Frequent contributor, Klaus Wentzel, mentioned that his dividend-driven portfolio was roughly +8.5% in 2025, after netting out the year’s living expenses. I’m watching the Sugar Bowl right now, so I thought I would add up how our portfolio ended the year. For benchmark’s sake, the S&P 500 was +16.6% (x-dividends) and the bond market (VBMFX) was +3.0%.

We finished the year with a pleasing +14.3% growth in our portfolio. Again, that is net of what we spent on living expenses for the year. I would guess our spending would be a 2.5pp drag on returns, so pretty close to where the S&P 500 ended up. I’m excited by that result, given that our portfolio is closer to 60% equities, 20% bonds/pension, 15% bonds, 5% cash/crypto.

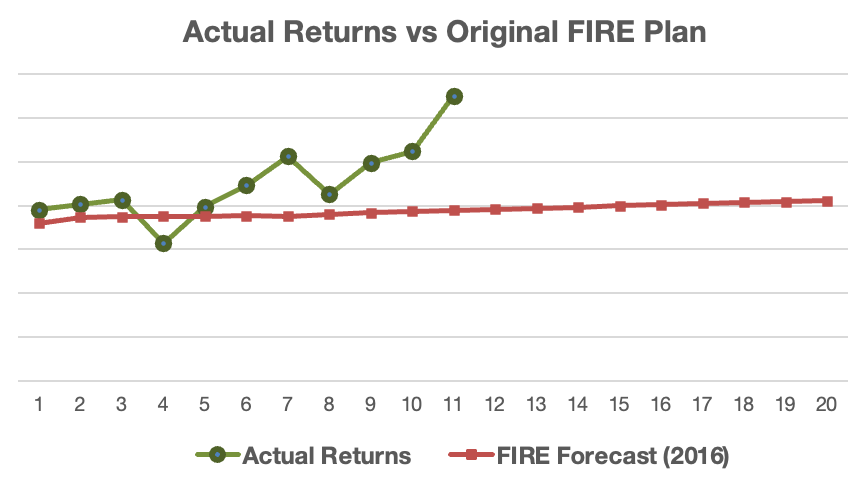

In fact, 2025 looks like it is the absolute best year of the 10 years since I retired early. You can see from the graph below that our retirement portfolio is almost now 167% of where I expected we would be at this point (FIRE Forecast 2016). You can see that overall, our investments have had 3 solid years in a row. (In fact, up 6 of the last 7 years)!

One of the things that drove our investment strength this year is the sale of the rental townhouse that our son lived in. We paid cash for the townhouse 3 years ago when we bought it and re-invested most of that cash when we sold it. The stock market was still somewhat shaking from Trump’s Tariffs at that point, so we benefited from healthy growth as the market rebounded. (No, I’m still not a fan of the tariffs!)

How did your portfolio perform in 2025?

Image: Pixabay

Happy New Year Chief!

Looks like your financial plan baked in around a 3% rate and you are beating it. We really needed to beat 3% to keep up with inflation over the last five years.

I reviewed my long-term numbers this morning and saw my annualized return is 10.1% going back to 1/31/2011. This is very close to the Ned Davis Research Study’s return investing in growing dividend stocks over the past 60 years.

For 2025, my return was 11.36% and I withdrew 3% to live on. My tradeoff is lagging the S&P 500 during up years for smaller drawdowns during down years. The most important number that dividend investors track is annual income from dividends. With dividend investing done correctly, your annual dividend income should still increase even if your market value decreased during the year. If you are reinvesting some of the dividends, you get to reinvest at higher current yields and can even trade to take advantage of some bargains. This kind of ties in with last week’s posts about pharmaceutical costs, Big Pharma is on sale right now.

LikeLiked by 1 person

I actually had an 7% return rate built in. That was roughly inline with the longterm investment market average of 5.5% growth and 1.5% dividends.

It probably looks like 3%, because of taxes & living expenses netted out.

Over the longer term, our portfolio growth is almost the same as yours … +10.4% annually for the 15 years since 1/1/2011. Again, that is net of spending on living expenses. Probably ~12% just on annual investment returns. (The S&P 500 with dividends is +13.9% over those same 15 years).

The good news is we are way ahead. So much so that I haven’t even bothered to track living expenses for the last 7 years, or so. As long as we are ahead on net worth, I’m not bothering. Time to head to the Sunshine State and enjoy ourselves this Winter!

LikeLiked by 1 person

My number is after withdrawing 3% living expense is right around your 7%. I figure around 10% return, 3% withdrawal and 3% to cover inflation. That leaves 4% for extra return safety.

Enjoy some good weather!

LikeLike

Time to start splurging that “extra safety 4%” – I’m sure it’s added up to quite a lot!

LikeLiked by 1 person

I posted some rough numbers the other day but this morning ran my “month end” numbers. I track financial assets monthly and my financial net worth increased on a percent basis 15.1% in 2026.

We live on pension and social security and pull money from investments only if needed to pay taxes and possibly a big trip. I also have a RMD on an inherited Roth IRA.

My consulting income for the year was more than anticipated but I have some outstanding invoices that I don’t count in my calculations. We also began gifting to children this year and completed our planned 529 funding for grandchild #1 and most of grandchild #2. We told their parents that we will contribute $18,000 to a 529 plan but do so early in their life so they will get the benefit of growth. The grandchildren are now 11 and 5 and the youngest will have his contributions completed in 2026.

I don’t count real estate in the Net Worth calculation as our condo is our home and while important when we pass on for inheritance, I don’t count it as a return positive or negative.

We are aggressive with allocations over 70% securities, and we don’t trade often. I note that some longterm value holdings get discovered and have short term run ups and then some overlooked tech does some amazing returns such as Broadcom and Lumentum. Who knew that Microsoft would bust out like it has in the post Gates and Ballmer era.

Life is good.

LikeLiked by 2 people

That’s a great return … 15.1%!

We have a pension and some investment interest / dividends, but this is the first year I haven’t done any paid board or consulting work. “Time for someone else to run the world”, I say.

Nice that you can share your $ with the next generation. We gifted our son some money when he was living in our rental townhouse the last few years, since it was much bigger than he needed. Now he’s living in the city, we stopped that. Probably need to start again at some point, but he’s not married & we don’t have any grandkids.

I don’t count our primary home as an investment either, but I do count our vacation place (and did our rental townhome) – although we don’t spend on it like it is an investment place. We’re pretty tipped to equities, too. With the Schiller PE ratio so high, it might be a good time to rebalance a bit.

LikeLiked by 1 person

I also have said that it is time for the younger generation to start taking over. A few weeks ago when I was asked to take over the board of my 110 unit HOA. I really like participation but I feel strong that I have a better role mentoring younger people.

The demand for my consulting services really is related to specialization over the past 25 years, I am fortunate to have the unique perspective to see how all parts of risk management, especially risk finance and insurance work together. Most people cannot think long-term which is how you have to think in the risk finance arena.

I am also fortunate to have unique personal investment experiences such as selling Amgen in October 1987 due to the October sell off. That was an expensive lesson on short term loss, but I learned a lot when I saw how much the security returned later, but I was out of the investment. That allowed me to be ok with the downturn in March 2020. Yes, I should have gone to a cash position in February or shorted the market, but that is not my risk tolerance, if I had gone all cash I would have had a tax bill and who knows if I would have invested back at the bottom of the market. Few of us can call the top or bottom, but staying invested long term pays off, at least it has in my lifetime.

LikeLiked by 1 person

Here is the crazy part, MSFT had a 4.5% current dividend yield and were growing their dividend in the mid-teens back in 2010. I bought it for the dividend.

Since 2010, Microsoft has been a black hole that sucked the life out of other software companies by building other’s capabilities into Office 365. Microsoft has clobbered IBM Notes, Zoom Teleconferencing, Drop Box, PC Backup, and Okta Identity Management / SSO into their Office Product. Having everything built into one platform that is scalable with disaster recovery built into it was huge.

You don’t see this sort of opportunity very often in dividend investing.

LikeLike

I’m at 14.65% for the year net expenses. You’ve trained the greatest investors of all time. I’m sure none of this had to do with almost all markets being up solid this year. 🙂 Great post. It’s nice to be able to benchmark.

LikeLiked by 2 people

A great year for you, too! It kind of makes you nervous, doesn’t it? Market is up 13.7% annually on average since the end of 2019. 15.4% with dividends. That period includes the pandemic craziness. The law of averages – and history of past drops – makes me nervous at this point.

LikeLike

Yes, reversion to the mean is real. However, we also have more/better data and AI helping to improve business decisions making everyday. I can’t imagine a scenario where we have a large supply/demand style recession. Financial-style recessions still seem very plausible, especially with the large deficits.

LikeLiked by 1 person

One of the main numbers I track is the annual income from my portfolio. My increase over last year was 10% which means we will have 10% more to spend in 2026 and almost all of it is discretionary. The restaurants are getting better and the concert seats are up front with overnight stays. Also did some significant improvements to our house and have more planned for 2026. Then time to get back to the auto resto.

LikeLike