Everyone is a genius in a bull market, and we’ve had a nice run over the last 10 years. The S&P 500 has grown from 2000 to 6000 over that period of time for a healthy +11.6% growth rate. The last 10 years have been amazing:

2024: 23.3%, 2023: 24.2%, 2022: -19.4%, 2021: 26.9%, 2020: 16.3%, 2019: 28.9%, 2018: -6.2%, 2017: 19.4%, 2016: 9.5%, 2015: -0.7%

If I was still working – and watching my retirement portfolio grow by leaps & bounds – I would be feeling pretty impervious right now. I see so many people posting $ million+ milestones in financial planning forums. If you trend this market run forward, even mediocre savers are envisioning a Ferrari in the garage at their beach house.

Still, as someone who has been through a few bull & bear markets, I would be cautious right now. There’s no such thing as a tower that grows to the sky. The concepts of diminishing returns and reversion to the mean are real and likely in play after a very big decade.

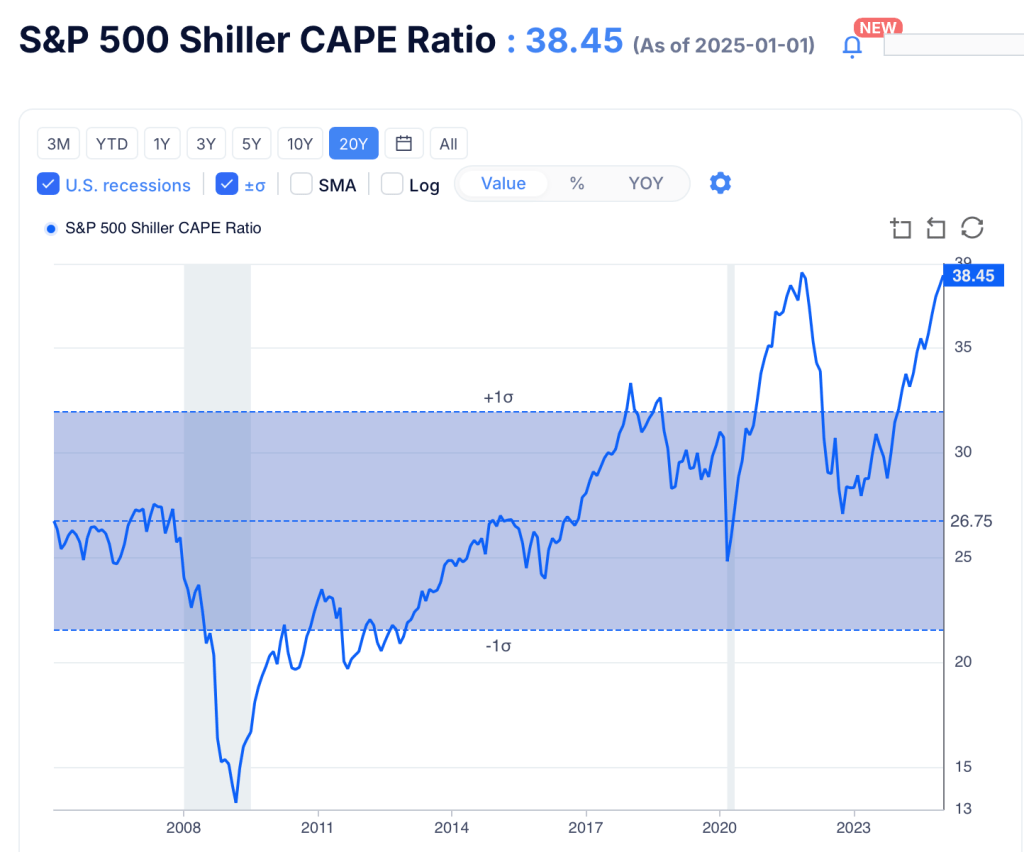

As you can see, the Shiller CAPE Ration (cyclically adjusted price to earnings ratio) is once again back to a 20-year high, with stock prices at 38.5x earnings. That’s 1.4x the 20 year average. (If you want to go WAY back, it’s the 2nd highest PE since 1871).

I don’t expect that the market is about to collapse, but I would plan for slower growth over the next 5-10 years. The economy seems to be improving and AI is a potentially huge opportunity. Still, I wouldn’t get too excited about your potentially luxe FIRE lifestyle until your unrealized gains become your actual wealth. The bull can be scared away by a big bear very quickly!

We’re two years in … How long do you think this bull market will continue?

Image: Pixabay

I wonder what effect the increased saving rate has had on the market. Not personal savings, but IRA, and other non-defined benefit plans have on the market. There’s more money being allocated to the market as companies move away from traditional defined benefit retirement accounts. Folks need to put there money into something and most will opt for mutual funds. Good article.

LikeLiked by 2 people

There was a lot of discussion of that in the 1980s and 90s as people poured into IRA and 401(k) for the first time. Of course, pension plans were always (and continue to be) big investors, too. CalPERS is the largest equity investor even today.

LikeLiked by 1 person

What is interesting about CalPERS (disclosure I get a monthly check from them) is that as of last June, they are now actuarially funded at 75% which is pretty good for a pension fund. They made considerable changes in 2012 to the benefit levels allowed including age to begin drawing but also they beefed up contribution levels. I was working for government then and while I saw the generous benefit changes of 2001 (thanks to market boom in 90’s, I also knew it could not last and I also benefitted from increased benefits even though lifetime medical benefits bargained away) I also knew that the underfunded liability would right itself in time and I thought that 2030 would be the year but we are there now. LIke or dislike California government, but CalPERS has done really good work, much better than CalSTARS, the teachers pension fund

LikeLike

Your timing is spot on. One should never plan on more than a 7% return and expect a 20% drop from time to time. The US continues to be the safe haven and I am staying the course with my broad spread of investments

LikeLiked by 2 people

Agree – A relatively big 1-day drop today (-2%). Apparently the USA isn’t the only country with AI technology.

LikeLiked by 1 person

Warren Buffett said, “When the tide goes out, you find out who isn’t wearing a swimsuit.”

LikeLike