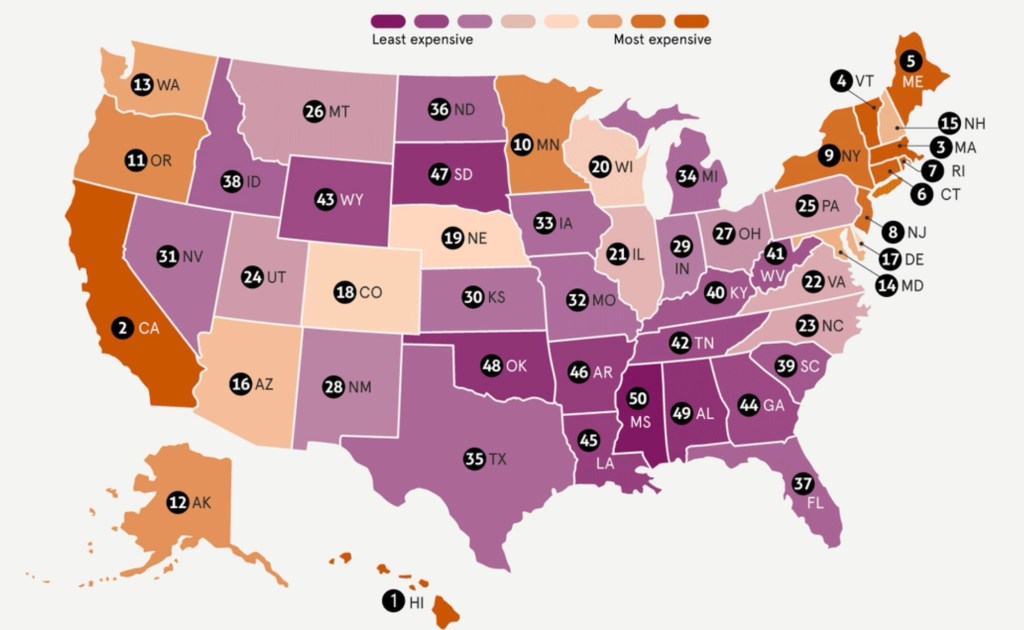

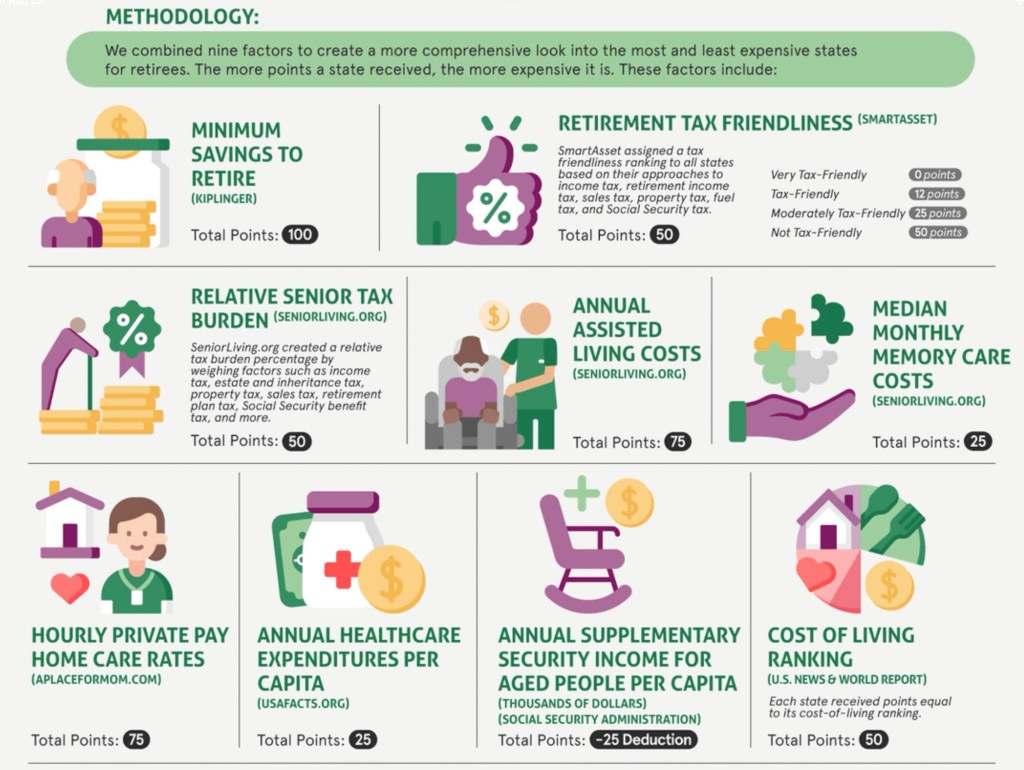

The website, Ooma, recently published this interesting infographic comparing the states for the cost of living for retirees. They used 9 different dimensions for their ranking

It’s a looooong infographic, so I broke it into key components so you can see the comparisons more easily.

How does your state compare? I wasn’t surprised to see that our primary home state of Minnesota ranked in the Top 10, but our secondary home of Florida is a much more affordable comfortable #37 …

Original Article: LINK

The People’s Republic of California is Number 2. However, the article failed to capture what is going on with many retirees who have planned well.

California has zero tax on Social Security Income and Proposition 13 which locks your Real Estate Taxes at 1% of the initial purchase price and only adjusts upward 2% per year. Since I have lived in my home for 34 years, my Real Estate Taxes are very low as a percentage of the value.

If you have planned well, metrics like SSI do not apply. Once you qualify for Medicare, I would expect the cost difference between states to compress. I have a married couple living a couple doors down and they are both Insurance Executives who moved down from Washington State a couple years ago, and they tell me there is a lot more competition for Medicare Advantage Plans in California and the plans offer a lot more benefits.

I read a publication called “International Living” which advertises that you can move to a cheaper International Country and get low cost to free health insurance, cheaper rents, food, etc. A typical article walks through the living expenses for a couple who didn’t plan well and only have a $2,500 per month Social Security income. They move to Spain and get ‘free’ health care and cheaper rent. The problem is, if you run the numbers for someone in our income bracket you find out who would be paying for all this ‘free’ healthcare. Namely, us.

My takeaway is, you need to really understand the numbers for any given area, before making a retirement destination move.

LikeLike