in an Escalade claiming my wife had hit her when parking the vehicle. There was a bunch of white paint on the side of the van. My wife took lots of photos with her cell phone.

After washing the van and using some polish on it, and the white paint came right off and the underlying paint looked perfect. I contacted my insurance agent and told her that we have a fraudster on our hands. She sent a photographer out to take a photo of a pristine van.

The woman’s husband or boyfriend contacted me and offered to let me pay for the damage out of pocket to avoid making an insurance claim because his “car only needed to buffed out”. I asked him to send over a copy of the estimate. He texted it to me and after opening it, I found the date on the estimate predated the accident by three days and was for almost $5,000. You would think if you had a fortune telling body shop, one could act on this information and avoid the accident entirely. -sarc

State Farm’s Adjuster looked at my wife’s photos and saw that the white Escalade and our van were parked about six inches parked. He asked my wife if she had to get out of the passenger’s side after parking because there wasn’t enough room to get out of the driver’s side. She got out of the driver’s side, which proves the Escalade wasn’t there when she parked.

I personally always park my vehicles, if possible, far away from any other vehicles. It is a great way to get a few extra steps in, to make your daily 10,000, and avoids a lot of parking lot drama. Take lots of photos if you are involved in an accident. Call your insurance company and go on the offensive to fend off the fraudster.

Many years ago, I had someone run into the back of my vehicle at an on ramp. Since I buy my cars by the pound or ton, there was not damage on mine. His was trashed. The fool tried to blame me for causing the accident where he ran into to back of me. I told the other driver he will surely be accessed the blame for this accident. My closing comment was, “It you still want to proceed, my neck is going to start hurting.”

LikeLiked by 2 people

I guess the only good thing is that the fraudsters aren’t real bright. My brother is a county judge and he’s commented that the people convicted in his courtroom usually have three things in common: stupidity, laziness, and/or addictions.

LikeLike

I saw a recent article, that calculates the tax burden in MN as being higher than the People’s Republic of California. Proposition 13 and living in the same house for over 30 years give me an effective property tax rate of less than a third of a percent. My property taxes can only be raised by 2% annually, which allows me to budget for government greed. The People’s Republic also does not tax Social Security, which is a big deal for a dual income couple who both will be receiving about the maximum payout and wait until age 70 to start collecting.

I have had friends move to Texas and they tell me that their property taxes almost give back any savings they have from no state income tax. The other problem I have with high property taxes based on assessed value is that they are not a function of one’s ability to pay. Your property assessed value and taxes can go up beyond your income just because some fool moves in from the People’s Republic of California and overpays for the house next door.

LikeLiked by 2 people

Here’s a link to a Tax Foundation analysis of SALT by State (2022). https://taxfoundation.org/data/all/state/tax-burden-by-state-2022/

CA: #46

MN: #39

FL: #11

TX: #6

Obviously, it depends on your own personal situation, but the overall averages are pretty telling of what is going on in these states.

LikeLike