The 2025 stock market has been a case study in “follow the bouncing ball”. We were up (inauguration), down (“liberation day”), way up (tariff pause & lower interest rates), and now not up as much (China issues). The volatility with Trump isn’t unexpected given his history, but it has been quite a financial ride in 2025.

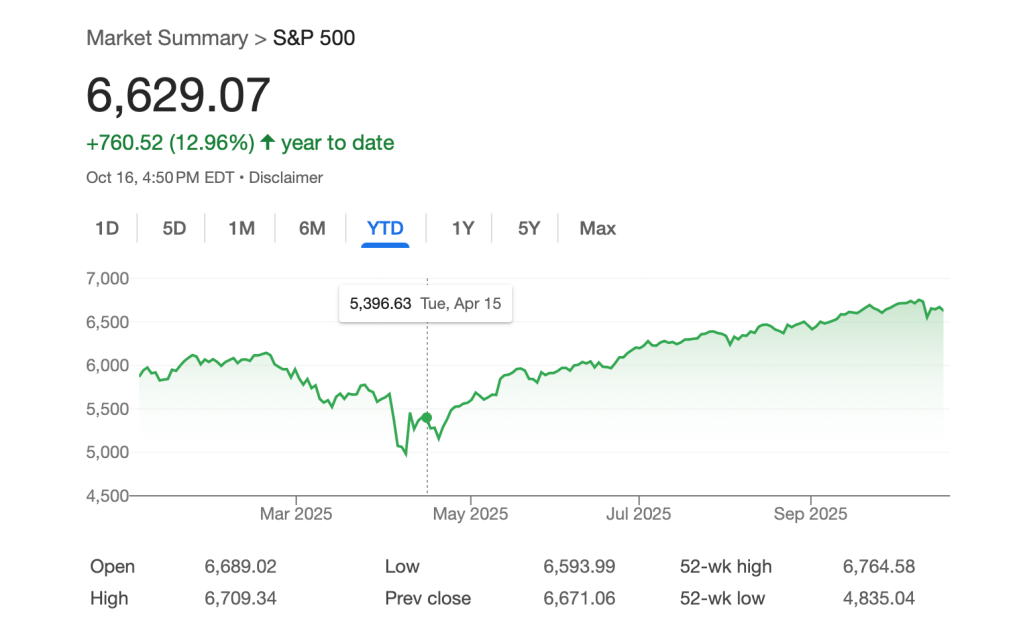

When we returned for the first time in 6 months to our Florida place last week, the S&P 500 was +13% for the year. A quite healthy result so far. When we left Florida on April 15th, the market was down -8% for the year. That’s an amazing 21ppt swing.

Back in April, I recall that most of the people in our neighborhood investment club betting that the S&P 500 would be down for the year when we regroup next month in November (I predicted “flat” for the year). I think when we get back together next month a lot of neighbors are going to be sheepishly surprised by how the market bounced back.

Related: Neighborhood Investment Club: Worrisome Market Predictions

As a long-term investor, I didn’t buy or sell any stock in 2025. We have enough cash to carry us through a few years spending, so there isn’t any urgency to make any trades. We try to keep 2-3 years spending $ in cash as a buffer against market volatility. That’s a retirement best practice. When we sold our rental townhouse in August, we were a little low (relatively) on cash, but that replenished our needs for a while.

How are you looking at the market this year? Surprised by the relative volatility? Surprised where the market is sitting right now? What do you think will come between now and New Year’s Eve?

Image: Pixabay; Chart: Google

I am under the S&P 500 on both a return and volatility basis but still doing well when benchmarking against dividend paying stocks.. Expect things to calm down when the government shutdown ends.

Still expecting good performance from the picks and shovels providers to AI play and the reshoring of US manufacturing by over weighting Electric Utilities and Natural Gas producers.

LikeLiked by 1 person

With Trump, I think there will always be volatility, but AI is a big boost. I am analysis today that suggested GDP growth would by only 0.1% this year if you took the AI investments out.

LikeLike

I would have guessed down this year. Like the first time Trump was elected I became conservative and like his first term my returns are suffering because of it.

And I am ok with that. As I get older I get more comfortable with a lessor return to have the insurance of safety.

Famous quote that circles my brain in these times

When you have won the game why keep playing?

LikeLiked by 2 people

Yes – at a certain point, it’s more important to protect what you have than take big risks. Unfortunately, that thinking stopped me from being a cryptocurrency zillionaire! – but no complaints.

LikeLike