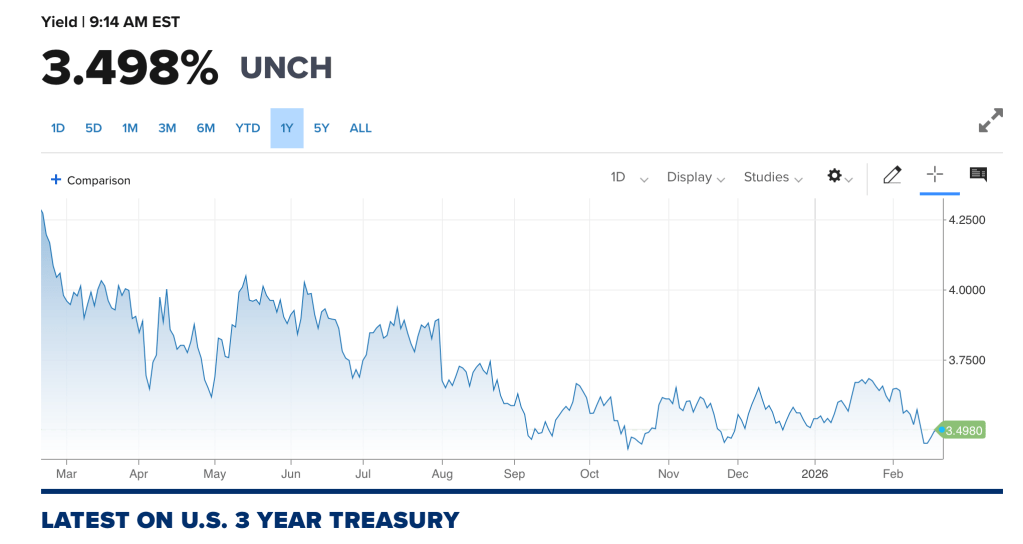

It’s been about three years since we started playing the “Savings Rate Game” (LINK) with Bank CDs and Treasury Bonds. That is, having to manage the savings rate of our cash holdings closely. The 3-Year Treasury rate is now at about 3.5%, down -0.6 pts from one year ago today.

When Biden took office in 2021, the 3-Year Treasury was just 0.3%. We didn’t even bother to use CDs or bonds with that low of a rate. Then it jumped 14x to 4.3% in 2022 as excessive CV19 stimulus spending hiked prices and inflation rates. They peaked at 5.0% in 2023 after inflation peaked at a 4-decade high, but have slowly receded over the last two years.

I’m happy for that relief, but it still means that the savings rate game continues. We still have to keep our “buffer” cash account parked in interest-bearing accounts and CDs. It’s a good deal of money, since it is usually equal to 2-3 years of our spending. Every couple months, we get a computerized notice from our bank or a friendly call from our financial advisor that something is coming due. We have pretty consistently been renewing the savings investments for a new period.

We also try to pay big bills near the due date, and not pay anything too early. My wife did pay our second-half 2026 property taxes early, which probably “cost” us $120 in lost interest.

Overall, I hate this kind of financial administrivia, but it doesn’t take a bunch of time. I’m sure it will continue as I don’t see ultra-low rates coming back. Over the last 40-years, a 3.5% 3-Year Treasury rate is pretty average. About 2/3rd of those years it’s been higher, about 1/3rd of the time it has been lower.

How do you see savings rate evolving over the next year or two?

Image: Pixabay; Chart: CNBC

Hey Mr. Firestation, I jettisoned the cash savings rate game about a year ago. Instead, I’ve combined my cash allocation and bond allocation into a single bucket. Then, I converted the entire bond allocation to short term bond indexes with Fidelity and Vanguard. Is it more risky than money market/savings? Yes. But it is indexed and short term to reduce the risk (default & duration). In summary, my total bond risk is down but my cash risk is up. Thanks for the article. Please let us know what road you decide to take.

LikeLiked by 2 people

I am following about the same strategy since my retirement and it has held up well. The only impact from Treasury Interest cuts is that the annual income drops in lockstep, but the principal has remained intake.

One byproduct of the interest rate cuts and further interest rate cuts that I have seen so far this year is that stable dividends such as utilities are valued higher and has driven up their market prices. Long term bond funds have also done well.

LikeLiked by 1 person