Today would have been the 28th Anniversary of the start of my career at The Pillsbury Company in Minneapolis, back in 1989. I loved working for Pillsbury and became good friends with the Pillsbury Doughboy over the years.

Instead of starting the day at 7am with a sprinkled, chocolate donut (a Mr. FireStation favorite) like I did back in 1989, I will be sleeping in on Monday morning and enjoying almost a year-and-a-half of early retirement.

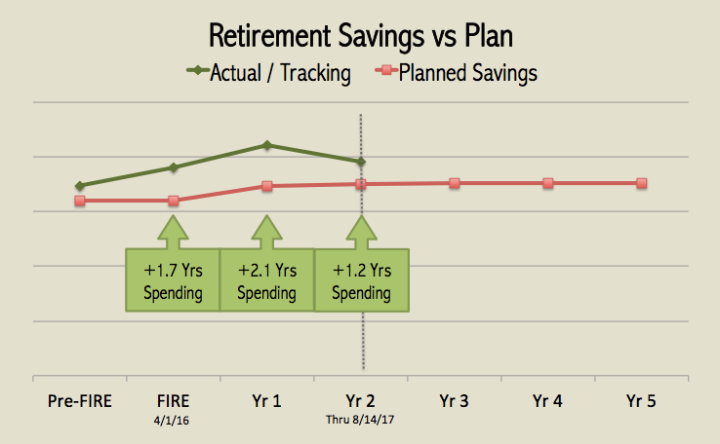

I’m sleeping pretty well with our retirement savings so far. We retired in early 2016 with more money than we had needed to support our planned FIRE lifestyle and had terrific market returns in Year 1 of early retirement. Eight months later, I thought now might be a good time to share how our savings ‘feel’ in what is turning out to be a more difficult year for our retirement portfolio.

Here’s how the balance sheet looks as we head into the last months of 2017:

You can see that our retirement accounts had swelled to +2.1 years of spending last year, but that we have now given back much of our ‘lead’ in Year 2 of FIRE. Right now we have a 1.2 year spending ‘lead’, which despite the losses, we’re not sweating too much about.

We still have a lot of stock options in one company that I am not in a hurry to sell. I exercise/sell a little each year between now and 2022, when they run out. This stock has unfortunately dropped from $72/share last year to just $56/share now (-22%). That’s a big year-to-date drop for a stable value stock that has seen growth 24 of the last 25 years. The company is in the need of a big turnaround and some potential acquisition excitement last year has died out. The performance of this one stock has put a big dent in our retirement nest egg given how leveraged options are.

The good news is that we sold a bit last year when the stock was still high and haven’t had to sell any other equities from our nest egg in the meanwhile. We entered FIRE with three years of spending in cash, so we have plenty of time to hope for a turn of fortunes. The rest of our portfolio (mostly S&P 500 Index Funds / Bond Funds) have done pretty well, so if this one stock start moving upward in the next 12 months, we should still be in good shape.

Hope, of course, isn’t a plan, and fortunately we have other stock options from another MegaCorp I worked at that are performing very well. In the short term, we also some stock in a employee stock purchase account that I can liquidate for some more cash in the short term. That stock has gone from $85 to over $205/share in the last 4 years, so it is probably a good time to cash some of that out.

We’ll also look at our spending so far this year to see how we are tracking on that. We haven’t made any BIG purchases this year, so I am hopeful we are tracking well on that front. I’d like to get a new vehicle, but I could easily put that off to 2018 if it feels like we should. While our nest egg still has a lead, that might make some sense.

In the end, it’s good to have options and since I have the day off today, my hope will be to go out and get a donut (or two) and think about something else! 🙂

Image Credit: Pixabay; The Pillsbury Company

Perhaps it is a good idea to cash some of the megacorp options and have a cash reserve for the next 2-4 years or so, give you time to re-invest if a correction comes around or keep the money to live life. You got many “options” 🙂

LikeLiked by 1 person

Yes – I’m at about 3 years of spending in cash now.. Maybe a little less. With the uncertainty after the market run up (and with MegaCorp weak), I’m going to sit on as much cash as I dare for a little while.

LikeLike