It seems every generation wants to dump on the next one. Or, the one before it. Boomers complain about Millennials and Millennials say, “OK, Boomer”. Millennials say Boomers left the world a mess and Boomers say Millennials are ruining the world with their decisions. The irony of the situation is that the Boomers parented the Millennials themselves.

(I’m a Gen X’er and our son’s a Gen Z, so we just try to lay low from the inter-generational culture war.)

Still, I’ve been positive on both of the younger generations since I started writing this blog 8 years ago. I’ve always thought they will take good care of themselves. They’re more educated, more digitally savvy, and in many ways, have many more opportunities than any previous generation in world history.

Related: Millennials – How Are They Doing?

Related: Millennials May Prove To Be The Best With Finances

And, it turns out – they are being good savers. A recent article from MarketWatch shows that all generations are getting better and better at saving through their 401k accounts. Especially Millennials & Gen Z. They report (from Fidelity) that 401k accounts are being embraced by a higher percent of young adults and that their balances are growing quickly. Despite relatively high student loan debt, they are showing that they value saving and planning for their future.

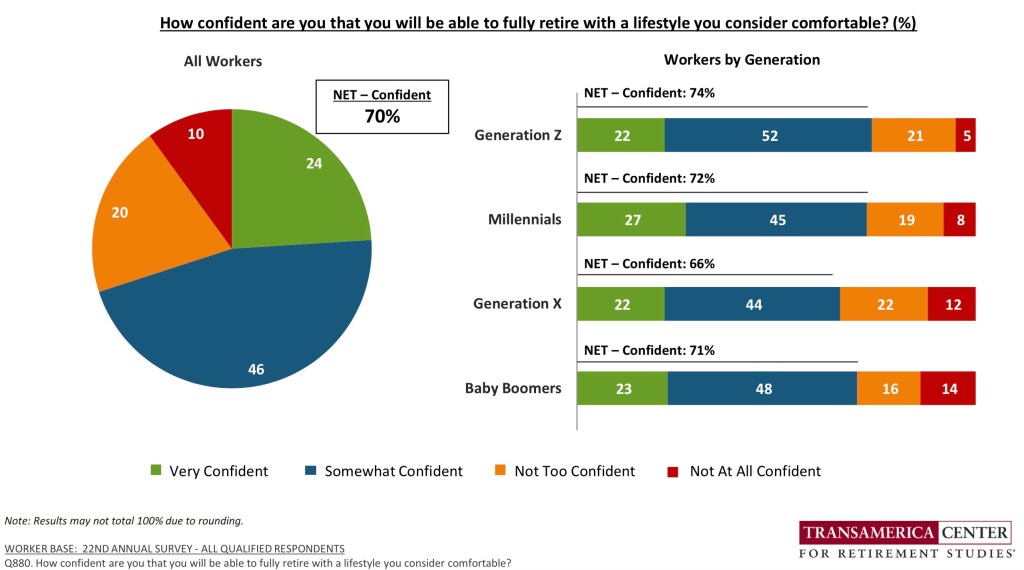

This chart, from TransAmerica’s most recent retirement study, shows that they are confident & serious about reaching a comfortable retirement. As confident as the two older generations …

All in all, this seems like good news. The kids are alright. They ‘get’ what they need to do and are doing it. It’s not everyone in these generations, no different than it wasn’t everyone in the Baby Boomers. Yet, enough of them that they’ll get through. I know when I look at my son and his six cousins – all in their 20s & 30s – they are a pretty solid bunch.

What are your thoughts on these next generations and their focus on good financial habits?

Image Credit: Pixabay

Tttalk’n bout my generation, And the kids are alright. Yes the boomer cites lyrics from the WHO!

Young people have so much emphasis on saving for retirement over the social security fears. I remember the discussions about 401k plans in the mid 80’s but unless you read Money magazine they were not front and center all the time. Today with automatic enrollment programs there will be good funding for their retirements.

As to social security fears….remember that social security was developed to keep the elderly out of poverty. Back then, 65 was elderly. I do think that eventually social security will be means tested, it is to a point at the moment given the reduction for those who have a government pension. I have a government pension, I consult for about $40k per year and if I work until 70 which I probably will at this level, I will then have 26 years of social security income which is enough to eliminate that reduction. I don’t need it.

People forget that social security is a welfare program. The anti-government types who hate welfare don’t like to hear that, but it is true, a tax scheme to pay benefits to those eligible.

LikeLiked by 1 person

Sorry, I’m not part of the “Boomer Class”, I’m just a lowly Gen X-er. I feel like a Boomer a lot of times, but also a Millennial when I listen to my older brothers.

I don’t agree that Social Security is a welfare program. It may become that, but it was established as a trust. That’s part of the difficulty of changing it after 80+ years.

It may be what they need to do to “save it”. but I’m not so sure they will. Politically, it is still a third rail that no one will talk to. If anyone dares mention cutting benefits – even hinting at it – the other party screams hysterically. I’m not sure what it will take to get over that.

It will probably be easier to either take the annual cap off SS taxation or slow the rate of its growth versus inflation. Since government controls the inflation measurement, they can play games there too.

LikeLike

I agree that it was set up as a trust, but in actuality it operates as a welfare program. This is supported by taxes and those who are entitled to receive the benefit do so.

If it was properly run as a trust, the contributions (taxes) would be decided based on sound actuarial practice and benefits would adjust based upon the success of investments, contributions and distributions.

What is interesting is that in the past few years, wages have increased at higher than historical rates and as such revenue from FICA taxes have also risen. Given lower birth rates, the demand for labor will be tight for likely the rest of my lifetime (25 years?). This demand keeps wages up and thus FICA revenue.

The US will never be able to do what Chile did and turn social security into personal accounts (I seem to recall reading that this has not turned out well). Bush II had this idea to save social security but then he decided to please Dick Cheney and punish Iraq for 9/11 and that took his attention away from financial matters.

Returning to the topic at hand, The kids including Gen X are all right.

LikeLiked by 1 person

Agree – The wildcard on labor will be immigration. Legal & illegal. We’re blessed to be in a country where people want to come to. We need to agree on the right way to do that. China also has aging demographics of their native population, but no one would want to move there to live under communism. Too bad immigration has become such a nasty political issue here.

LikeLike