Having enough money to support the lifestyle you planned for early retirement is the key concern for many people on their path to financial independence and retiring early (FIRE). The awesome website early-retirement.org had an interesting discussion recently over how much people are spending in early retirement: more, less,or about what they expected to spend before they left their jobs.

For us, our spending has been pretty close to what I expected this year. If anything, we’re spending a little less than what I would have guessed, although we have some trips and household repairs coming up that might be a bit pricey.

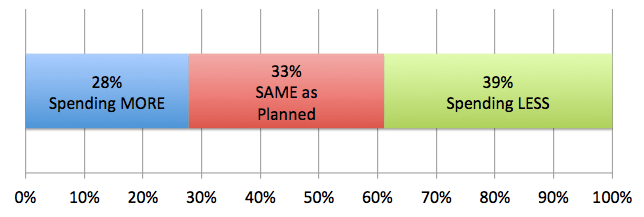

Here is a chart that shows the responses that people had to the forum question:

The numbers aren’t scientific by any means, but they do represent the input of almost 50 people who responded to the question.

You can see that many people in the forum (28%) commented that they are spending MORE in retirement than they initially planned by choice. They wanted to travel more or treat themselves to some luxuries that were enabled by their investments doing better than expected. At the same time, others were facing unexpected health care costs – either higher because insurance is costing more than planned or because they had health issues that have emerged unexpectedly.

Among people spending about the SAME as what they expected (33%), plenty are still spending more than they did before they retired. As was our case, many people worked long enough to bank a higher level of spending in retirement and upgrade their lifestyle, particularly with more travel. These folks are spending more by choice than by need. Others are spending what they expected because they are very good budgeters and track their expenses very closely. Some of these folks are spending less than they did pre-retirement, although I would say that is a minority of people.

Slightly more people reported spending LESS in early retirement than they expected than the other two categories (39%). The reasons were quite varied. First, some commented on inflation not being as high as they had expected over the last 5-10 years and that has kept their expenses lower. Inflation changes even by as little as 0.5% a year make a huge difference over a decade (5% of your net worth). Second, others reported that they had more time to look for deals and discounts in early retirement and that was keeping their spending low. I know that traveling ‘off season’ is certainly saving us a lot of $$$. Lastly, I think we are spending less now because our son isn’t living at home and we’ve frankly reached the point where we don’t have that many more things we need to buy.

Regardless of what you are spending in retirement, the most important thing is to keep flexible because unexpected things certainly arise and market conditions can change quickly. For those of you who have already retired, are you spending less or more? For those of you still on your journey, how will you manage flexibility?

Image Credit: Pixabay

Considering we fall in the “no there yet” category, we manage our flexibility by allowing an “other category” in the budget. This is for everything we might have missed (about €1000 per year). Also, we have a healthy travel allowance (€4000), if we find out that we are spending more, we have ways to cover these expenses by dialing back the “extra’s” in life. Worst case, we go back to work.

LikeLike

We are in the “getting there” category, so we plan to be flexible. This is by adding in things to the future spending to account for that.

This ranges from mundane stuff like accounting for car purchases every 7-8 years, household maintenance and repairs, travel, car maintenance, and the like to more unpredictable expenses like increases in clothing costs when the kids get closer to middle school, increases in grocery spending in another 5 years when they turn into revenous destroyers of our pantry, and even increases for anticipated future activity participation – music, sports, art, etc…

While not super scientific, having a little extra buffer there will hopefully keep us in the “as expected” spend category and not “overspend” side of it.

Only time will tell though, because one cancer diagnosis, bad car wreck, or who knows what could throw a real expensive monkey wrench into the best laid plans.

LikeLiked by 1 person

Yes – you can only ensure yourself against certain catastrophes, not others. Sounds like you have planned out your future needs and a lot of detail though. We have a retirement framework for cars and travel – those are the big expenses that are pretty discretionary for us.

LikeLike

Interesting survey results, Mr. FS. It’s good to see that there are more underspending than exceeding their allowance.

Our plan allows for significant overspending. I’m aiming to have at least 40x expenses by the time I hang it up. If we go 50% over our expected spending in a given year, we’re still abiding by the 4% rule.

Cheers!

-PoF

LikeLiked by 1 person

Wow – 40 X expenses would be a huge buffer. I can’t imagine too many things coming your way that would get you in trouble with that kind of question. We have about 30 X annual spending, but a lot of our spending is fairly discretionary.

LikeLike

If you take the opportunity to travel more than what you planned, I can definitely see how the retirement expenses end up being higher than planned. But that also depends on you travel. Do you go on cruises and all-inclusive tours? Or do you do budget travels?

LikeLiked by 1 person

Travel is purely a discretionary expense, so if that is the one thing that drives you over – I guess you made a choice. We doubled our budget for annual travel in our retirement model. That seems to be a good call right now, because I have the itch to get on a plane a lot lately.

LikeLike