Northwestern Mutual does a nice annual study on the ‘state of retirement’ in the USA. It’s a pretty exhaustive analysis that looks at all aspects of life and our involvement and satisfaction with each dimension.

Link: Northwestern Mutual 2025 ‘Planning & Progress’ Study

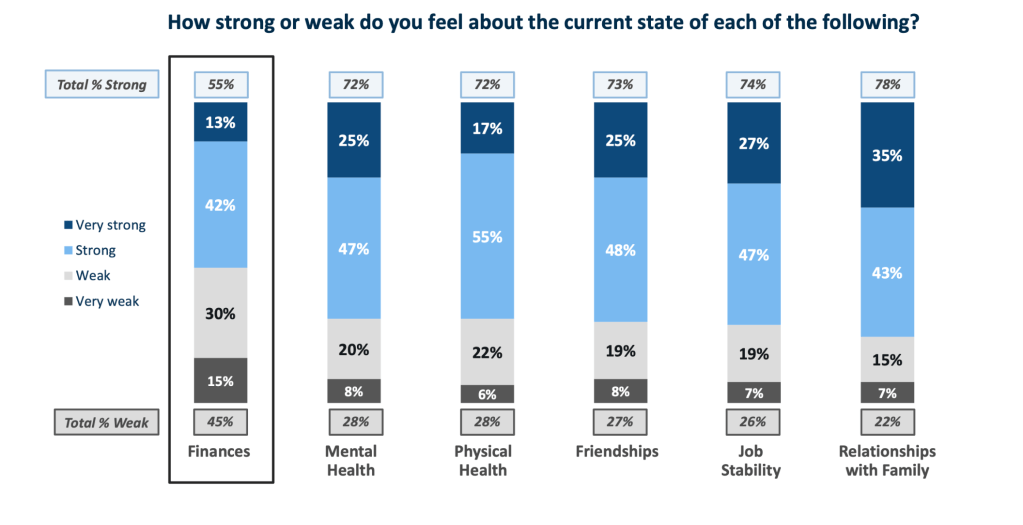

I was surprised by a few of the numbers from this year’s study and thought I’d share them. First, Americans are pretty satisfied with most aspects of their lives, but financial planning is not one of them. Finances outrank all other areas with nearly half (45%) of Americans labeling their finances as “weak” or “very weak”.

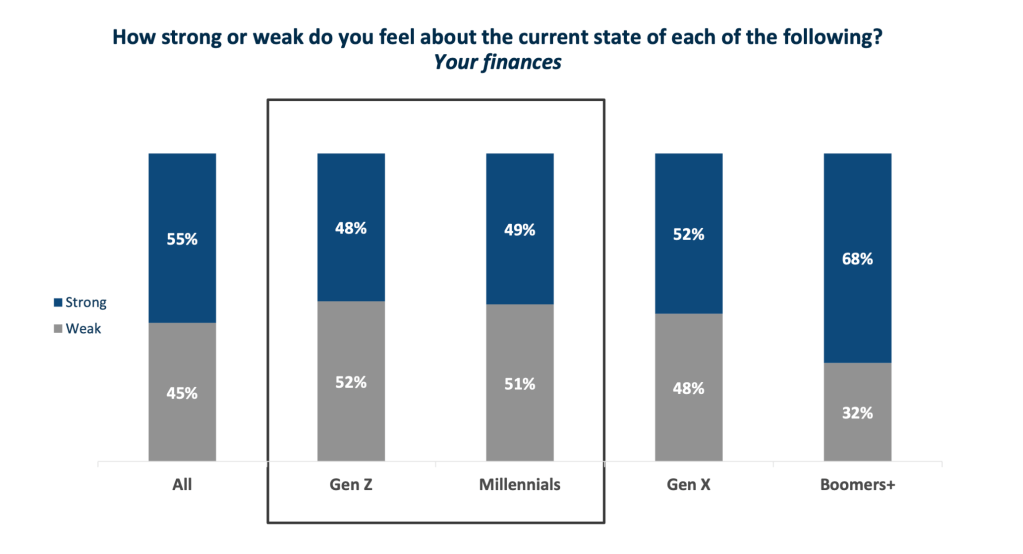

The data isn’t skewed just by young adults, either. A substantial portion of all generational groups raise the flag when it comes to financial weakness. The Boomers, as you would expect, seem to feel the best for where they are, but even a third (32%) of them aren’t doing so well financially.

Still, most people – regardless of age – think they will be financially prepared for retirement when the time comes to retire. Surprisingly, Gen Z leads the pack with 63% believing they will be well-positioned financially for retirement. Only my Gen X cohorts aren’t feeling so positive.

Maybe it’s not for surprising that the group with the longest runway ahead of them, feels best about their chances to get to retirement. When we were in our 20s, we might have been feeling that our financial situation was relatively “weak”, but still positive about the future. It’s maybe more concerning that 44% of Boomers don’t feel like they are ready for retirement, when that cohort is already well into retirement age as a group.

There is a lot in this study and I’ll share some more next week. Overall, you can definitely see people’s concern with their level of saving for retirement. I’m guessing it’s a bit of a bi-modal distribution, too – some feel great, some feel horrible about where they are at.

I’m guessing that the people reading this blog are highly confident about their financial situation and being ready for retirement. How about the people around you? Is there a substantial percent of your friends & family who are puzzling over their situation? How does that intersect with their age group?

Image: Pixabay

My wife and I see a lot of peers who have not planned for retirement. My wife worked as an RN and made good money. She has nursing peers who have gone through a couple divorces, still live in a rented apartment and haven’t given a second thought to retirement because they can work a couple days a week and make enough to support themselves.

Youth is wasted on the young. The young people are likely thinking they will have wonderful finances in the future where houses become affordable and they can save for retirement. I bet they don’t realize that the funds they are not setting aside for retirement in their 20s and early 30s are the most important funds they can stash away, because the funds will have more time for their retirement investments to compound.

Many people in the US are going to be forced into FIRE, but the problem is they will be trying to start their FIRE savings plan when they are in their 50s and 60s. They better hope their job and health hold out long enough to give them years of serious saving and investing.

LikeLiked by 1 person

Agree – at any age, many aren’t prepared. I saw an analysis from the Social Security Administration that 27% of Americans over 65, SSI is their only source of income.

We met a financial planner 30+ years ago – when we were just starting out – that had the equation “P x R x T = Success” on his office wall. “People don’t realize this,” he said, “but the T (time) is often the most important one”. Good advice.

LikeLiked by 1 person

I am surprised that only 27% have no retirement income other than Social Security. Would have thought the number was much higher.

LikeLiked by 1 person

That’s still almost 20 million people. I’m sure for MOST people, SSI is still their PRIMARY income in retirement. Most people have secondary sources, although those might be small.

LikeLiked by 1 person

Part time jobs would count as not relying solely on Social Security.

LikeLiked by 1 person